Weekly Market Comment: May 1st

Straight Outta Comparables

Earnings season kicked in to high gear with much of the economy enjoying pent-up demand relative to the first quarter a year ago, which included an especially dystopian March. Apple’s sales skyrocketed 54% from the year ago quarter, thanks to exceptionally strong iPhone 12 sales and the relatively easy year-over-year comps (finance talk for “comparable”). They also authorized a gargantuan $90 billion share buyback (up from $50 billion last year and $75 billion the year before) and increased the dividend by 7% to 22 cents per quarter.

Tesla sales and earnings were impressive, but investors worried about the lack of bullish guidance and how the global chip crunch might complicate their ability to produce cars as quickly. Legacy owns Qualcomm in the chip space, which posted a strong quarter, and stronger 2nd half to come.

Back to Tesla, they earned more money trading bitcoin and from green credits than it did selling cars. Of their $438 million quarterly profit in Q1, $518 million came from selling green credits to other car companies that don’t yet produce enough green credits of their own. They also tabled a $101 million bitcoin capital gain. A profit is a profit, but what if that bitcoin bet went the wrong way?

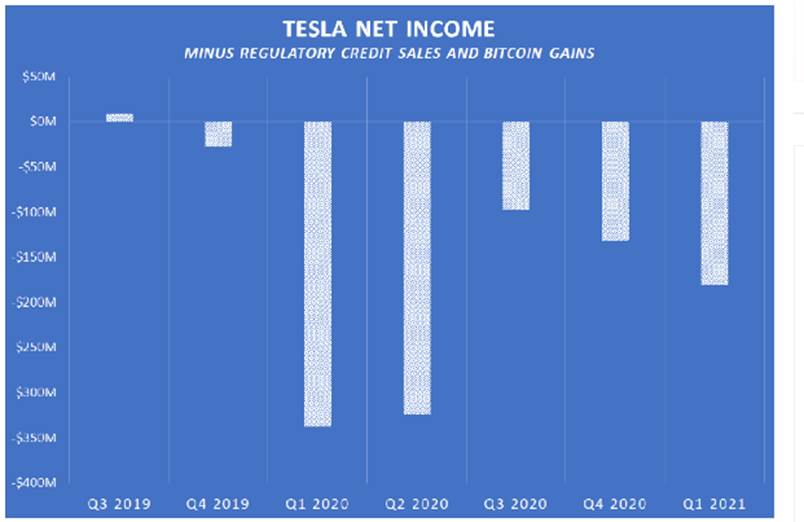

As you can see, Tesla’s car-making business, minus the crypto and green credits, is a money loser:

(source: The Motley Fool)

United Parcel Service (UPS) reported record profits due to unprecedented demand for doorstep deliveries, while the conglomerate 3M warned that supply chain distribution challenges, due to the pandemic, caused their costs to rise, even though earnings beat due to strong demand for their safety products (such as their N95 masks).

As an aside, 3M stands for “Minnesota Mining and Manufacturing Company”, the name it incorporated at the turn of the last century. It changed its name to 3M in 2002.

Our Legacy holding TFI International bought UPS Freight’s trucking operation. TFI’s earnings were 40% higher than a year ago with revenues up 24%. The stock has shot up to an all-time high of $107, almost double its $65 price before the UPS deal was announced in January.

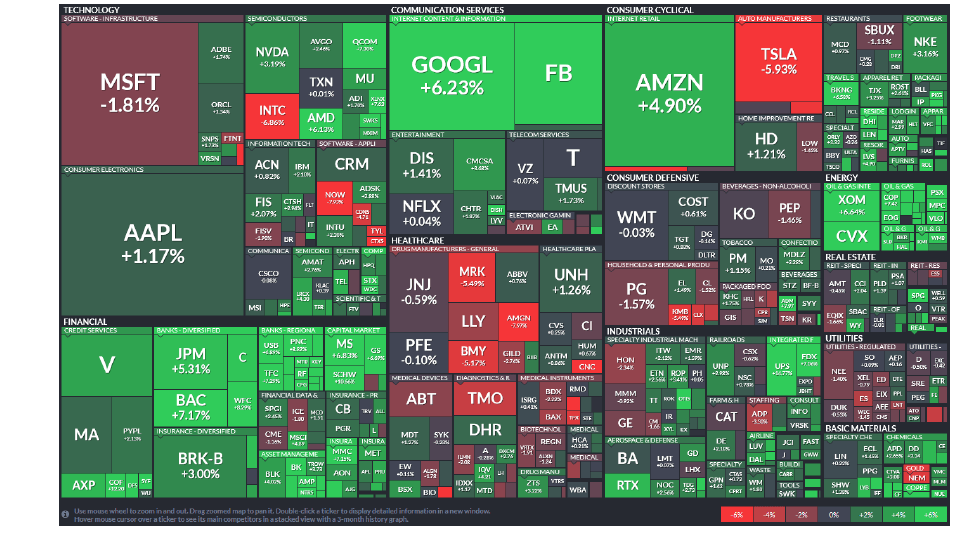

Below is an illustration of the week’s tech stock moves. The size of the box represents the size of the company’s market capitalization (share price x multiplied by number of shares in existence):

For the week ending 4-29-21

The “Shroom Boom” is here

Toronto’s Mind Medicine was approved to up-list to Nasdaq (MNMD). The stocked jumped 32% on over $100 million worth of stock trading hands (10% of its $1.1 billion market cap). This will give Compass Pathways some company, the only other Nasdaq listed psilocybin name. More deals are coming, including ATAI Life Sciences, backed by billionaire Peter Thiel. They plan to raise $100 million in an IPO soon.

But it’s not just hype. This month, a study by the Imperial College of London found that psilocybin (the active ingredient in psychedelic mushrooms) was far more effective and fast acting in treating depression than Lexapro. While Lexapro pulls people out of deep depression, it also blunts their ability to feel much of anything – including happiness and joy. On the contrary, the study reported psilocybin much better at inducing feelings of happiness, mental well-being, and at measures of work and social functioning.

Instead of blunting extreme feelings (targeting bad ones but taking down good ones in the process), psilocybin seems to “re-order” the way a person thinks about things. Participants reported feeling “recalibrated, reset like they haven’t for years” and “enjoying life.”

Scientists cautioned that the 59 person study was small but it’s pretty clear which way the evidence is leaning.

The word is getting out. The promise of magic mushrooms even hit the New York Times recently. We also noticed that a store called Cybin opened up on the corner of Davie at Richards in Vancouver (we assume there are others like it).

Musings Beyond The Markets

On this week in 1856, Granville T. Woods was born in Columbus, Ohio. Armed with a 4th grade education, he went on to invent dozens of patents such as the multiplex telegraph, which dramatically increased train travel safety by allowing trains to signal their location to stations and other trains. The excerpt below is from “Granville Woods, the black Thomas Edison, was noted inventor and held many patents” in the North Kentucky Tribune:

In 1888 Granville Woods, a highly respected Black inventor, was “unmercifully beaten” by Louisville and Nashville Railroad (L&N) employees. Woods had purchased a first-class ticket on the L&N from Cincinnati to Nashville, and during the first leg of that journey to Louisville, sat in relative comfort in first class. Upon arriving in Louisville, however, a new crew “objected to a colored man riding through the ‘Dark and Bloody Ground’ [the South] in first-class style, and attempted to eject him from the car.” When Woods resisted, the crew beat him (“A Colored Man’s Rights,” Cincinnati Post, June 25, 1888, p. 4).

Of all the possible ironies in history, this incident should be recorded in the history books. After all, it was Granville Woods’ many inventions that literally made American railroads safe, fast, and efficient. One of his principal patents, in fact, enabled instantaneous telegraphic communication between the conductors of moving trains and station masters. Thanks to Woods, at any time railroads could keep track of where their trains were, thereby preventing unnecessary collisions.

Noteworthy reading:

- Ballard Power bets the day has finally come for technology that Elon Musk called ‘mind-bogglingly stupid’

- AirTag vs. Tile Buyer's Guide - MacRumors

- Why you can’t compare Covid-19 vaccines (video…very interesting!)

- Stop spending time on things you hate. Your time on Earth is precious and limited.

- Photos of the week

- Best moments from CNN and Sesame Street’s coronavirus town hall for kids and parents

- Space next chapter: the past, present and future of space tourism

- Different is beautiful: 2-year old born without hands to get puppy without a paw to change perceptions

- Prosecco Rose: the bottles actually worth buying this summer

Word of the Week

conglomerate (n.) – a number of different things or parts that are put or grouped together to form a whole but remain distinct entities. “Sir Richard Branson started out as a small business owner and now owns a conglomerate that will give you a ride to the moon.” – Perianne Boring