October Newsletter - The Last Hurdle

We look forward to our next webinar focused on Estate Planning in B.C. featuring Patricia Chartrand, Senior Trust Advisor. If you have not registered yet, please click here.

During this informative webinar, Patricia will present a comprehensive exploration of the essential

elements involved in crafting a personalized estate plan tailored to you and your family's unique needs. Our goal is to shed light on prevalent pitfalls and guide you toward a well-prepared approach to managing your financial affairs, ultimately facilitating a smoother transition for your loved ones.

We will also hold our quarterly market update webinar on October 17 (click here to register). We will discuss how markets have evolved since we called stocks entered a “Goldilocks” period, address the economic and market backdrop, how we are positioned ahead of the seasonally strong period for markets and what risks we are monitoring that may impact our outlook.

On the Lighter Side

Ahead of our quarterly call, we preview a few of the questions we have been chatting with clients about. We figured if one is asking, many may also have those questions on their minds.

Q. Markets were weak in September. What is driving the recent pullback?

Remember, September tends to be one of the weakest months during the calendar year. From a seasonal perspective, investors were primed to be in a selling mode. But September was also negatively impacted by a reacceleration in government bond yields. The relentless move in bond yields pressured stocks. Uncertainty surrounding where bond yields will level off has created greater near-term uncertainty.

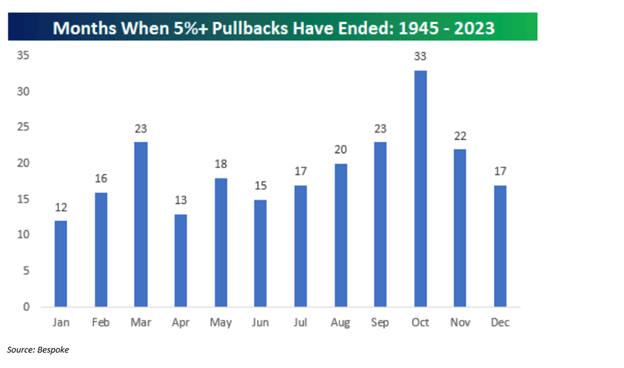

However, we remind clients that when we look back at history, we see markets find a firmer footing in October – September-October 1982, October 1987, September-October 2002, and September-October 2008, to name a few past periods. October, indeed, is a month the bears should fear! November to December are among the strongest months of the year for equities.

Bottom line: September has lived up to its reputation as one of the worst months of the year, but October tends to be a bear killer.

October’s Higher Frequency of Bottoms in the Market

Q. What’s up with the markets this year?

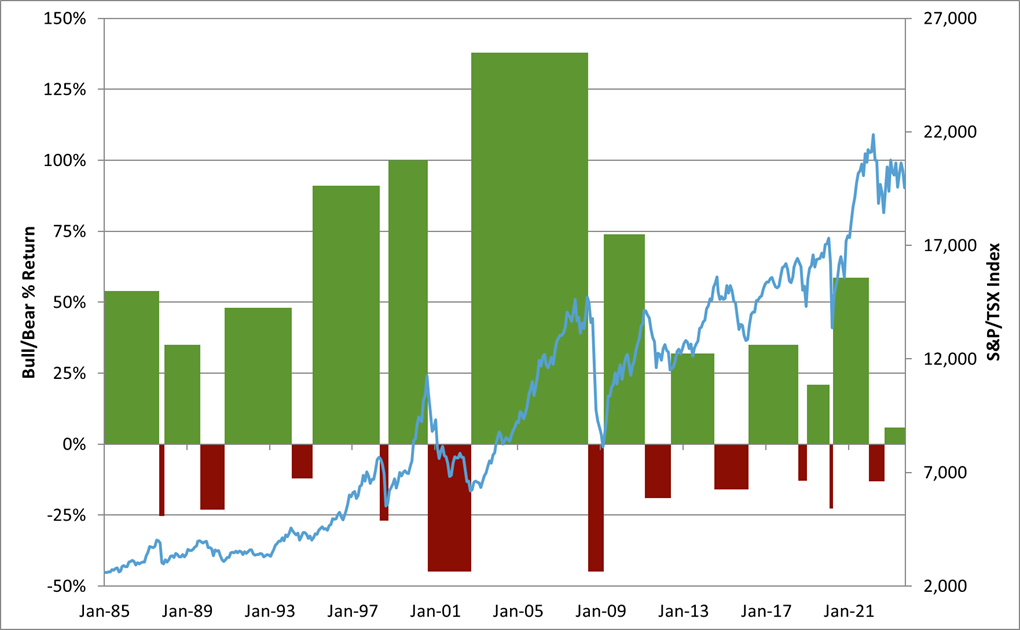

Last October marked the bottom in equity markets. Unfortunately, markets don’t go up in a straight line as they invariably experience setbacks along the way. Earlier this year, it was a U.S. regional banking crisis. Today, the continued advance in government bond yields is putting downward pressure on stocks.

The Dow Jones Industrial Average, S&P/TSX, and S&P 500-equal weighted indices have largely traded sideways for much of this year. The S&P/TSX was up as much as 7% and flat for the year.

For most of our clients, we emphasize that equities' short-term ups and downs should be viewed in the broad context of history. Over the long run, equity markets are the best asset class to compound wealth, delivering mid-single-digit returns composed of capital appreciation and dividends.

During challenging markets like today, we underscore the importance of investing in an asset class that generates a growing cash flow. Our large-cap North American dividend-focused strategy currently yields 3.1% with an annual growth rate in the mid-single digits.

The Canadian bond market has also traded largely in a sideways pattern, up nearly 4% earlier this year and currently flat. Bond returns are composed of both interest income and capital appreciation. Our bond investments currently yield 4.1% (interest income) and have a yield to maturity of 6.5% (yield plus capital appreciation).

Bottom Line: Get paid while you wait. By investing in companies that can weather challenging markets and deliver stable and growing cash, investors will literally be paid dividends.

S&P/TSX Long-Term Price Appreciation and Bull/Bear Periods

Q. How are we lining up going into year-end?

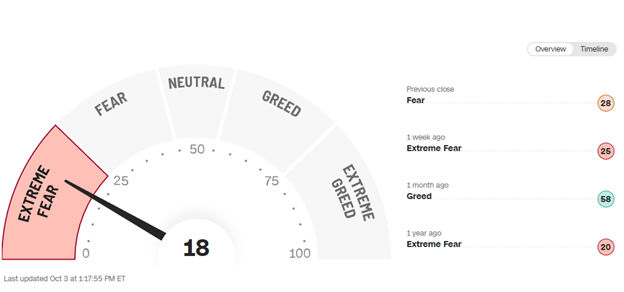

The good news is the markets are following their typical seasonal pattern and are lining up to experience their typical bounce. Along with the seasonal trends, other indicators suggest this October may provide a near-term floor for stocks.

- The last three times the S&P 500 lost at least 1% in August and September, it bounced in October, rallying 8% in 2022, 8.3% in 2015 and 11% in 2011.

- Investor bearish sentiment is at levels that have been associated with significant S&P 500 bounces, fitting with the squeeze higher.

- Earnings season may provide the needed catalyst to reinforce the outlook. S&P 500 2024 earnings estimates bottomed in June and have been revised higher by ~1%, an encouraging sign that corporates are managing the higher interest environment and the slowing economy.

Bottom Line: September weakness typically carries over to the first week of October, but by mid-October, elements are in place for the market to experience strength into year-end.

CNN Fear and Greed Index

Source: CNN

Q. What are the biggest risks to your outlook?

We are reminded of Donald Rumsfeld's famous quote about known and unknown risks whenever we think about risks.

While we are monitoring plenty of risks, the greatest known unknown risk is that inflation does not cool when the U.S. economy lurches toward recession. Under this scenario, the Fed would handcuff to cut interest rates to help stimulate economic growth.

Both equities and bonds would underperform in this environment, but not all equities and bonds are the same. Some defensive sectors like healthcare and consumer staples would offer a safe haven. Within bonds, cash and short-term government and investment-grade bonds would outperform other areas of the bond market.

Bottom Line: While this is not our base case, we must be prepared to deal with the unexpected. An appropriately diversified portfolio allows us to rotate to the areas that protect capital during challenging environments.

Q. I hold the Select Equity Pool but don’t see any dividends paid into the account anymore.

All dividends are received and held within the pool. This allows the dividend to be immediately reinvested into high-interest savings accounts and/or invested in the existing holdings. This way, the dividends received can be compounded at a higher rate of return.

Additionally, dividends paid in U.S. dollars remain in USD, avoiding unnecessary conversion to Canadian dollars and allowing us to convert the currency at the right time opportunistically.

Charts of Interest

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.

Raymond James (USA) Ltd. advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Raymond James (USA) Ltd. is a member of FINRA/SIPC.