Weekly Market Comment: April 24th

A budget without much budgeting

The Canadian government is poised to grow larger still, with a budget proposal that seeks to increase spending despite an expectation that the Canadian economy stands to grow about 6% this year. Spending will encompass an extension of emergency support programs like wage and rent subsidies, a new hiring program, money to support long-term care facilities, and money to support the tourism industry. Other initiatives include expanding Quebec’s early learning and child care system to the rest of Canada, supporting vaccine development and production within Canada, and a $15 minimum wage. Did we mention interest-free loans for green home renovations?

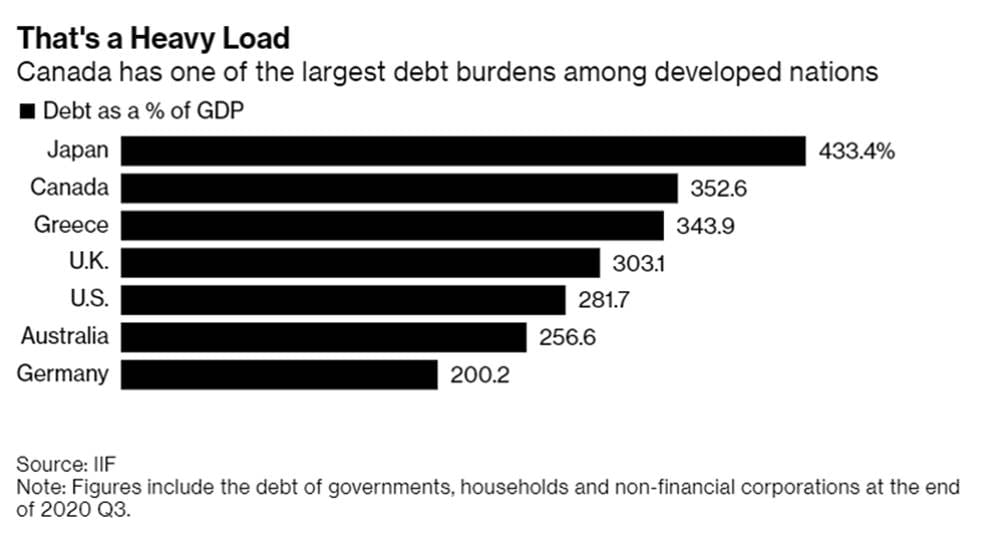

RBC estimates the proposed spending will tally about $100 billion over five years, or 4-5% of GDP (for context, they point out that the U.S. is proposing spending of 10% of GDP). Last year’s deficit clocked $354 billion while federal debt is poised to explode from 31% to 51% of GDP this year, according to the bank.

“Imagine adding as much debt to finance social spending programs in a six-year span (about $700 billion) as in the prior 152 years combined,” tweeted the economist David Rosenberg.

How to pay for it all? Well, they left the capital gains inclusion rate as it is, as well as income tax rates. But if you’re buying a new car or aircraft costing over $100,000 or a boat costing over $250,000, you’ll be paying an extra 10% luxury tax on top of the GST/PST.

A 3% digital services tax will commence in 2022.

The Bank of Canada seems to have more faith in the Canada economy than Ottawa does

Government stimulus spending, combined with vaccine success, has prompted the Bank of Canada to increase their 2021 GDP growth forecast by 2 percentage points to 6.5%. Predictions for 2022 and 2023 were increased to 3.7% and 3.2%, respectively, figures that are above consensus amongst economists. As a result of their increased bullishness, the bank has announced new steps to slow government debt purchases by $3 billion (a quarter). It also pulled forward its expectations for rate hikes from 2023 to the second half of 2022. Canadian bond yields rose, as did the Canadian dollar (higher bond rates attracts foreign capital).

Death and taxes may be inevitable, but they shouldn’t be related

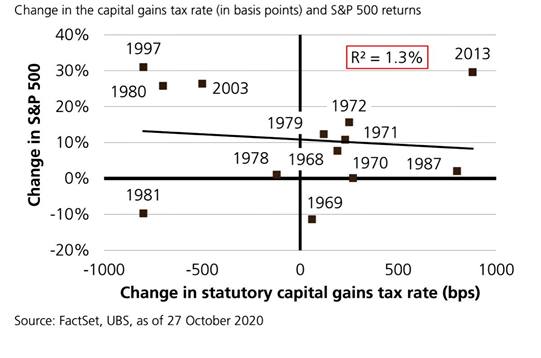

On Thursday, reports emerged that the White House is considering doubling the capital gains tax rate for investors earning $1 million or more. Such a proposal would not be a slam dunk, as a number of Democrat senators reside in conservative districts (think Joe Manchin). Also, there has been little correlation to tax policy and S&P 500 returns, as illustrated by this chart:

An Apple a day

It’s always a fun day when Apple announces new product upgrades and gadgets. This week, the world’s largest technology company unveiled an all-new iMac design, new iPad (with a brighter screen and 5G capabilities), an upgraded Apple TV, and iPhone 12 in a funky purple. They also unveiled a subscription podcast service, one that claims to make searching podcasts easier (this sounds dubious, as it’s already so easy) and ad-free.

One of the coolest releases was the release of AirTags, a new tile-like item tracker that you can put in your wallet, car keys or any other item you have a tendency to misplace. You can track them via Apple’s “Find My” app on iOS devices. You can also be provided notification when you are separated from them.

Apple has expanded the number of their devices using its own in-house chips and not Intel’s. It’s a reminder that when evaluating the specs of an Apple device, it’s important to focus on its overall speed and performance and not individual stats in isolation. Since they design their own software and increasingly more of their own hardware, it’s all the parts work seamlessly together that matters the most.

Andorra and Luxembourg don’t have clouds, only smoke

Tobacco shares got smoked after the Biden administration said it would consider requiring cigarette makers to lower the level of nicotine in cigarettes to non-addictive levels. Some 480,000 Americans die each year, where about 15% of the population smokes according to 2015 data (for a list of per capita smoking by country, click here … Andorra and Luxembourg rank at the top while Canada is #66 and the US is #68).

Simply put, less addiction should mean less death and less burden on the healthcare system. It also implies less cigarettes sold. Studies confirm that smokers are more likely to quit smoking and/or switch to e-cigarettes or nicotine gum when nicotine levels are at non-addictive levels.

Similarly, menthol is being considered for a ban. It occurs naturally in mint but has been used as an additive in cigarettes since the Roaring Twenties, giving the smoker a colling sensation akin to how menthol gum or cough drops do. According to the FDA, menthol helps sooth the harshness of smoke inhalation and is preferred by less experienced smokers like teenagers.

Not surprisingly, the industry denies the FDA’s findings. Menthol cigarettes constitute about a third of U.S. cigarette sales so they simply can’t afford to agree.

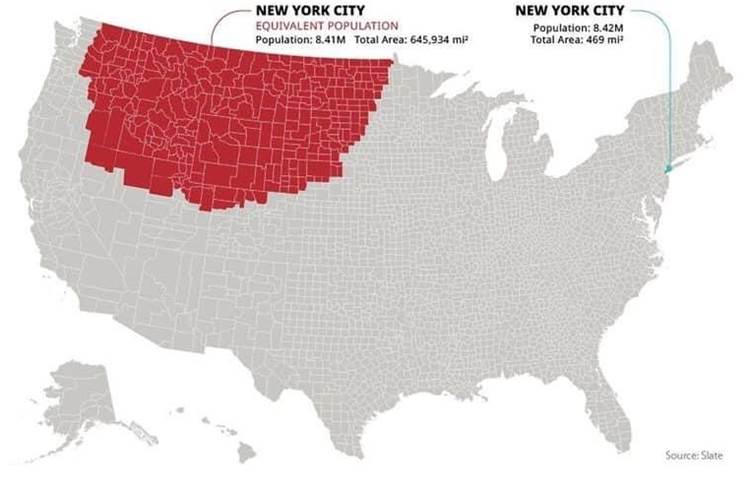

By the way, here’s a fascinating demographics chart to ponder:

Musings Beyond The Markets

Israel leads the world in per capita Covid-19 vaccinations, with their average daily case count falling from a high of 8,500 per day to 136 of late. About 60% of Israelis have at least one dose and over 55% have two.

Key reasons for their advantage includes paying BioNTech-Pfizer almost double per vaccine dose what the EU paid (23 euro vs. 12 euro). Israel also agreed to shoulder liability for the safety of the vaccine, something the EU was very much against during their negotiations with drug makers. To them, Israel was a much less risky customer.

Perhaps Israel’s strongest selling point was its ability, through its highly digitized health care system, to provide weekly data from their vaccination campaign: number of vaccinations, number of infections, age and gender of patients, etc. All this information was anonymously handed over to Pfizer, in an organized, timely and thorough manner. Their program was not just a national vaccine roll-out but a real-time study like none other.

One such peer-reviewed study was published in the New England Journal of Medicine , showing that the key to reversing their burdensome hospital patient trends happened when they crossed the 50% mark for vaccinated 60+ year-olds. Protecting older citizens is especially potent in Israel, where households tend to be large and multi-generational, and is where most of their covid transmissions occurred.

But the overarching lesson from Israel, as well as others like China, is that there is light at the end of this pandemic tunnel. A return to normalcy is a question of “when” and not “if”.

Noteworthy links:

- Apple releases all-new iMac

- Exxon proposes huge carbon capture and storage hub

- Robert Friedland of Ivanhoe Mines discusses energy, mining and copper

- The carpenter who built tiny homes for Toronto’s homeless

- An addiction psychiatrist’s counterintuitive approach to dealing with worry, craving and anxiety

- Michael Jordan’s last 3 minutes in his final Bulls game in 1998

- Photos of the week, by the Guardian

- A Florida McDonald’s is paying people $50 just to show up for a job interview, and it’s still struggling to find applicants