Weekly Market Comment: Friday, October 30th

Markets began the week poorly due to worsening case counts in many parts of the world, as well as an inability of Washington to agree on another round of stimulus. Especially hit were highly Covid-sensitive industries such as airlines and cruise ships. Ironically, October 28th has historically been the strongest day of the year for market on average over 70 past years yet experienced some of the worst volatility this week.

Besides the expected arrival of a second wave of this virus, and delayed stimulus, there is obviously some anxiousness as to the outcome of the US election. Our position going to into this election is to keep cautious but glass is half full outlook. Although some investors had concerns of a Biden Presidency we believe that regardless of who wins the market gets want it wants and that is certainty in leadership. We personally are more interested in the outcome of the Senate in terms of which party has/takes control as it will be a good/better indicator as to sectors that will experience tail/head winds in going into 2021. And yes, depending on the outcome there could be riots and squabbling amongst the candidates like in 2000 which will makes for TV headlines but like all things it too shall pass. More importantly, in the weeks and months ahead markets will be focused on the economic recovery and corporate earnings. A vaccine in the next couple of months along with stimulus (bigger under Democrats and still big under Trump) will give a tailwind to investors going into 2021.

Earnings season hit its stride this week, with most of the famous tech names reporting. At the top was Alphabet (Google’s parent company) which saw a big improvement in digital ads (15% growth). Twitter saw more advertising as well with sales up 14% instead of the expectation for a mid-digit contraction. User growth disappointed, sending the stock down over 17% today alone.

Our favourite data point was Apple’s continued growth of services. Subscriptions to iCloud storage, iTunes, Apple Care, and the Apple Pay service saw services grow 16% to a record $14.5 billion and past Wall Street’s expected $13.9 billion. More growth should be stoked by this quarter’s Apple One subscription bundles that will include the new Fitness+ services.

As for iPhone sales taking a hit, that’s simply because consumers (like your author) were waiting for the new phones to be released. Not every iPhone buyers wants the latest phone because they are expensive. But upgrading to older models gets cheaper after the new models are rolled out. For an iPhone review, check the article in our “noteworthy links” section below. Critics regard the latest phone to be one of the most improved phones in a couple of years.

While earnings have been generally good, being merely “good” isn’t being rewarded by the stock market right now. All of the big 7 tech names, including Amazon, Facebook and Microsoft, saw their shares fall this week.

In terms of Legacy holdings, we had the infrastructure construction company Aecon and Abbvie, most famous for Botox, report strong earnings that did move their stocks quite positively today despite the overall market’s being negative.

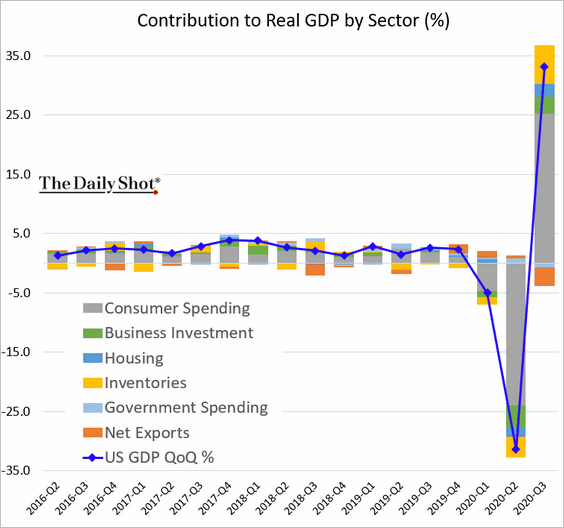

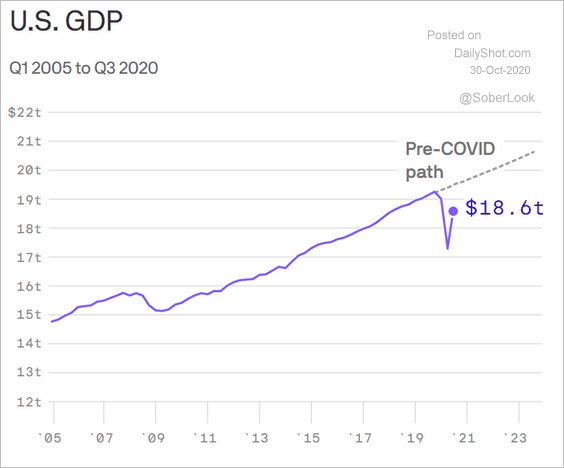

A “V” bottom for GDP?

The US economy continued to rebound in third quarter, With GDP climbing a record 33%. Keep in mind we also witnessed a record GDP drop at onset of Covid-19 economic shutdown. Despite this impressive bounce back in economic activity the US economy still has a way to go to get back to pre-Covid economic trends as seen in second chart blow. And Of course, within this “V” you’ve got sectors like tech that have totally recovered while others sectors such as hospitality and travel that continue to languish badly.

Unfortunately, the economic recovery since March-April around the world has come at a great cost to deficit spending.

In Canada the deficit for this year is projected to be at $343 billion with no clear path to exactly how deficit spending will be brought under control. The majority (55%) of Canadians recently surveyed believe the country is spending too much.

You can also consult the Economists’ global debt clock by country. As The Financial Times pointed out this week, “the global debt to GDP ratio is unsustainable, at over 320%.”

While we obviously welcome economic recovery, we are mindful that the biggest contributing factor to growth has been government stimulus and deficit spending. Medical breakthroughs on the Covid front will be vital to cooling down governments spending borrowed money.

Fracking or renewables? We need both.

Which industry is more important for Pennsylvania’s job market: oil & gas (including fracking) or renewable energy? On an absolute basis, oil & gas is just over 100,000 jobs while renewables is about 90,000. But in terms of growth, renewable jobs have almost doubled in 5 years (ending 2019) while oil & gas grew less than the rate of inflation.

Ideological discussions about the merits of oil & gas vs. renewables miss the point that both are needed and have value. Our cars, plastics and heating needs still require hydrocarbons and the world will require them for a long, long time. But renewables will continue to grow market share and expand at an accelerated pace, as their economics continue to benefit from technological advancements that make them more and more cost competitive.

The market will ultimately sort things out just as it has been to date. Competition is good for consumers.

Noteworthy links:

- iPhone 12 review: Apple’s best since the iPhone X

- Death rates have dropped for seriously ill covid patients

- Record 200 days with no local cases makes Taiwan envy of the world

- How NASA's Apollo program kicked off Silicon Valley's tech revolution

- Five spooky movies to watch this weekend

- Canadian researchers test groundbreaking approach to treating Parkinson's disease

Trepidation

When a visit from a ghost sends shivers down your spine, or when a brush with a vampire gives you goosebumps, what are you feeling? Trepidation, of course.

Food for thought: