Weekly Market Comment Friday January 8th

Happy New Year! Despite some strange and unexpected headlines in the past few days, stocks got off to a strong start this year. That’s bullish.

But what about the pandemic?

America’s goal of vaccinating 20 million people by the end of 2020 fell woefully short, with only 2.8 million getting a jab. Some waited overnight while others refused their opportunity (a few American hospitals reportedly saw 50% of staff declining the vaccine).

Unlike the flu shot, it also takes more time to administer this vaccine. Recipients are monitored for 15 minutes after the needle, 30 minutes for those with a history of allergic reactions. There are no universal standards, as protocol varies from region to region.

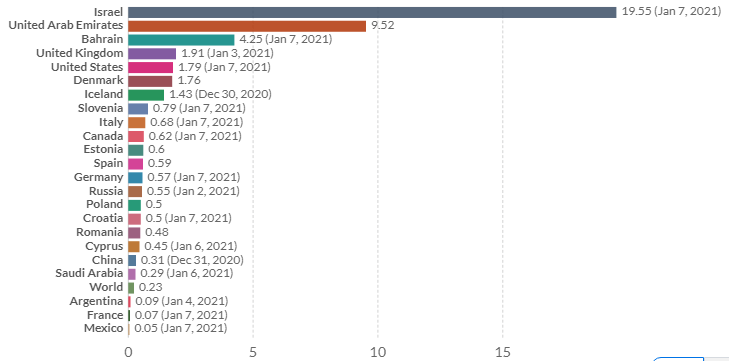

Canada’s rollout has been even worse, with only 0.6% of the population vaccinated to America’s 1.9%. Israel is by far and away the fastest. The following chart is vaccinations per 100 people (note: some will have received more than one dose, so the total number of people vaccinated would be something less):

(source: ctvnews.ca)

In the meantime, Europe approved Moderna’s vaccine while a reported 1 out of 50 Brits has the virus. Shutdowns continue to get announced. So, the pandemic has not played itself out by any stretch of the imagination. Nevertheless, Mr. Market continues to look down the road where there are clearer skies.

“Honey, did you fill up the SUV like I told you to?”

The Saudis shocked markets with a pre-emptive cut of a million barrels of their own production. The news jumped North American oil by 5% and benefiting our Legacy portfolios’ Pembina Pipeline investment. It appears that the Saudis are worried world demand would fall as the pandemic grows worse and vaccine roll-outs prove to be going slowly. While this decision appears to make logical sense, we wouldn’t give Saudi decision makers too much credit. Their tone-deaf production hikes during the most frightening moment of the pandemic lockdowns back in March was sufficient proof that these men don’t necessarily know what they are doing.

Despite the rise in oil prices, the broader stock market didn’t seem to mind much. Markets also took the Georgia runoff results – and the resulting majority hold Democrats will hold over all three branches of government – in stride. Normally, a split Congress is what the stock market favours. Stocks also prefer the U.S. Congress not to be overrun by invading somnambulists, though Mr. Market took that strange spectacle in stride. The siege ended about as quickly as it took to happen.

Deficit spending as far as the eye can see. What else is new?

The U.S. 10 year Treasury yield rose over 1% for the first time since the pandemic shutdowns began. The bond market is signaling that it sees economic recovery on the horizon – essentially the opposite of what Saudi sees. Part of this is an expectation that Democrats will have a freer hand to spend liberally. A stark illustration of this expectation was the huge jump in green energy stocks after the Georgia runoff results solidified Democratic control (albeit it barely) of the House.

All of this rampant and continued spending means budget deficits will continue to bleed a lot of red. This is a long-term problem and one day markets will be forced to care. Also, there is another reason why the U.S. Treasury has been on the rise: increased inflation expectations. In theory, all this government spending is inflationary and is why we have some inflation-deflecting precious metals holdings in our Legacy portfolios.

But who worries about the morning hangover and long-term health consequences when the party remains in full swing?

Noteworthy links:

- Global vaccine tracker

- Quebec imposes curfew as ICU cases near peak levels

- Canada loses jobs for first time since April on covid clampdown

- Canada running short of vaccines despite No.1 ranking in orders

- Footage inside the US Capitol you didn't see on the American networks

- Millions of stimulus payments sent to wrong accounts

- Tommy Lasorda, legendary LA Dodgers manager, has died

- Soul is another cerebral winner from Pixar

- 25 movies to look forward to in 2021

Word of the Week

somnambulist (n.) – a person who sleepwalks. “It gave me no hope to see him doing these simple things with the sluggishness of a somnambulist. It proved nothing more than that he could go like this forever, our silent accomplice, little more than a resuscitated corpse.” – Ann Rice, The Vampire Lestat