Weekly Market Comment Friday December 18th

Real life super heroes

The Covid-19 vaccination rollout began in Canada and America, an astonishing display of scientific, medical and political accomplishment. For America, having surpassed the grim signpost of 300,000 dead – the most of any nation – the good news could not have come too soon. Another full shutdown is being contemplated in New York state and other areas.

A second round of virus-era bailout totaling $906 billion is reported to be getting closer to materializing. The bill will include liability protection for businesses and help for cash-strapped local governments. Talks remain ongoing as of this writing.

A coven of witches

Today was a “triple witching” day. It’s when options on futures, indexes and stocks all expire at the same time, typically making for extra market volatility. It also is a day of index rebalancing. Tesla is joining the S&P 500 on Monday, the most high-profile addition in years.

FedEx was down 5.7% today despite beating analyst earnings expectations. The cause was higher costs related to purchasing personal protective equipment. While the market didn’t like the news of FedEx’s increased expenses, much of these costs (certainly the vaccine) will be temporary and should be viewed as worthy investments.

We’ll probably see large companies spend material dollars to get their work force vaccinated.

Who knew that posting personal photos to the internet could disrupt democracy?

Last week, the F.T.C. moved to accuse Facebook of buying rivals to eliminate competition. Big tech firms have publically acknowledged for the first time a need to update the Communications Decency Act that protects companies from liability for content their users create. Google admits there are “legitimate questions” to be asked about the current rules, while Twitter suggested “expansions”. Though political pressures are mounting for changes, the tech companies would rather pretend to be concerned and make changes on the margins.

Separately, 38 U.S. states filed a lawsuit against Google, claiming the tech behemoth inflicts monopoly power over search by using anticompetitive contracts and other conduct. Obviously, Google denies it all, as every other accused corporation in the history of the world has.

Despite Silicon Valley’s self-perpetuated image of caring more about doing good and connecting the world, the fact is they are first and foremost in it for the money and will strongly resist any real changes proposed by Washington. Litigation is expected to take years.

As far as investors are concerned, these lawsuits will be more of a curious side-show than a damper on their enthusiasm to invest. While government lawsuits are not without merit, most consumers are plenty happy enjoying free Google searches and posting photos to Facebook and Instagram, and messaging or calling long-distance via WhatApp for no cost.

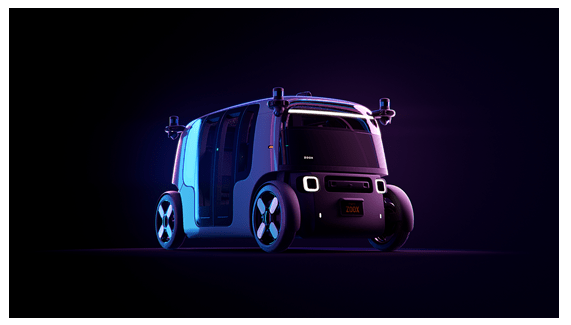

Amazon’s newly unveiled robotaxi with no steering wheel, capable of driving day and night on one charge.

Noteworthy links:

- Top Ten Christmas movies of all times

- CRA allowing up to $400 tax deduction for people working 50% or more from home

- White House official recovers from severe Covid-19 but loses lower leg against the virus

- Larry Ellison is the latest billionaire to leave California, while Oracle moves its headquarters to Austin, Texas

- It doesn’t take many of the ultra-wealthy changing their address to wreak havoc on cities’ finances

- New York spent $1 billion on virus supplies, now it wants money back

- A Winnipeg expert's advice on how to tell the kids Christmas will be different this year

Word of the Week

disinhibition (n.) – a lack of restraint manifested in disregard of social conventions; impulsivity; poor risk assessment. “Deficient serotonergic functioning, ventral prefrontal cerebral cortex, disinhibition of impulsive-aggressive behavior, blah blah blah: the medical lexicon boils emotion from human being. Go take a drug, the doctor says. Pain is a biochemical phenomenon. Erase all memory.” – Antonella Gamotto-Burke