December Newsletter – All I Want for Christmas is Another November

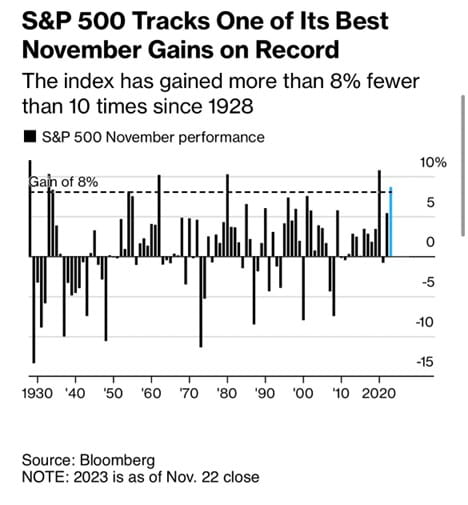

What a difference a month can make. November did not disappoint as both equity and bond investors enjoyed some of the strongest monthly returns in decades.

We had been stressing that markets were due for a bounce since early October and November did not disappoint!

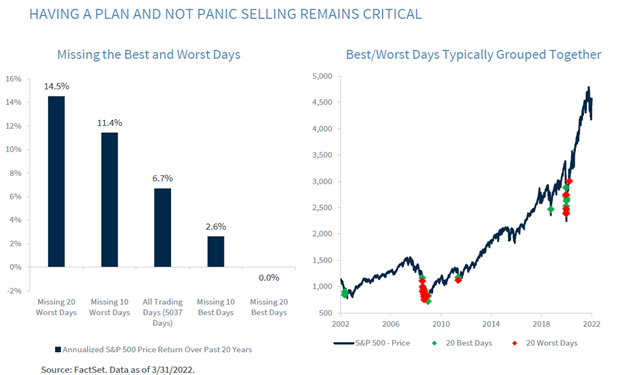

We remind clients to ignore the daily ups and downs of the market, as too short of a time horizon can easily cause you to be whipsawed. Markets can move in extremes in either direction, and we should use those opportunities when investors are fearful to build positions in solid businesses with a track record of success (Buffettology 101).

Despite the diverging returns between October and November, there was surprisingly very little new information to drive such a dramatic return difference. November’s returns were caused by the same factors – declining inflation along with interest rates and the strength of the U.S. economy.

The inflation narrative and outlook we have been discussing for over a year has continued to move in the right direction. Yes, there have been some hiccups along the way; nothing is a straight line up or down, but our view is that inflation would cool, allowing interest rates to level off, which is playing out over time.

Unlike the Canadian economy, which is technically in a recession (two consecutive negative quarters of GDP growth), the U.S. economy remains resilient, perhaps too resilient, which helps to explain why inflation has taken longer to fall.

Nonetheless, evidence that the U.S. economy is cooling has allowed the Federal Reserve to pause its interest rate hiking cycle, which was rejoiced by both equity and bond investors in early November.

Bottom Line: November’s strong returns were driven by inflation moving in the right direction and signs the U.S. economy is slowing, both of which have allowed the Fed to pause its interest rate hiking cycle.

Crystal Ball?

As we approach 2024, we are beginning to lay out our forecast for the year. We will outline this in further detail during our January Outlook webinar. Still, our starting point is that a decoupling between the Canadian and U.S. markets will characterize next year. This also means asset and sector allocation will matter- More to come on this with the January Outlook webinar.

Canadian equities must contend with a more severe deceleration in economic activity weighed down by the heavy-indebted consumer. Mortgage refinances will divert significant disposable income away from consumers, even if interest rates decline from 2023 levels.

The Bank of Canada is forecast to cut interest rates by 100 bps in 2024; some economists are even forecasting a 200 bps cut. The depth of interest rate cuts will be dependent on further progress on the inflation front, employment and levels of immigration.

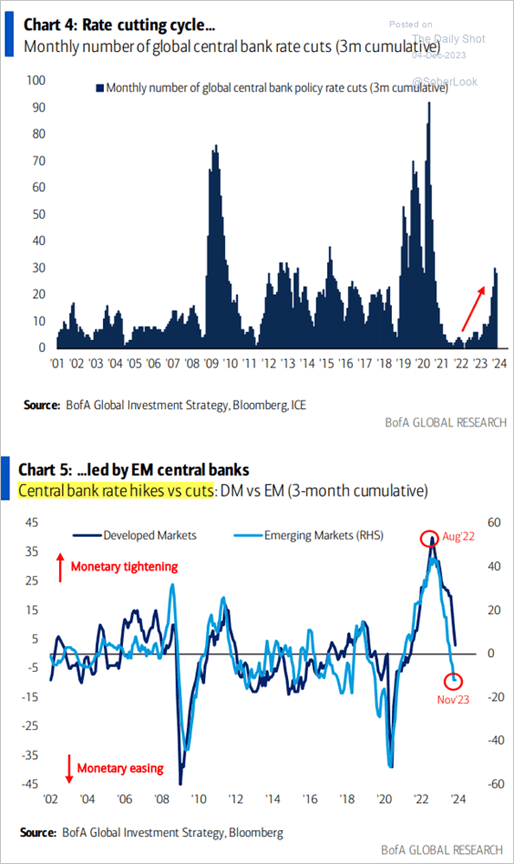

Globally, Central banks have already begun to pause or even cut their key policy rates. Emerging Market economies are in full easing mode.

Turning our attention to the U.S. economy, given the strength of the US consumer, we believe the U.S. will avoid recession over the next six months. Further progress on inflation may push recession risks even further out or, perhaps, even allow the Fed to achieve the so-called soft landing.

Regarding investment positioning, we are favouring a more defensive positioning in the Canadian market that may benefit from interest rates falling. In the U.S., we believe we have a window to continue focusing on more economically sensitive sectors and high-quality dividend growers.

Bottom Line: said another way, we’ll get income from Canada and growth for the U.S.

Charts of Interest

Reasons to stay invested. Best and worst days tend to be clumped together, but if you miss the best 20 days of the year, your annual return is a big fast goose egg.

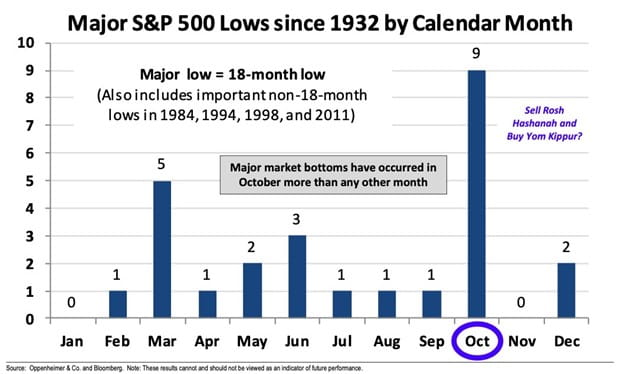

Looks like history repeated itself yet again. Last October proved to be the market low, and right on queue October 2023 provided a floor for equities.