Lets Make a Deal June 2023 Newsletter

Let's Make a Deal

The US debt ceiling has consumed investors’ attention for much of the past few weeks, though the market has been relatively sanguine about the prospects of default. Nonetheless, this risk has now been removed from concerns weighing on investors’ psyches.

The debt ceiling was initially established a century ago to allow Congress to raise funds to support the war effort. Before the Second Liberty Bond Act of 1917, Congress directly authorized debt issuance. An aggressive limit was established to ease the ability to fund the war, allowing the government to borrow without direct authorization.

A century later, the debt ceiling has unintentionally become a political bargaining chip, where each party seeks concessions at the risk of the government failing to meet obligations it has already incurred.

Think of the debt ceiling like you and your friends going out for a nice dinner, ordering and enjoying your meal, then arguing with the restaurant about the final bill, even though you were fully aware of how much the meal would cost.

Despite the wide political divide, a compromise was eventually found, and the debt ceiling was suspended for the next two years. So, mark your calendars for 2025, when we will go through the same uncertainty surrounding the US government meeting its obligations.

Keep a Lid on It

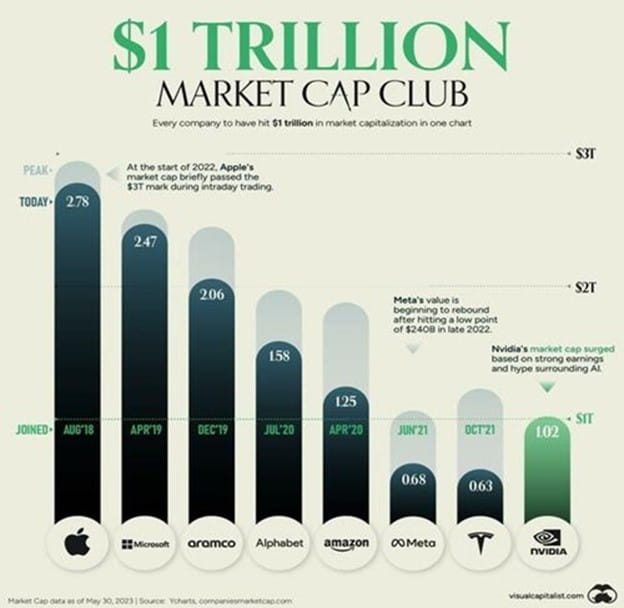

The debt ceiling has kept many investors on the sideline, and those stepping into the market have tended to favour the safety of the world’s largest companies like Apple (AAPL-US), Microsoft (MSFT-US) and NVIDIA (NVDA-US) – we hold all three in the portfolios.

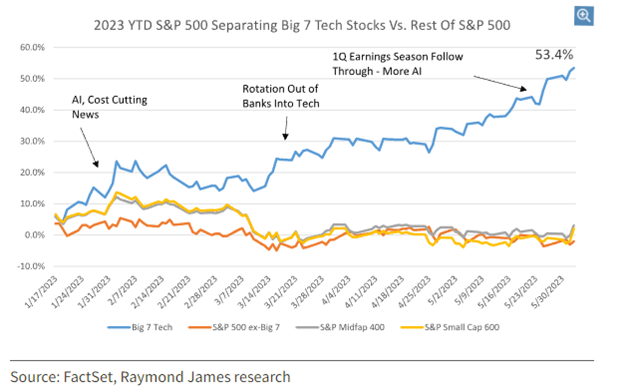

Amazingly, the top seven US stocks by market capitalization have accounted for almost all of this year’s gains and eight of the market’s largest stocks—Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, Nvidia and Tesla—now account for 30 per cent of the S&P 500’s market capitalization.

Said another way, market breadth has been extremely narrow.

Bigger is Better in 2023

Narrow breadth for an extended period of time has often been a yellow flag, but this period has lasted for only a couple of months and was preceded by a period where all stocks were participating in the rally.

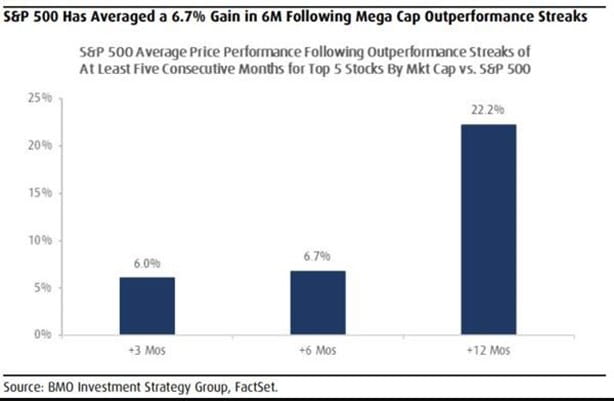

According to BMO Capital, the S&P has returned an average of 6.7 per cent in the subsequent six months after outperformance by the market’s largest five stocks. Out of 12 periods of similarly narrow breadth, BMO found that the index has only gone on to produce negative returns one time.

The bottom line is, narrow breadth is not always bad breadth, as long as the rally broadens at some point.

Period Where Mega Caps Drive Market Returns

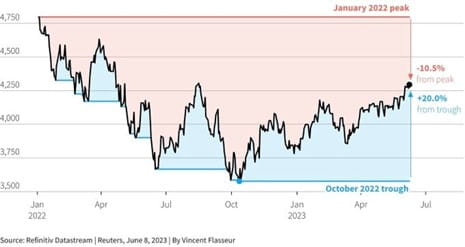

We do anticipate the current rally will broaden, particularly now that the S&P 500 has broken above 4,200, which has acted as overhead resistance for much of 2023.

With plenty of investors on the sideline, fear of missing out (FOMO) is a distinct possibility, which would create excess demand for stocks.

Where will this demand come from? There is a record level of short interest in the S&P 500 (shorts are beating against the market) and nearly $5 trillion in money market funds. When we see these types of imbalances, they tend to be inflection points in the market, similar to the extremes achieved in March 2009.

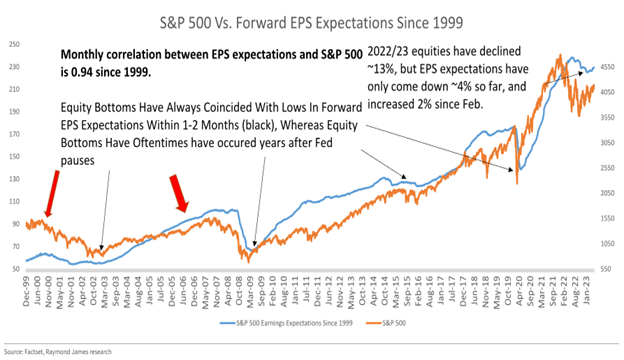

The catalyst to drive excess demand for stocks may be the lack of deterioration in corporate earnings that so many strategists have been forecasting.

Underlying earnings estimates are actually moving higher, despite a US regional banking crisis, likely due to tightening credit, lacklustre China recovery and debt ceiling uncertainty.

The bottom line is investors are not positioned for any good news. And, we believe the market has entered somewhat of a Goldilocks period where the Fed is pausing/slowing its rate hikes, inflation continues to move toward the Fed’s target, corporate earnings remain resilient, and US treasury issuance is doing some of the Fed’s heavy lifting. Oh, and did we mention the S&P 500 just entered a new bull market (see Charts of Interest)?

Stocks Follow Earnings

Zoltar Speaks: AI a 2023 Winner

We’re not in the business of predicting, but we did have some fun earlier this year, laying out our 2023 predictions during our Outlook webinar. One prediction that we called out was artificial intelligence (AI) capturing the minds of investors.

One such stock, which is held in our portfolio, is Nvidia (NVDA-US). The stock has gained 161 per cent YTD, helped by the company blowing past analysts’ expectations when it reported quarterly results and raised its guidance well ahead of consensus, marking the largest revenue upside surprise in history for a company its size.

AI is in its infancy, and we see it becoming a larger theme that will propagate across the entire economy, leading to productivity gains and producing oversized gains for those companies that can deliver and integrate the technology with their operations.

Within the portfolio, we have direct exposure to the AI theme through the following companies:

Zoltar Speaks: AI a 2023 Winner

We’re not in the business of predicting, but we did have some fun earlier this year, laying out our 2023 predictions during our Outlook webinar. One prediction that we called out was artificial intelligence (AI) capturing the minds of investors.

One such stock, which is held in our portfolio, is Nvidia (NVDA-US). The stock has gained 161 per cent YTD, helped by the company blowing past analysts’ expectations when it reported quarterly results and raised its guidance well ahead of consensus, marking the largest revenue upside surprise in history for a company its size.

AI is in its infancy, and we see it becoming a larger theme that will propagate across the entire economy, leading to productivity gains and producing oversized gains for those companies that can deliver and integrate the technology with their operations.

Within the portfolio, we have direct exposure to the AI theme through the following companies:

- Nvidia (NVDA-US) has significant exposure to AI through its GPUs, which are widely used for accelerating AI workloads like deep learning. They provide specialized software frameworks and libraries for AI development and offer dedicated hardware solutions.

- Microsoft (MSFT-US) has exposure to AI through its Azure cloud platform, which provides a range of AI services and tools for developers and businesses. They offer pre-built AI models and frameworks, such as Azure Cognitive Services and Azure Machine Learning, enabling developers to incorporate AI capabilities into their applications. Additionally, Microsoft has made a significant investment in OpenAI, the developer of ChatGPT.

- Cadence Design Systems (CDNS-US) has exposure to AI through its design automation tools and software solutions for the semiconductor industry.

- Adobe (ADBE-US) has exposure to AI through its suite of creative software, such as Photoshop and Illustrator, which incorporate AI-powered features like content-aware fill and image recognition. They also offer Adobe Sensei, an AI and machine-learning platform that enhances various aspects of their products, including image and video editing, document processing, and marketing analytics.

Charts of Interest

The S&P 500 just entered a new bull market, advancing 20% from the October 2022 low.

NVDA joins the trillion-dollar club after delivering a big forward guidance upside surprise.

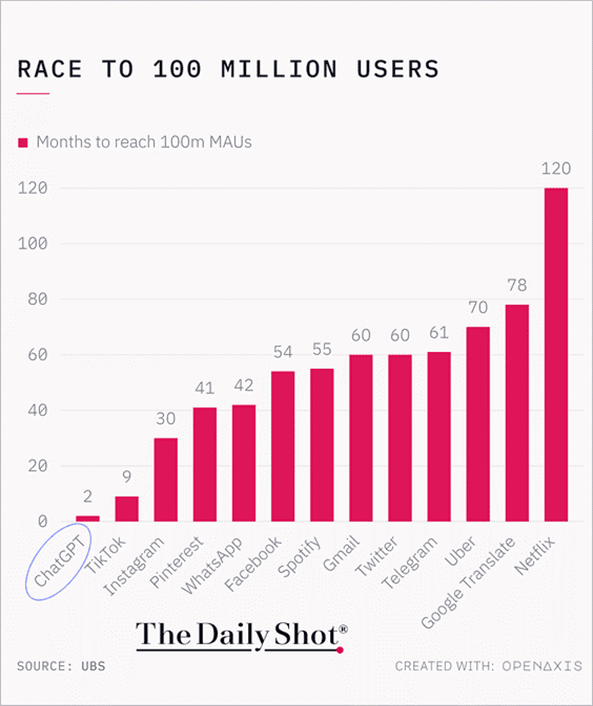

OpenAI’s ChatGPT is the fastest-growing app, gaining over 100 million users in just two months.

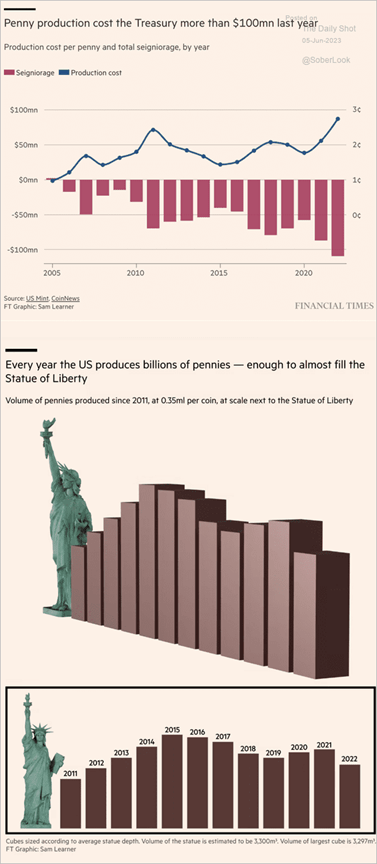

US penny production costs to the US Treasury presently a losing proposition.

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.

Raymond James (USA) Ltd. advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Investors outside the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Raymond James (USA) Ltd. is a member of FINRA/SIPC.