Weekly Market Comment: Friday, November 6th

Mid-week hangovers are not advisable

That’s how most market participants feel about this U.S. political election that never seems to end, eager to just put it behind us and move forward. And Mr. Market did just that, waking up on Wednesday morning very bullish, despite the many questions and uncertainty that remained. Namely, who exactly won? At the time of writing it appears Biden will win the presidency, however what is less clear is which party will control the Senate as well as how much of a majority the Democrats will hold on to in the House. Readers may recall last week’s comment where we pointed out that although it was important to have certainty as to who the next president is, our thoughts are more focused on who will control the Senate. Why is this important for investors? A blue (Democrat sweep) means that there will more likely be higher corporate taxes, increased focus on green energy, increased scrutiny within healthcare and tech sectors, and a lot more stimulus (even greater deficits). Whereas, a divided government appeals to investors as it holds back either party from doing much of anything drastic and extreme. Taxes are unlikely to be raised as much, regulatory crackdowns on Silicon Valley and health care will be more mild, and Biden has a more calm and predictable personality that should make for fewer day to day surprises. Currently the markets are anticipating another split Congress, but this could change particularly if the Republicans lose Senate seats in Georgia.

Our base case is for divided government at this point, which provides more continuity of the current environment rather than the potential for wide-sweeping changes. We view this is as a net positive for equity markets, particularly in this scenario given it puts the odds of higher taxes very low in the years to come. In the near term, investor focus is likely to shift back toward fiscal stimulus and Covid. The likelihood of a divided government, and potential for contested results, dampens the size and timing of additional aid. However, we do believe it comes at some point and are encouraged by the change in tone of Mitch McConnell yesterday, that he wants a fiscal package by year end. Also, the virus spread continues to intensify and remains a headwind. While this can influence market volatility, our expectation of positive news flow on therapeutics and a potential vaccine by year end remains.

Earnings and Legacy

Besides the US election, we had several companies that we own in Legacy report earnings this week including Capital Power, Telus, Choice REIT, Parkland (blew the lights out), Endbridge and Pembina. On balance, all of our Legacy positions reported as/better than expected and their share prices moved higher with the exception of the pipelines (Enbridge and Pembina). The question of owning pipelines in the face of a Democratic presidency is open for debate. However, our thesis is that both Endbridge and Pembina offer compelling value including a healthy sustainable dividend yield at these prices. And despite market sentiment, they will continue to play a role in any future energy strategy.

Economic news continued to improve but the question remains whether the recovery continues “V” shape as been the case in China, or begins to look like a square root in North America. Some of the positive news to support a continued recovery in the US include personal income being up in September, despite the lack of any new stimulus, inflation staying in check, a labor market that continues to improve with job gains better than expected, and an unemployment rate tumbling more than the most optimistic forecasts, even with the labor force participation rate increasing.

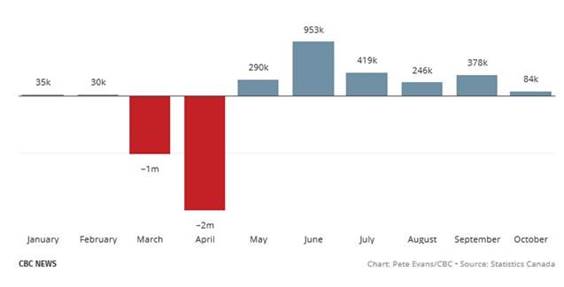

However, Canada has been less impressive on the jobs front adding a tepid 84,000 new jobs last month, according to Statistics Canada estimates. The jobless level sits at 1.8 million people with a further 433,000 workers working less than half the hours than normal. The country remains 600,000 workers behind where it did pre-Covid. Every industry saw some level of improvement except for the food services industry.

Ontario’s recently announced shut-down and the record-setting Covid infection cases across Canada, will likely result in net job losses this month. But it’s worth pointing out that, while the virus is breaking previous infection levels, peak-fear in the stock market seen in March is likely going to remain a memory. Again, automobile traffic (which our Legacy holding Parkland benefits from) is one of the simplest and most visible gage of a society’s coronavirus fear.

Notable Reads

- The pandemic shows us the genius of supermarkets

- Jack Ma’s blunt words just cost him $35 billion (ok, not exactly)

- Bentley to stop making petrol cars by the year 2030

- Dread making decisions? From “This is your Brain with Dr. Phil Stieg” (podcast)

- The erasure of Arsenal’s Mesut Ozil

- Photos of the Week

- 2020

- Yes democrats are trying to steal the election in Michigan, Wisconsin and Pennsylvania (one viewpoint)

- President Trump's false claims on vote fraud: a chronology (another very different take on the events this week)

Musings Beyond the Markets

The conservative columnist, George Will, makes an unflattering observation that virtually nobody wants to admit: all of these regular global government bailouts, wage subsidies, central bank rate moves and asset buybacks that the world has become used to and expects, is essentially a modern day version of socialism (a word most beneficiaries of said government handouts will loudly insist they have no common cause with). There is a difference between government prudently backstopping markets and society in the face of chaos and rushing to the rescue like a helicopter/snow-plow parent does for their precious little junior. Too much of a good thing can actually grow out of control and become bad.

From Will’s “Socialism is no longer just a specter:”

If socialism is government allocation of economic resources (and hence of opportunity), then . . .

John Cochrane of Stanford’s Hoover Institution, who blogs as the Grumpy Economist, notes that in the 2008 financial crisis, the Federal Reserve launched “creditor bailouts, propping up asset prices to keep investors from losing money, buying unprecedented assets.” The risk of moral hazard — incentives for reckless behavior — is obvious.

Today, counter-covid-19 spending already is approximately five times larger than that triggered by the Great Recession of 2008. By 2020, Cochrane says, “once again a huge vat of debt had built up; once again, nobody kept any cash around for bad times, once again, the government stepped in and offered an enormous put option, just as, arguably everyone expected.” The Fed has propped up the prices of corporate and municipal bonds, and bailed out airlines, “or rather airline bondholders.”

“This time, however,” Cochrane writes, “I don’t even hear the promise to clean up the moral hazard. We are, apparently, permanently in a financial system in which people should load up on debt and risky assets in good times, and the government will buy them up should prices ever waver. Private gain, public loss.” Central banks buying trillions of assets are thereby “allocating credit.” Which is the essence of socialism. The Fed buying government and corporate debt creates something difficult to unwind — what Cochrane calls “an entirely government-run financial system”: an attribute of socialism.

Word of the Week

specter – a ghost or spirit; something that haunts you, like a bad memory or regret. “Socialism is no longer just a specter.”