Weekly Market Comment Friday December 4th

Canada’s economy exited the hospital in the 3rd quarter, its strongest quarterly bounce in more than 50 years. Royal Bank, which we own in Legacy, saw its 3rd quarter earnings slightly beating its year-ago performance. It’s an illustration that many Canadian businesses are back to their pre-covid norms.

More improvements are expected, especially in light of vaccine shipments that have already begun in anticipation of imminent government approvals.

Also, there are reports of a bi-partisan U.S. stimulus bill coming into focus, worth approximately $908 billion, involving Mitch McConnell and Nancy Pelosi. While considerably less than what Democrats were pushing for, the numbers being discussed are by no means small. The parties are also in agreement to lift the spending ceiling to avoid a shutdown on Dec. 11.

When healthy optimism loses its sobriety

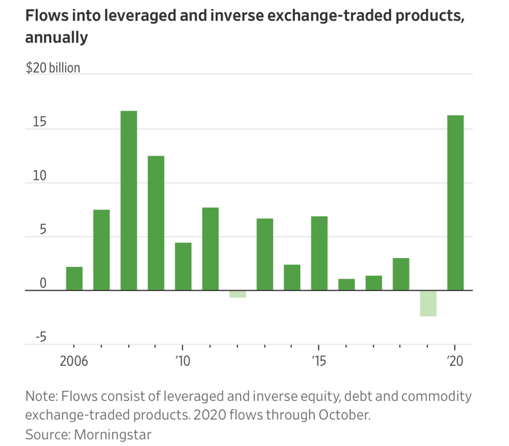

When optimism and confidence is high, some investors get cocky. And the money piling into leveraged ETFs is a good example.

How many of them have heard Warren Buffett’s famous warning that futures are “financial weapons of mass destruction”? Do those investors know that the leverage from leveraged ETFs comes from futures contracts?

This Morningstar chart illustrates the crush of money being thrown at leveraged ETFs. Keep in mind the 2020 tall green bar measures only up until Halloween. Chances are the money flows in November pushed the green bar past the record set just before the Credit Crisis unleashed its mushroom cloud on to the world economy:

A good kind of disappointment

Last week we mentioned having picked up some NGA shares, a blank-check company with $320 million in the bank and reported by Bloomberg to be in talks to acquire the Quebec-based EV (electric vehicle) company. On Monday, a deal got announced. But the good news hit on a day EV shares were getting hurt. Disappointed by the market’s reaction – it was positive but not as positive as we expected – we sold for an 11% gain.

Sometimes it’s best to sell when your investment thesis has played itself out, even if it only took a few days.

Noteworthy links

- California issues its strongest coronavirus lockdown yet

- Diane Francis: A great reset isn’t the problem, the great rerun of stupid handouts is

- Tesla CEO Elon Musk has told friends and associates he plans to move to Texas

- How America’s deadliest serial killer went undetected for more than 40 years

- 10 best books of 2020, according to the New York Times

- Best movies of 2020, according to the New York Times

Musings Beyond The Markets

Critical thinking avoids the following illogical arguments. While not always easy to spot, they are incredibly common and all of us are susceptible to then to one degree or another. In the spirit of clarifying and strengthening our ability to reason and form smarter arguments, we bring you the list. The hyperlink from Karla Cook dives deeper into each one but here is a summary:

1) The Straw Man Fallacy – when a debate opponent over-simplifies or misrepresents your argument (i.e. sets up a “straw man”). Instead of addressing your actual views, they make up views and attack those.

2) The Bandwagon Fallacy – just because a viewpoint is popular and widely held does not automatically make it true.

3) The Appeal to Authority Fallacy – Just because one person of authority/expertise/power holds a certain view does not necessarily mean it is right nor is it a sufficient argument in itself.

4) The False Dilemma Fallacy – oversimplifying a complex issue into two opposing sides with no middle ground, when in fact a spectrum of possibilities in between those stances can be true.

5) The Hasty Generalization Fallacy – jumping to conclusions and a sense of certainty based on insufficient evidence or investigation.

6) The Slothful Induction Fallacy – the opposite of the hasty generalization fallacy, when sufficient and logical evidence reveals the truth rather obviously, but someone refuses to acknowledge it, instead suggesting mere coincidence or some other unsubstantiated speculation.

7) The Correlation/Causation Fallacy – when two things appear to be correlated, it doesn’t prove one causes the other (no matter how much we want to believe that it does).

8) The Anecdotal Evidence Fallacy – instead of logical evidence from a sufficiently large sample size, this fallacy draws conclusions from one or a few limited personal experiences.

9) The Texas Sharpshooter Fallacy – akin to shooting a gun at a barn door and then drawing a target around the hole to make it a perfectly placed shot. Speakers utilizing this strategy tend to cherry-pick data to fit their already formed conclusion. In fact, all evidence should be considered before settling on a conclusion.

10) The Middle Ground Fallacy – believing that the truth is always somewhere in between to conflicting views when in fact one or both of the views may be true.

11) The Burden of Proof Fallacy – when a person claims X is true, the burden on proof is on them to prove it, not on others to prove that it isn’t. For example, let’s say person A says there are mermaids manufacturing teapots behind Pluto while person B says that it’s not true. The burden of proof lies with person A, not person B.

12) The Personal Incredulity Fallacy – just because you can’t understand how or why something is true does not automatically mean that it isn’t.

13) The “No True Scotsman” Fallacy – making universal generalizations and deflecting contradictory examples. For example, person A claims “no expert would ever do such a thing!”. When an example of an expert doing such a thing, person A changes the terms of his claim: “well, then that must means he isn’t an expert!”.

14) The Tu quoque Fallacy – Latin for “you also”, using criticism to answer criticism instead of presenting a counterargument.

15) The Fallacy Fallacy – just because an argument relies on a fallacy doesn’t necessarily mean their position isn’t true. One claim could be right despite offering wrong reasons.

Word of the Week

sophism (n.) – reasoning with clever but fallacious and deceptive arguments. A specious argument; a fallacy. “Abuse of words has been the great instrument of sophistry and chicanery, of party, faction, and division of society.” – John Adams