August 2023 - Newsletter Are We There Yet?

If you missed our July 2023 webinar: Goldilocks Zone, please click here (passcode: Nb7@JYmG).

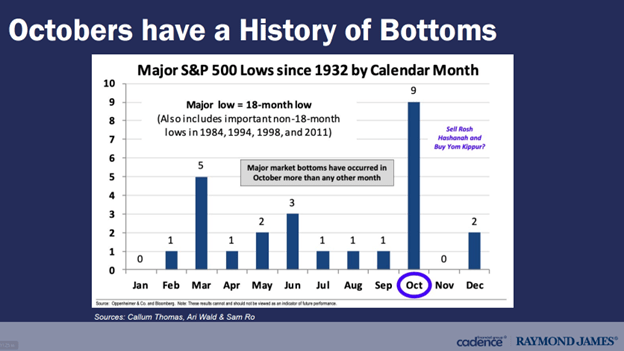

Why tune in? You may gain valuable insights similar to our October 2022 webinar: Looking for Greener Days, where we highlighted the tendency for markets to bottom in October.

Both the S&P 500 and S&P/TSX bottomed on October 13, 2022.

October Webinar: Looking For Greener Days

We’ll Get There When We Get There!

In recent weeks both the Bank of Canada (BoC) and the U.S. Federal Reserve (Fed) raised their key lending rate. Although inflation has cooled lately – Canadian and U.S. annual CPI fell to 2.8% and 3.0%, respectively – both central banks are not ready to declare "mission accomplished."

Like kids on a long road trip, investors are asking “Are we there yet?” The Fed’s response has been “We’ll get there when we get there! Stop asking.”

Fair enough. Central banks would rather deal with a recession than the damaging impacts of persistently high inflation. So, despite the progress to date, we don't expect central banks to declare victory anytime soon, contrary to the evidence that clearly shows they are winning the battle.

To this end, the Fed's language suggested that further tightening could be in the cards at the September meeting. However, with a rather large window between meetings, perhaps the dog days of summer will provide further evidence to sway the Fed to do nothing:

- Two CPI readings on August 10 and September 13

- The Fed's preferred inflation indicator, PCE, hit the tape on August 3

- Two employment reports will be released on August 4 and September 1

Bottom line: inflation is closing in on BoC and Fed's target, but they are unlikely to declare victory anytime soon. Nonetheless, we're approaching a peak in rates which is a welcome development for investors.

How are you Feeling?

Earlier this year, we talked about how investor sentiment and positioning were overly bearish and that any good news would provide a catalyst for stock prices.

Well, here we are after plenty of good news on the earnings and economic front. Investors that were caught offside have begun to re-entered the market.

Sentiment readings, according to the AAII bullish sentiment jumped to its highest reading since late-April 2021 and the longest above-average streak since a 13-week stretch from February to May 2021.

Bearish sentiment fell to its lowest since June 2021 and near the bottom of its typical range.

The near-term bullish read could make markets vulnerable to a pullback; however, we would need a catalyst and with quarterly corporate earnings coming in better than expected, the more likely scenario is a pause in the upward price action.

This pause may allow the final leg of the FOMO trade to play out as the remaining investors that missed the rally in 2023 pile into the market.

Bottom line: investor sentiment and position have improved since earlier this year. A near-term pause is in order before we push higher into year-end.

Where's the Beef? The Case for Energy

Remember the days when TV commercials were entertaining? Good writing has now been replaced with social media influencers and digital ads. On the off chance you're actually watching TV, commercials are now safe and boring.

Thankfully, we're old enough to remember the heydays of commercials, and there were some gems. Who could forget the Wendy's "Where's the beef" lady? She came to mind as we thought, "Where's the value?"

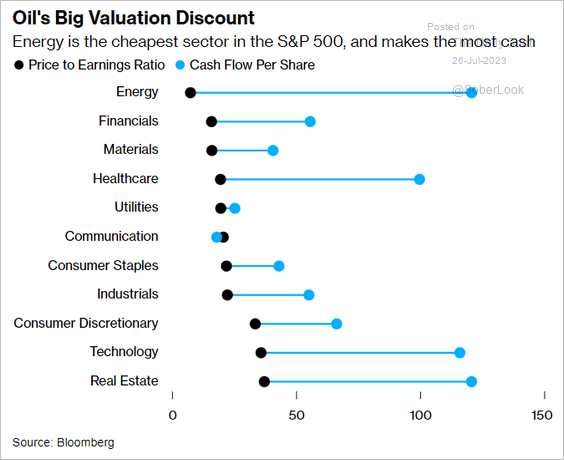

On a price-to-earnings basis, energy shares are the cheapest sector in the S&P 500. It's a similar story in Canada. The sector offers the best value and produces a ton of cash flow per share, and balance sheets are in good shape.

Said another way, energy shares are cheap, and their new found religion of capital discipline offers excellent flexibility to return cash to shareholdings via dividend increases and share buybacks.

We added PrairieSky Royalty (PSK-CA) in May, joining mid-cap E&P Whitecap Resources (WCP-CA) as our two ways to gain exposure to Canadian energy companies with solid balance sheets and the ability to rapidly return cash to shareholders.

Each of these holdings offers greater leverage to oil prices and is ballasted by our steady-eddy pipeline holdings TC Energy (TRP-CA) and Enbridge (ENB-CA), which offer dividend yields of over 7.5% but are growing those dividends at a much-measured pace.

Oil Macro Drivers

The biggest wildcard for energy is the demand outlook. A recession, which we are currently forecast to occur in 2024, could put downward pressure on the commodity.

However, given the supply-side constraints, we currently do not foresee a large negative significant swing in the price of oil over the next couple of quarters.

The global oil supply dynamic is currently dominated by Saudi production cuts, fewer rigs drilling for oil (U.S. rig count is down ~15% from its peak in January), ESG pressure limiting new production and limited ability to release additional barrels from the Strategic Petroleum Reserve.

Bottom line: These aren’t your parent’s E&Ps; the industry has right-sized their balance sheets and is committed to returning cash to shareholdings rather than aggressively growing production. Energy share valuation levels remain attractive, particularly in light of supply constraints and solid near-term demand supporting the commodity.

Wrapping our Heads around AI

For those attending our quarterly webinar, you may recall a slide that estimates the economic benefits of the adoption of AI. McKinsey & Co. estimates $17-25 trillion in additive global benefits. If that number looks oddly familiar, it's because it is closely equivalent to the entire economic output of the world's largest economy, the U.S.

While it is impossible to know with certainty the future economic implications of AI, today's estimates give you a sense of the potential scale investors are assigning to the theme.

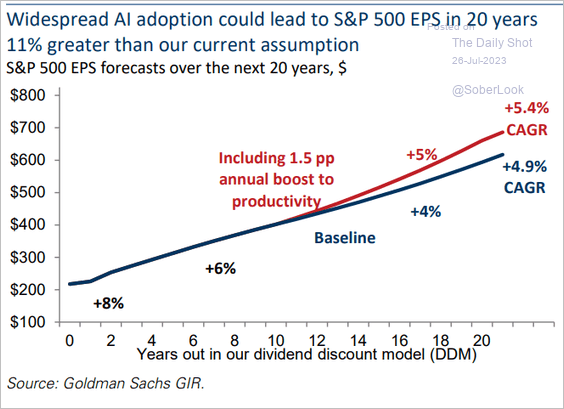

Goldman Sachs attempts to quantify the impact on corporate earnings, potentially boosting its long-term EPS growth trajectory by 1.5 percentage points.

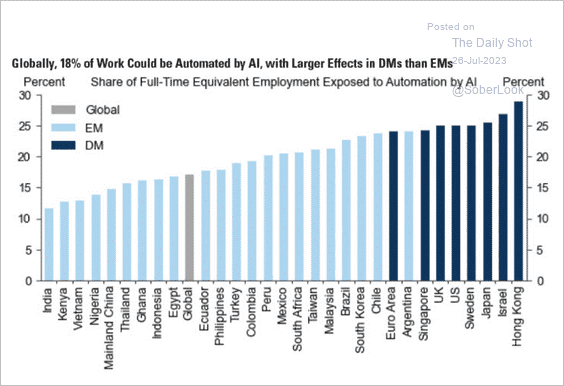

As for the potential impact on labour, some estimates suggest 18% of full-time employment could be automated, with a larger share of those workers in developed markets potentially impacted.

Bottom line: estimates vary widely, but there is no denying AI will have a profound impact on the way we work. Productivity gains may have significant economic implications, which is why there is such a buzz around the companies participating in the theme.

Charts of Interest

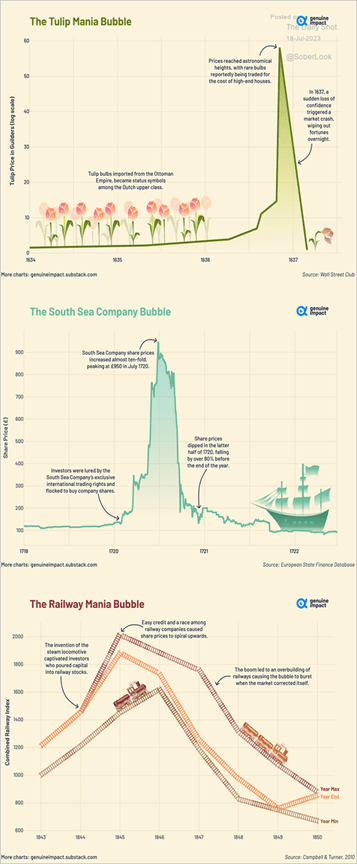

Some famous asset bubbles. AI may potentially follow in the footsteps of some of the greatest bubble, but it’s very early days.

Most common baby names over time.

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.

Raymond James (USA) Ltd. advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Raymond James (USA) Ltd. is a member of FINRASIPC.