November Newsletter – Up, then Down, Now What?

Upcoming Events

We look forward to our next Curated Speaker webinar on Estate Planning in B.C. featuring Patricia Chartrand, Senior Trust Advisor. If you have not registered yet, please click here.

During this informative webinar, Patricia will present a comprehensive exploration of the essential elements involved in crafting a personalized estate plan tailored to you and your family's unique needs. Our goal is to shed light on prevalent pitfalls and guide you toward a well-prepared approach to managing your financial affairs, ultimately facilitating a smoother transition for your loved ones.

On the Lighter Side

Up, then Down, Now What?

So long, October; say hello to November!

October headwinds in the form of weak seasonality, a material back up in long dated and the initial market reaction to conflict in the Middle East weighed on equity markets.

Some of those headwinds now flip to a positive tailwind. Underscoring the more construction outlooking heading into year-end was the Federal Reserve's (Fed) decision to hold interest rates steady at its last policy meeting citing tighter financial conditions were having the desired impact. This resulted in government bond yields, including the closely watched U.S. government 10-year yield, falling ~10% from its recent peak, a welcome developed for equity and bond investors.

Bottom Line: With sentiment in bearish territory and the Fed indicating they are done for now, the most beat-down names, including solid-yielding dividend blue chips, experienced a sharp reversal in the first week of November.

In fact, both the S&P 500, S&P/TSX, and Cadence portfolios experienced their best one-week gain of the year!

Earnings season has been a bit of a mixed bag. Q3 reporting season was good enough, but the outlook is getting a little murky. Bottom-up consensus estimates for S&P 500 Q4 earnings have been marked down more than is typical, and nearly half the companies reporting lowered their outlook.

The weaker outlook is consistent with an economy losing momentum and coincides with economic data on the margins, coming in a little on the soft side.

As long as earnings and economic data do not deteriorate further, it supports the view that the Fed is likely done raising rates and the coveted soft landing a potential outcome.

Recall that when the Fed is done hiking rates, we typically have a window where equities can perform well.

Portfolio Insights – Down on the Corner

The first convenience store (C-store) dates to 1927 in Dallas, Texas. Unlike the local grocery stores, Southland Ice Company was open 16 hours, seven days a week but was solely focused on selling foot-long freezer blocks, which customers would take home to refrigerate their food.

Seeing an opportunity, the concept expanded to everyday essentials. The concept proved to be very popular, and Southland Ice Co. began expanding the 7 a.m. to 11 p.m. concept across various locations.

First C-store Dallas, Texas

Source: National Association of Convenience Store

In 1946, Southland Ice Co became 7-Eleven, now the largest convenience store operator in North America owned by Japan’s Seven & I Holdings.

With President Eisenhower’s Federal Highway Act in 1956, which expanded the U.S.’s interstate highway system, the modern-day gas station and C-store format underpinned the need and growth of the convenience format.

The c-store market is now dominated by the top three players, 7-Eleven, the largest operator, followed by Alimentation Couche-Tard (ATD-CA) and Casey’s General Stores (CASY-US).

Hoohoo Do You Love

We have exposure to the C-store theme via Alimentation Couche-Tard, the second-largest industry player operating under the Circle-K, Couche-Tard and Ingo brands. The company has a coast-to-coast presence in Canada and operates in 47 of 50 U.S. states. In addition, it has a leading market share across many European markets.

ATD generates ~24% of revenue from merchandise, yet this drives ~50% of gross profits. Foot traffic is the key to these concepts. Remarkably, 65% of transactions are convenience only, 25% fuel only and just 10% is a mix of both. In short, C-stores are more than just gas and go, they are a primary destination for many consumers.

For those who have visited Ireland, you can see this in action. The C-store experience is remarkably different than the standard Canadian gas station. It is not uncommon to see locals filling their baskets with the week’s groceries, stopping for fresh fast food and perhaps treating themselves to ice cream.

Knowing that merchandise is more profitable than gasoline sales, C-stores have invested heavily to improve the in-store experience. To drive foot traffic, C-stores have upgraded properties to ensure a consistent experience and expanded their high-margin fast and fresh food offerings.

The introduction of private label and fresh food offerings across the channel will drive incremental growth. To see this in action, look no further than ATD’s Canadian rival Parkland Fuel’s acquisition of M&M Meats in 2022.

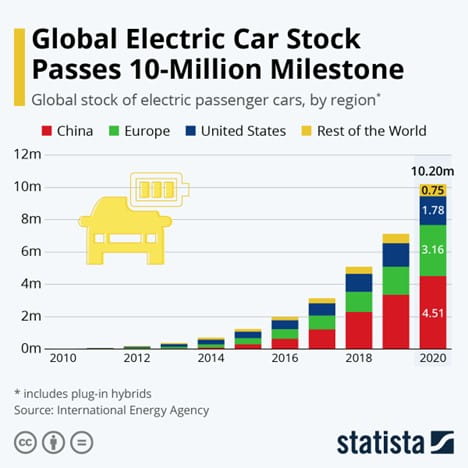

A welcoming store format becomes a greater competitive advantage as EV adoptions increase and EVs look more like an opportunity than a threat. Yes, gasoline revenues will be negatively impacted, but successful C-store formats will increasingly drive a higher average basket size, resulting in higher gross profit.

ATD’s European operations have demonstrated this as EVs longer dwell times in relation to charging have led to an increase in traffic in our stores and, ultimately, a positive lift in sales. However, we may need to take this data with a grain of salt, given current EV owners are generally in a higher snack bracket. Nonetheless, we suspect the data will hold true as EV adoption expands across other regions.

Circle-K in Bamble, Norway

Source: Alimentation Couche-Tard Investor Presentation September 2023

Besides internal growth opportunities, ATD has plenty of external paths to grow through acquisition. ATD’s market share in the U.S. stands at just 5%, yet the C-store industry remains highly fragmented, with many mom-and-pop shops owning one to many locations. Increased regulatory costs and general cost headwinds favour large players and provide ATD with additional opportunities to expand.

ATD is a proven consolidator completing 73 deals and adding ~11,000 stores globally since 2004. ATD also launched a failed hostile takeover bid to acquire Casey’s General Store in 2010.

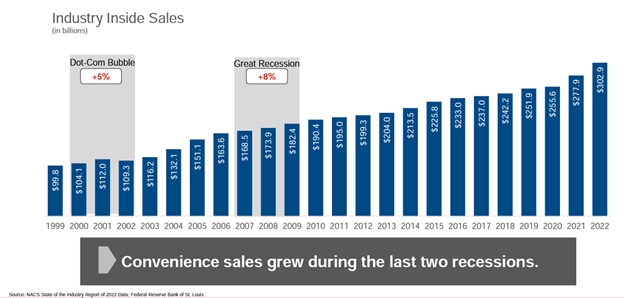

Besides ATD's attractive attributes as a standalone company, the industry is remarkably resilient. Sales have grown consistently since 2002 and even showed growth during the Dot-com bubble, Financial Crisis and the pandemic.

C-store Industry Sales

Source: Alimentation Couche-Tard Investor Presentation September 2023

Charts of Interest

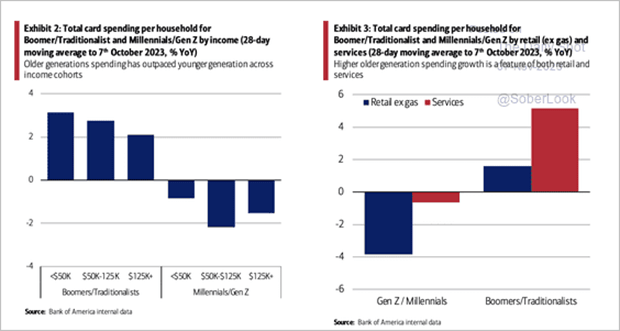

Boomers are booming. Older generations have outpaced younger generations in credit and debit card spending this year, particularly in services, according to BofA.

Global EV adoption on the rise, particularly in China and Europe.

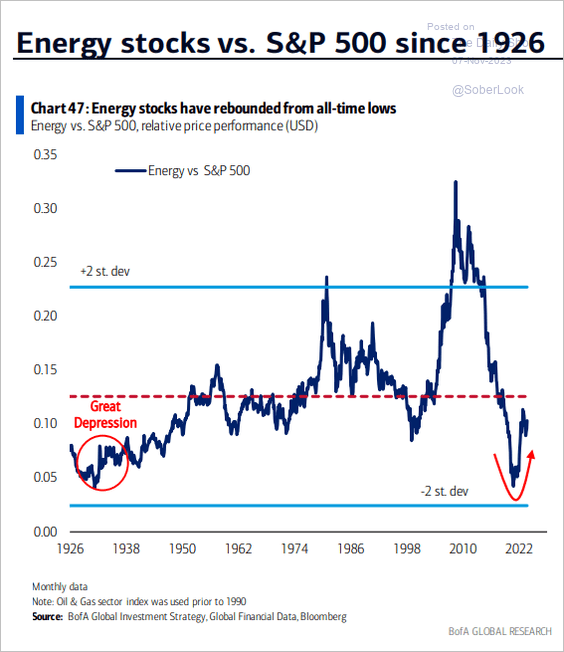

U.S. energy sector rebounds from all-time lows relative to the S&P 500 but has plenty of room to run to return to its historical relationship.

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.

Raymond James (USA) Ltd. advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Raymond James (USA) Ltd. is a member of FINRA/SIPC.