Weekly Market Comment: Friday, February 26th

Science 1, bears nil.

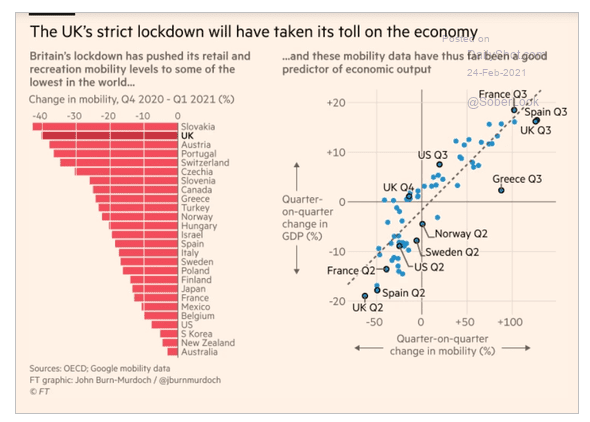

Like a bear not eating during her winter hibernation, the degree to which countries locked down mobility had a direct impact on that nation’s economic output.

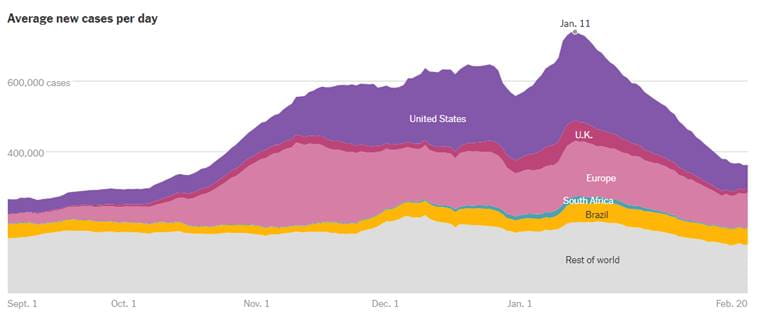

Setting aside the debate as to the effectiveness of lockdowns, the simple fact is that lower case counts (see chart below), should result in more mobility and therefore more economic output later this year. Further cause for optimism is that J&J’s vaccine was found to be 86% effective against severe forms of Covid-19 infection in the U.S. (82% in South Africa), and, of the 22,000 vaccinated people studied, not one died from the disease. These results are miraculous.

As the world sees tangible improvements with the pandemic and earnings last quarter saw about 80% of S&P 500 companies grow (the expectation was for a flat performance), the stock and bond markets became a little jittery at the prospect of a recovering economy also heating up inflation.

“Cheaper and steeper,” as bond traders call it when bond prices fall and the yield curve steepens (when yields on longer-term bonds rise faster than short-term bonds).

The Fed Chairman, Jerome Powell, reminded markets that the Fed would not be raising rates for a long time. “The economy is a long way from our employment and inflation goals,” Powell told the Senate Banking Committee on Tuesday.

Despite the increase in long-term interest rates, it’s worth pointing out that over half of the S&P 500 companies pay a dividend yield greater than 10-year U.S. Treasury bonds. That’s the average. Our Legacy portfolios and SMA managers have a stronger dividend average still.

A Bit. of a bubble?

With asset prices backing down these past few days, JP Morgan observed that the spread between the VIX (volatility index, as measured by S&P 500 index options implied volatility) and the actual volatility of the S&P 500 these past weeks hit an extreme, implying that stocks have more upside yet.

We also read Bridgewater’s Ray Dalio newsletter which outlines factors he uses to measure a stock bubble. No stranger to predicting them, his indicators are mostly neutral or negative.

Yes, price to earnings of the S&P 500 are high but the denominator “E” in “P/E” have been recovering faster than anyone expected, and multiples can fall without prices needing to correct.

But there is a collectibles boom going on, such as Michael Jordan rookie cards selling for US$800,000. These are assets that do not generate operating earnings or cash flows the way companies do.

This article reviews one of the more obviously ridiculous speculative bubbles of recent times: the Beanie Babies bubble. Yes, grown adults bid up the value of these stuffed toys to thousands of dollars apiece while children watched on in awe.

And with that in mind, we caution readers against the new onslaught of crypto ETFs. Prices are in mania mode (though they have come off the boil these past few days) and the corresponding ETFs are as risky as a listed asset gets. As the Beanie Baby article summarizes wisely, bubbles involve the following: scarcity, story, a new marketplace, people in search of entertainment, FOMO (the fear of missing out), and no one knows how far it will go. The article goes on to describe the end of the Beanie Baby bubble:

Speculative bubbles rely on constant upward movement; once the momentum slows, the bubble collapses. By 1999 every single person who could become a Beanie Baby collector already was one. With no prospects for an influx of increased demand, prices stagnated because there was nothing else for them to do. Once casual collectors could no longer count on quick price appreciation on recently retired pieces, they dropped out—and then prices fell as the market contracted, driving out still more collectors.

Chances are, crypto is the financial Beanie Baby of our day. If not Bitcoin, then Dogecoin and hundreds of others. Oh, you’ve never heard of Dogecoin either? It was started up as a lark eight years ago and named after a viral dog meme on the internet, only this lark is worth about $7 billion today at a price of about 5.3 cents after Elon Musk started posting about it.

According to Coinopsy, 1,730 cryptocurrencies have failed as of late last year. And like Michael Jordan rookie cards and Beanie Babies, cryptocurrencies don’t generate operating earnings and cash flows. This is the key difference between these assets and stocks, bonds and real estate. Cryptocurrencies are what Warren Buffet described as assets that only generate a profit if a greater fool comes along to pay more.

Below is a photo taken in 1999 of a divorcing couple in Las Vegas who couldn’t agree on how to divide their Beanie Baby collection, only to have the judge force them to divvy up their riches on the courtroom floor. Yes, these are two adults who were convinced – convinced! – that these raggedy children’s toys were worth thousands of dollars a piece.

Noteworthy links:

- Trudeau approval sinks over vaccination rollout delays, Angus Reid Institute

- The people giving the vaccination shots are seeing hope, and it’s contagious

- The US government spent billions on a system for detecting hacks. The Russians outsmarted it.

- Bill Gates spars with Elon Musk about cryptocurrencies

- The CIA blames MBS for the murder of Jamal Khashoggi

- Hong Kong announced an increase in stamp duty on stock trades, sending shares sharply lower

- Unable to pay tuition, Calvin E. Tyler Jr. dropped out of college to become a UPS driver. He worked his way up and has now pledged $20 million to fund his former school

- Lionel Messi, Barcelona and the crippling cost of success

Word of the Week

asafoetida (n.) – a sulfurous smelling powder that’s extracted from Furula plants, used as spice to add savory and pungent flavor to Indian food. “Asafoetida’s popularity in India is not just a matter of taste. Many followers of Jainism avoid eating root vegetables, so they use asafoetida in lieu of onions and garlic.”