April 2021 Newsletter

Growth When Growth is Scarce

Growth stocks have been basking the warm glow of a global economy that was growing below trend since the global financial crisis (GFC). Investors often seek out growth when it is scarce, which partially explains why growth stocks have performed well over the past decade. More recently, though, the global pandemic pulled forward or accelerated many trends in renewables, e-commerce, technologies to support work from anywhere. While not an exhaustive list, the pandemic has improved the financial prospect for many technology companies. It may be counterintuitive, but in hindsight, technology stocks behaved more like safe-haven consumer staples stocks such as Kimberly-Clark (KMB-US) or Clorox (CLX-US), which benefited from pantry loading (think of the great toilet paper run of 2020).

Based on what we know today, we are past the worst of the global pandemic; thus, investors are now looking past current economic challenges and toward the re-opening of the global economy. Savvy investors are using their COVID winners, technology stocks, as a source of funds to rotate into areas of the market that are anticipated to experience a strong recovery.

Economic data points to a rather robust recovery. The significant policy response (fiscal and monetary), excess savings rates, pent-up demand and low inventory levels, all point to an economy that will grow above trend over the next 12-24 months. Economists forecast Canadian and U.S. real GDP growth of 4.7% and 4.9% in 2021, compared to an average of ~1.7% for each country over the last decades. We believe there is potential for GDP growth to overshoot the current consensus by a couple of percentage points. To state the obvious, growth is no longer scarce.

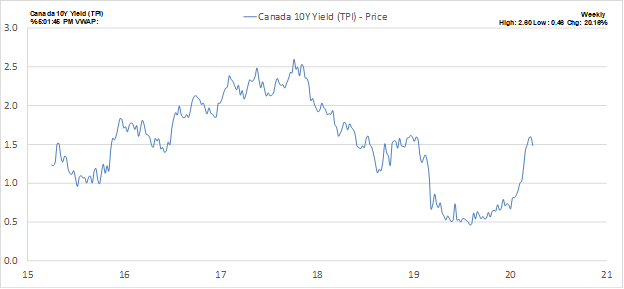

The markets have picked up on this and have begun pricing in a faster pace in the economic recovery as well as building inflationary pressures (more on this later). Canadian and U.S. long-term government bond yields have risen to pre-pandemic levels, gaining for nine consecutive weeks.

Canadian Government 10 Yr Yield Returns to Pre-Pandemic Levels

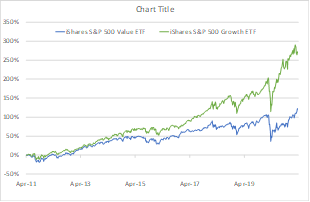

The improved growth outlook and higher long-term yields have diminished investors' need to seek out growth stocks. We can see this by simply looking at the tech-heavy NASDAQ index, which officially entered correction territory last month by slipping ~12% peak-to-trough (February 16 to March 5), while broader markets have continued grinding higher. Another way we can observe this market dynamic is to consider growth versus value stocks. As an investment style, value tends to perform well when economic conditions are accelerating, like the dynamic we see today.

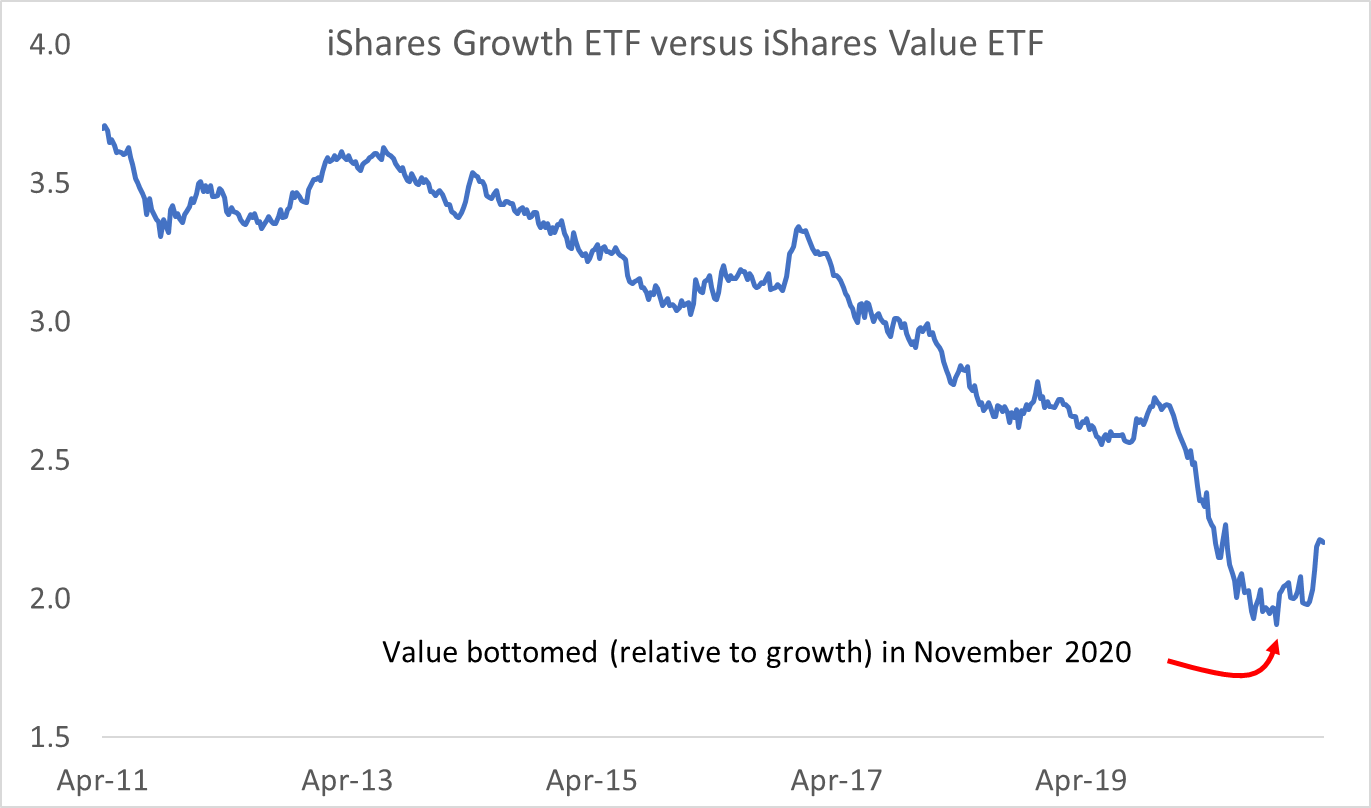

Using the iShares Growth (IVW-US) and Value (IVE-US) ETFs as our proxies, we can see that growth has outperformed value for over a decade. However, plotting the two investment styles as a ratio reveals an interesting inflection point. Value has been outperforming growth since November of 2020; this is no coincident, as the low point coincided with Pfizer’s (PFE-US) vaccine announcement, the key ingredient to ending the lockdowns and allowing the economic recovery.

NASDAQ & SPX Chart

Growth/Value ratio

Source; FactSet, Cadence Financial Group

We like many of the secular growth stories found in the Canadian and U.S. technology sectors. However, we believe we can be patient for better entry points which may materialize throughout this year as the growth to value rotation continues to playout.

Inflation Outlook

We discussed inflation in our previous newsletter but felt it was worth another look this month, given the significant attention the subject has garnered in recent weeks. There is no doubt in our mind we will see higher inflation in 2021. This is a simple math equation as we lap the deflationary period of the 2020 global pandemic. The larger debate among economists is whether this year’s inflation will stretch into 2022 and beyond. There are arguments that both camps can make, but we are in the inflationary camp and believe it is something we need to be considering when positioning portfolios. Our inflationary views are predicated on the following factors:

- Policy shift. Central banks have indicated they will allow inflation to run hot, and they have changed policy to allow this to occur. Governments are no longer concerned about austerity and are more than willing to spend to spur economic activity. In unison, these are two notable shifts that require close attention.

- Pandemic versus great financial crisis (GFC). Since the GFC, inflation has undershot the target leaving many with the view that inflation has gone the way of the dodo birds. However, the policy actions taken to combat the pandemic were considerably different than the steps taken in 2009. During the GFC, financial institutions received trillions in stimulus; these cash infusions were used to deleverage bank balance sheets. Today, banks are well-capitalized and didn't require a "bailout," but individuals did. This crisis is unique because individuals received direct cash infusions. Some of this cash will be saved; most of it will be spent potentially drive up prices. This is a crucial distinction between now and the GFC.

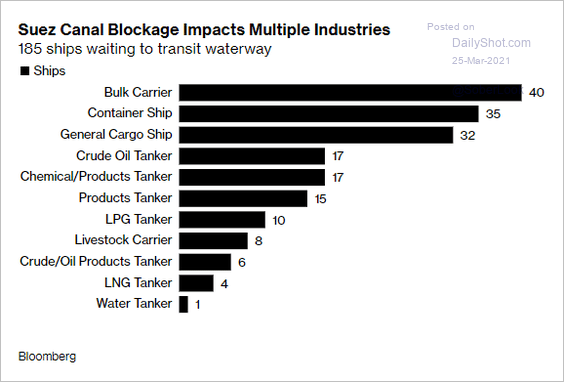

- Bubbling beneath the surface. Onshoring (bring some production back to North America), higher minimum wage, rising input costs, supply constraints, environmental considerations (ESG), higher commodity prices, protectionism, and the demographic deflationary trend is nearing an end.

Inflationary concerns are now front and center for the market. According to Bank of America’s Global Fund Manager Survey, Covid-19 is no longer the most significant tail risk, replaced by inflation and rising interest rates. Fund managers have reflected this in their allocation, moving to overweight financials and reducing exposure to information technology.

Charts of Interest

Captain turn left… no right!

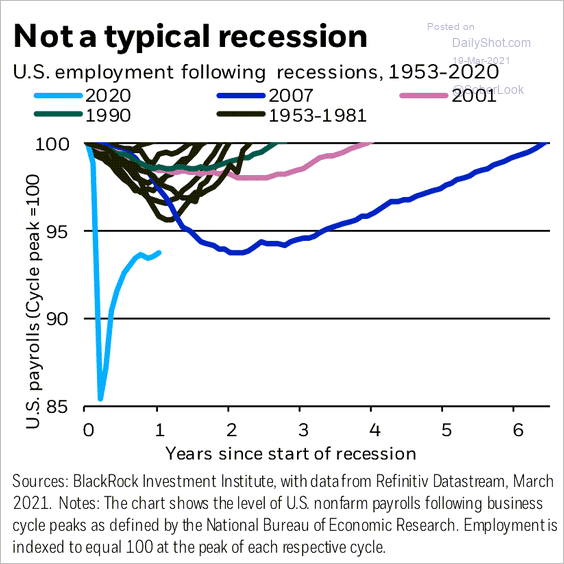

To state the obvious this ain’t your typical recession

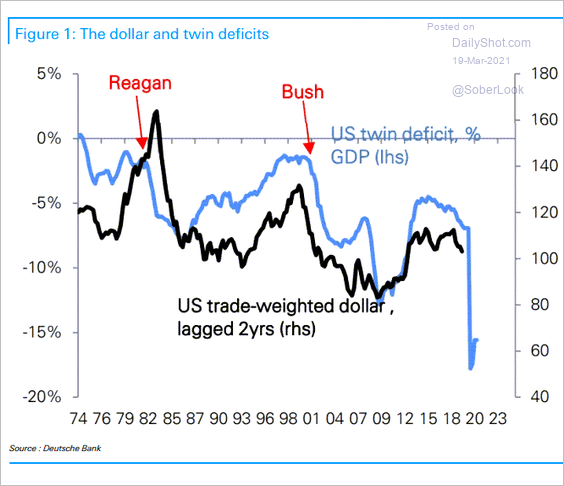

Deficits and the Dollar

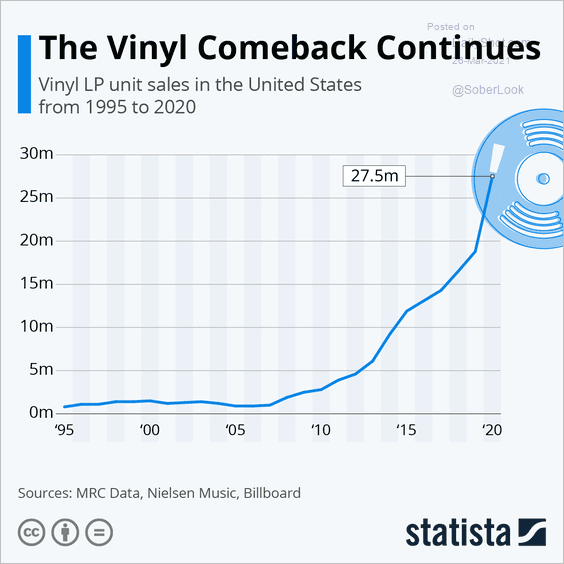

Don’t Call it a Comeback

April 20 Webinar: Quarterly Update

Team member Feature: Madison Chlum

This month, we are proud to feature Madison, a member of our Kelowna branch. Madison Chlum is a client service specialist at the Cadence Financial Group. She joins the team after accumulating several years of experience in the financial industry in both Calgary and Kelowna. As our client service specialist, Madison is responsible for the day-to-day administrative activities required to keep the business running smoothly, such as sending out money, booking meetings and administrative client paperwork. She is devoted to providing excellent client service and using all of the tools available to ensure clients’ needs are met.

After graduating from the University of British Columbia with a Bachelor of Management, Madison spent time travelling before starting her career. Madison has since completed the Canadian Securities Course and is a fully licensed investment representative.

In her free time, you will find Madison enjoying the network of hiking or mountain biking trails in our beautiful backyard. When in need of some relaxation time, she enjoys tinkering in her craft room or baking.

Tips from Tanya: Why Should I Contribute to a TFSA?

Q: Why should I contribute to a TFSA?

A: A TFSA is an excellent personal savings vehicle. It can help you save money for various purposes throughout your life stages, and your investment can grow tax-free. Within a TFSA account, you can hold a variety of investment vehicles such as cash, stocks, bonds, mutual funds and GICs. Unlike its sister account, the RRSP, one of its main benefits is that you can withdraw your money at any time… tax-free. With the 2021 annual contribution of $6,000, the cumulative TFSA contribution room is $75,500 if you have been eligible to contribute since its inception in 2009. I will be more than happy to discuss with you how to best utilize your TFSA in 2021.