Weekly Market Comment: Friday, January 22, 2021

Peak-fear is behind us despite some concerning virus trends

While stocks continued to party in America, the IMF warned that Europe may slip into a Covid-induced recession should Q1 economic performance resemble last year’s fourth quarter. They promised to do more to support nations that especially need financial assistance (the IMF said their focus will be the developing world). England is struggling badly with overflown hospitals, resorting to cancelling some important operations to make room for Covid patients. The silver lining is that infection rates last week down ticked slightly but those measures are predicated in part on the velocity of testing and are decent approximations at best. Boris Johnson warned that this 3rd lockdown could last into the summer.

In this light, Charlie Munger of Berkshire Hathaway fame lamented of an inability to find ideas in the throes of what he sees as “a speculative frenzy” for stocks. While there is proof of this, bulls rightly point out that most of the Covid relief received by individuals has gone to savings and not spending. When vaccinations eventually hit a majority of people, their wallets – so argue the bulls – will start to open.

Nevertheless, a market pull-back would be welcome and even healthy. Having said this, we have no expectation for anything like what we saw in March. That level of fear – as most easily illustrated by the number of cars on the road and people walking around downtown city centers– isn’t even close to being replicated today.

Irrational exuberance personified

The virus shut-downs left most people with more time on their hands (with exceptions, such as embattled healthcare workers and parents forced to occupy young children all day). Combined with lost incomes, many debutante investors turned to online trading. One young couple saw their TikTok messages go viral after claiming more than 2,000% return in one month of trading.

“I see a stock going up and I buy it – and I just watch it until it stops going up and I sell it,” the author of the video bragged with feigned modesty. “I do it over and over and it pays for our whole lifestyle.” They claimed to turn $400 into $14,000 in one month and then turned “less than a thousand” into $20,287.

Such short-term gains, even if true, are just another example of a get rich quick scheme. Making a quick buck riding the wave of an incredibly powerful bull market with little to no diversification owning thee very riskiest of speculative stocks? It can happen. But these youngsters will soon realize that momentum trading (the name of the strategy they described, though they may never have heard of the term) is hardly risk-free nor easy to successfully replicate.

Runaway bull markets make even the least sophisticated and experienced investors look smart. “When the wind blows, even the turkeys fly,” as our old colleague and research analyst Grahame Currie used to say.

Mark Cuban, himself a prodigy of the tech bubble, summed today’s market this way: “You know, everyone is a genius in a bull market, and everybody is making money right now because of the Fed put, and that brings people in who otherwise wouldn’t participate.”

New investors making highly risky, concentrated bets is part of the reason why stocks have been so strong, many of whom will exit as quickly as they entered when the double-edged sword of risk brandishes its other edge.

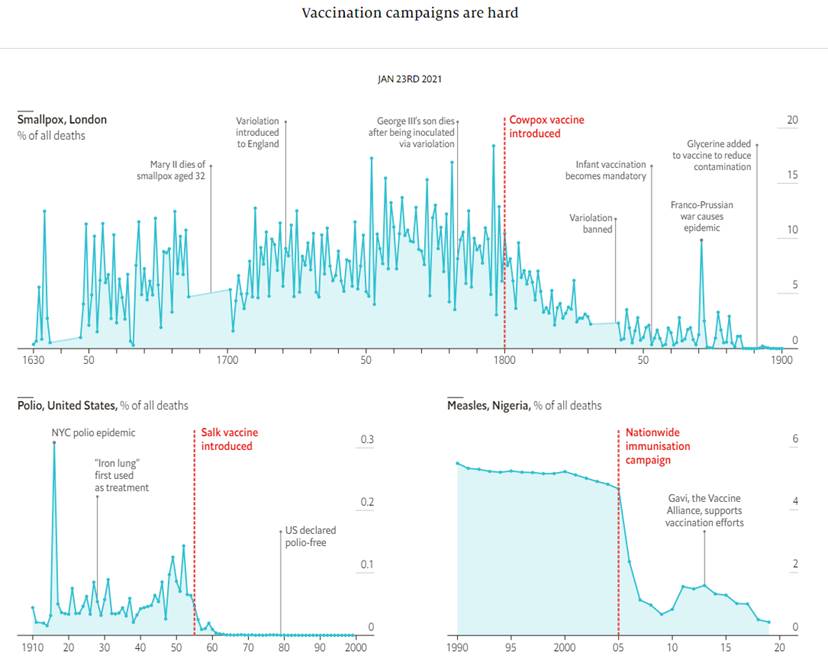

(The Economist)

Noteworthy links:

- Overreach on Covid measures risks turning Canada into a police state

- Canadians piling on mortgage debt as hot mousing market continues

- Ten surprises of 2021, by Blackstone’s Byron Wien and Joe Zidle

- Chilly this winter? Cozy up to the computer that’s mining bitcoin and save on your heating bill

- Jill Biden will keep her job as a parttime college teacher

- Malcolm Gladwell’s Revisionist History: “The Obscure Virus Club” (Gladwell, a Canadian, doesn’t just write great books. His podcasts are excellent)

- How to carve on skis

- Photos of the Week by The Atlantic

Musings Beyond The Markets

For this week’s Musings, we won’t depart from markets but we will depart from today’s markets as we look back in history to a bygone era.

At the peak of the tech bubble (the NASDAQ peaked on March 10th, 2000), Mark Cuban’s Broadcast.com was bought by Yahoo! in an all-share deal that Cuban was smart enough to hedge before the tech bubble famously burst. That acquisition is considered one of the worst internet acquisitions of all time and the company was shut down within a few years of being acquired.

For a Canadian version of this train-wreck story, look no further than Cuban’s Shark Tank colleague Kevin O’Leary. He sold The Learning Company (TLC) to Mattel in the same year (1999) for hundreds of millions. Mattel, thinking their new acquisition would earn $50 million the following year lost between $50-$100 million. Mattel shareholders filed a class action lawsuit against Mattel, accusing O’Leary’s former company of grossed up numbers and accounting trickery.

From a Canadian Business article in 2010:

TLC had been losing money leading up to the Mattel acquisition, a fact that eluded O’Leary in that same 2010 article:

While TLC grossed US$839 million in 1998, it lost $105 million. It recorded losses the two previous years as well. Some analysts questioned why Mattel would pay billions for a money-losing company. “Well, that’s not true,” O’Leary says, eyes narrowing. “The company was profitable when we sold to Mattel. Who said it wasn’t profitable?” I read him the earnings taken from the company’s annual reports, and he asks to see my notes. “You know, I gotta check. This doesn’t look right to me,” he says. After another moment of scrutiny, he tosses the notes back on the table. “Those were public numbers, so whatever they were, they were,” he concludes. “But I don’t think Mattel was worried about that. They were looking at the growth in market share and what our top line was.”

Shareholders filed a class action lawsuit against Mattel, alleging TLC used accounting tricks to hide losses and inflate quarterly revenue. The defendants, including O’Leary, denied the claims. Mattel settled in 2003 for $122-million.

Word of the Week

aesthete (n.) – a person who has or affects to have a special appreciation of art and beauty. “I was an aesthete rather than an athlete and my only wish was to be an ecstatic wanderer.” - Clarissa Pinkola Estes