Weekly Market Comment September 4 2020

Pandemics ain’t cheap

Coronavirus cases have generally been down trending in America while up trending in Europe. Spain’s rate of infection was stronger this week than America’s.

According to Diane Francis of the Financial Post, Canada has spent about 15% worth of our GDP on Covid, compared to 10.6% in Australia, 8.9% in Germany, 5% in France, and 4.9% in Italy. A Fraser Institute study estimates that 25% of pandemic income support payments went to people (Canadians and non-Canadians) who didn’t need help.

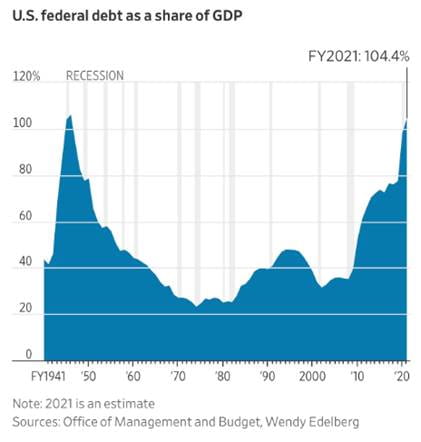

In the meantime, there seems to be little to no progress a bi-partisan agreement to resume stimulus checks to Americans. One challenge is their debt levels are so high, set to grow larger than their annual GDP by next year:

This week’s Weekly Market Comment is brought to you by the letter “K”

We recently heard a fascinating suggestion that the economic recovery doesn’t resemble a “V” or “W” or Nike Swoosh, but the letter “K”. Some people/sectors/stocks have seen their fortunes rise while others are worse off as a result of coronavirus complications.

This bifurcation is happening in market leadership too, perhaps rather symbolically illustrated by the exit of Exxon Mobile from the Dow Jones Industrial Average after 92 years of inclusion. One of the names taking its place is Salesforce.com, the cloud computing behemoth. Out with the old, in with the new.

But the “letter K” is an oversimplification as are the other shapes/letters used to describe something as complex as an economic recovery. One of the worst hit industries has been cruise ships but this week Carnival announced two of its cruise lines will gradually resume cruising, starting with Italy on Sunday and another in Germany on Nov. 1st. New health and hygiene protocols will be implement, which is predictable. Just as the 9/11 terror attacks forever changed the security process in the airline industry and other cross-border transportation, so too will Covid-19.

And then there are tech stocks, which were high flying up until Thursday. The NASDAQ has corrected about 6% in two days, though much of it is driven by the higher flying names like Tesla (down 17% over the same time). Both Tesla and Apple recently split their stock. It’s clear that investors bid up the shares in anticipation of making a profit on the announced splits, only to see many of them get out after the split took place.

In theory, a stock split doesn’t make a stock cheaper any more than exchanging a $100 bill for five twenty dollar notes makes you richer.

What a split can do is make investors think it is cheaper because, in Tesla’s case, a $500 per share stock quote is lower than a $2,000 per share quote. But studies have shown that splits only move stocks higher in the short-run, unless earnings also go up.

Research also shows that splits increase volatility. We certainly saw that this week.

Noteworthy links:

- 26-year-old film editor’s descent into coronavirus vaccine conspiracy theories

- ‘It never went away’: What the 1918 flu can tell us about when life might return to ‘normal’

- Belarus political protests explained (podcast)

- California forecasted to see hottest temperatures ever, extreme fire risks

- Painting one wind blade black ‘can cut bird deaths by up to 70%’ turbine

Word of the Week

bifurcation (n.) – the division of something into two branches or parts. “One way to find food for thought is to use the fork in the road, the bifurcation that marks the place of emergence in which a new line of development begins to branch off.” – William Irwin Thompson