May Newsletter

It’s been more than two years since we’ve had the opportunity to parse through a federal budget, thus we spend this month’s newsletter providing some context and potential implications for your investments. We also highlight the Bank of Canada, as it made a rather noteworthy shift in policy which has implications for our inflationary outlook. We are mindful of the risks of much higher inflation that may come with easy central bank policy paired with record government spending, even though we are constantly reminded by officials that the near-term price pressures are “transitory”.

Welcome Back, Budget

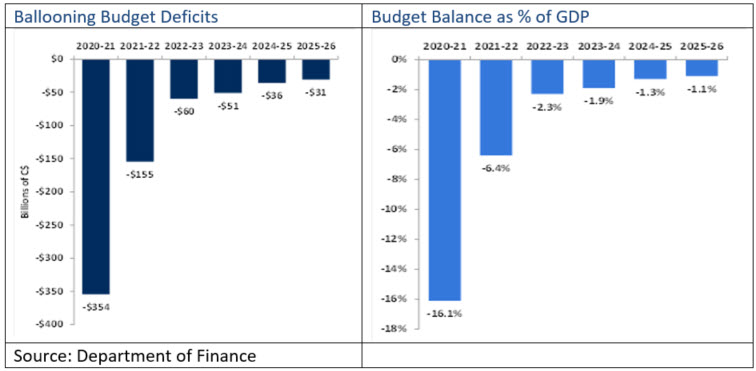

It seems like a distant memory; the days of $20 billion deficits are a thing of the past. Today, $20 billion looks like a small pebble on the annual budgetary road and it will likely take a decade until we arrive at a similar level of deficits.

Much of today's red ink is pandemic-related, thus temporary. Still, the federal government’s first budget in nearly two years introduced a host of new spending measures ensuring large deficits for the foreseeable future. Ottawa pledged $101.4 billion in new spending, in addition to the emergency COVID measures, over the next three years, the high end of the $70-100 billion range proposed in the fall. However, the Trudeau government is betting on a rapid economic recovery to keep deficits in check, and this may be the case at least in 2021. The Bank of Canada (BoC) forecasts Canadian GDP growth of 6.5%, then levelling off to 3.7% and 3.2%, respectively, in 2022 and 2023. Federal Debt-to-GDP will peak at 51.2% in 2022, compared to 31% pre-pandemic, declining to 49% in the fiscal year 2025/26 when total debt outstanding will hit ~$1.4 trillion.

Surprisingly, markets collectively shrugged at the new spending measures (what’s a few more billion tacked onto the national debt when our neighbours are proposing multiple trillions?). This unencumbered spend-while-you-can attitude is a rather dramatic shift for policymakers. Still, with rates at current levels, one can see the rationale to spend in a bid to jump-start a robust economic recovery. As Winston Churchill once said, never let a good crisis go to waste.

For a fulsome review of the 2021 federal budget, please click here. While the budget still must pass parliament, it appears the Liberals have the needed votes from the NDP to move the budget ahead. From an investment standpoint, we can point to a few spending initiatives and potential implications:

- Green recovery. Green infrastructure spending has become a cornerstone of the recovery efforts in North America. The federal budget proposed $17 billion in the years ahead to promote "green" initiatives. We believe WSP Global (WSP-CA) stands to benefit as a professional services company that provides solutions to governments, businesses, architects and planners. Further, WSP’s acquisition of Golder Associates Corp. (closed April 7, 2021) expands its reach in the engineering and environmental science services. We view WSP as well positioned to benefit from infrastructure spending on both sides of the border. Given much of the infrastructure-spending plans in Canada and the U.S. which will be financed by bond issuances, we recently added S&P Global (SPGI-US) as a potential way to benefit from the record level of debt issuance. SPGI generates ~50% of revenue from its credit rating business.

- Housing support. The budget pledged billions for affordable housing, providing further support for a red-hot housing market. Given Canada's lofty immigration goals, there will be no shortage of future demand – Canada targets 401,000 new permanent residents in 2021, followed by 411,000 in 2022 and 421,000 in 2023. Canadian housing has become an essential contributor to GDP growth, supporting the construction industry, consumer spending, mortgage lending and housing-related retailers. Our direct portfolio exposure to housing is primarily through the Canadian banks and to a smaller extent Home Depot (HD-US).

- Labour market. The Liberals have pledged $30 billion for a national daycare system that would lower fees by 50% next year and drop the average cost to $10/day by 2026. We view this as a general positive for labour market participation providing some much-needed relief for struggling parents. In addition, the government support for higher national minimum wage will broadly support retail consumption, particularly for companies focused on lower-income individuals.

For the number of new spending initiatives, there were very few new revenue sources. NDP Leader Singh criticized the budget for the lack of new taxes, particularly on the ultra-rich and big corporations, but given we are still in the early stages of the economic recovery, corporations and individuals are unlikely to see any significant changes for now. Once we have fully exited the pandemic, we would anticipate taxes will be moving higher. On capital gains tax front, unlike our counterparts in the U.S. (the White House is considering doubling the capital gains tax rate for investors earning $1 million or more), Canadian investor capital gains inclusion rate will remain unchanged.

In terms of new revenue sources, the federal government did outline very modest measures, which in aggregate will raise less than $5 billion over the next three years. These include:

- A digital services tax of 3% on revenue from digital services that rely on data and content contributions from Canadian users starting on January 1, 2022.

- A luxury tax on the sales of personal cars and aircraft with a retail sales price over $100,000, and boats for personal use priced above $250,000.

- A foreign non-resident housing tax of 1% on the value of non-Canadian owned residential real estate that is considered vacant or underused, effective January 1, 2022.

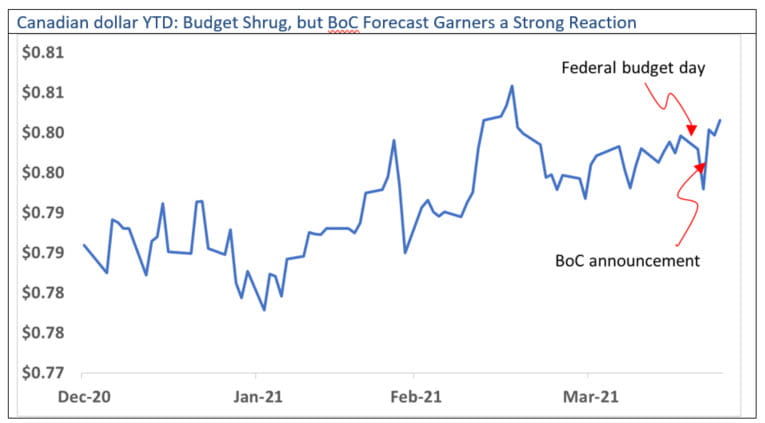

The Canadian dollar reaction to the budget was rather muted unlike the loonie’s reaction to the BoC rate decision on April 21. Our central bank held its target overnight rate at the effective lower bound of 0.25%, but more importantly, announced plans to reduce its weekly purchases of government bonds (effective the week of April 26, 2021) citing progress made in the economic recovery. This is a notable shift, as the BoC is the first developed market central bank to begin to taper its asset purchases, beginning the process of exiting the emergency measures put in place almost one year ago.

While the BoC is taking steps to reduce some of its stimulus measures, Canadian borrows can continue to enjoy rock bottom interest rates “until economic slack is absorbed so that the 2% inflation target is sustainably achieved.” Sustainably achieved is an important qualifier here as it disqualifies the sharp jump in consumer prices in March due to the low base effect from a year earlier. Based on the latest projection, the bank may begin raising rates in H2/2022.

Source: FactSet

Charts of Interest

If you were a turtle which would you be?...Why the turtle wins the race…

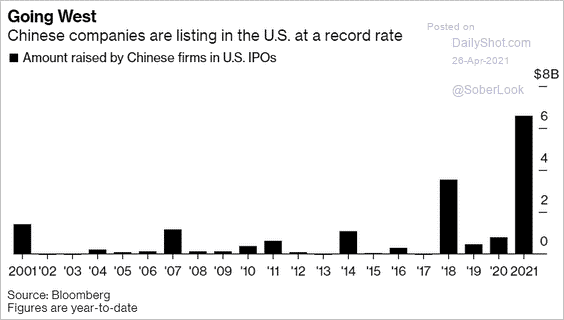

U.S. listings by Chinese companies increased sharply this year.

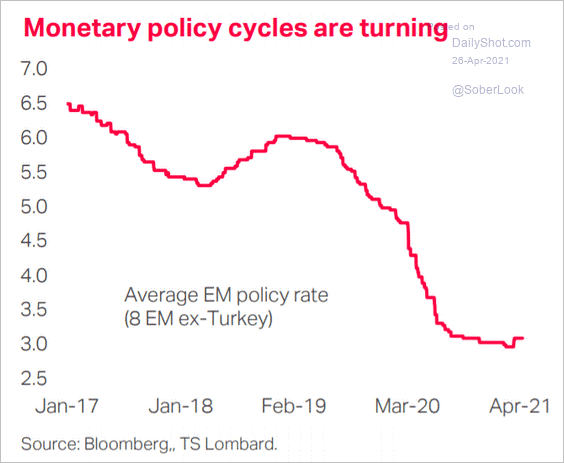

Emerging markets policy rates have bottomed, on average.

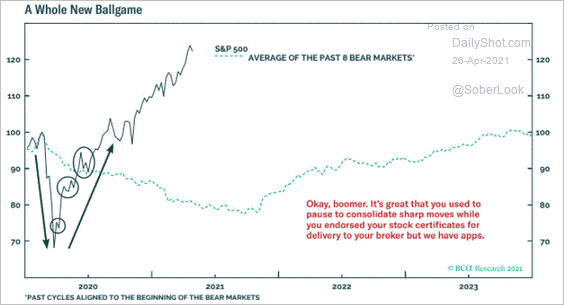

The market performance has been highly unusual relative to previous post-bear-market recoveries.

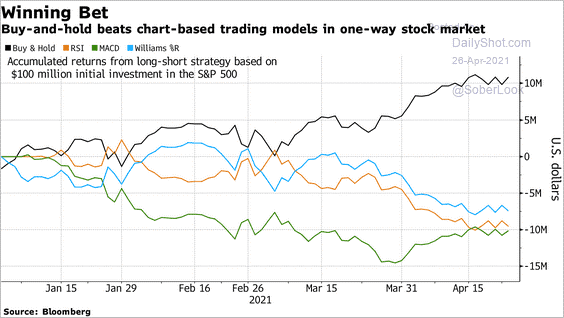

Investing versus trading, buy-and-hold winning.

May is Cadence’s Client & Community Appreciation Month

Our clients and community are important to us. That’s why, for the month of May, we are showing them our appreciation by introducing Cadence’s Client & Community Appreciation Month!

Over the next few weeks, we have various initiatives planned to “give back” to our clients and community. Between charity donations, team volunteer projects, the introduction of Living Wealth, client giveaways and a partner Q & A panel webinar, we want to show that we care. Every Monday, we will share a new initiative in our newsletter, so please stay tuned.

We appreciate your relationship and are grateful for the trust and confidence you have placed in Cadence. Let’s celebrate you!

Partner Feature: Brendan Willis

This month, we are proud to feature one of our partners, Brendan.

We would like to congratulate him for being selected as a Top 40 over 40 honouree with the Kelowna Chambers of Commerce. Tune in tomorrow, May 4, 7:20AM PST on AM1150 radio with Phil Johnson, for Brendan’s feature.

Brendan Willis is a partner with the Cadence Financial Group and leads the team as branch manager and compliance officer. From an early age, Brendan was drawn to business. Not surprisingly, he eventually enrolled in business administration specializing in financial services. Starting at a major bank owned securities firm in August 2000 as an associate to an established advisor, Brendan soon moved to another major bank owned brokerage to take their advisor training program. This 18-month program sent Brendan to Toronto to learn the craft from some legends in the business. After a few years building his business, Brendan partnered with Gerry Austgarden and they moved to Raymond James in May 2006. In 2012, Brendan was approached nationally to take on the branch manager position for the Kelowna corporate office. Seen as a natural leader, he accepted the role.

In 2021, Brendan joined the Cadence Financial Group. He has always believed that an investor should only take on as much risk as necessary to meet the rate of return required to meet their financial goals. His decision to become a partner was driven by Cadence’s ethos of being committed to investing clients’ hard-earned savings in suitable, best-in-class investment strategies, managed in a measured, consistent, and proactive manner.

Outside of work, Brendan is passionate about curling, cycling, raising money for charities and of course, his family. After five years as president of the Kelowna Curling Club, he recently joined Curl B.C. as a director at large. He is dedicated to giving back to a sport that he’s loved since his youth. Brendan is a devoted family man, but when he can get away, enjoys the challenge and reward of road cycling. Conquering B.C. and Alberta, Brendan has his eyes set on cycling across our beautiful country a province at a time. Brendan has helped raise hundreds of thousands of dollars for the B.C. Cancer Foundation, the Foundry, Salvation Army, Central Okanagan Food Bank, Prostate Cancer Foundation and countless others. He is passionate about philanthropy and supporting the community.

The Gift of Membership: Introducing Living Wealth

We are grateful to have you as a client. As a gesture of our appreciation, we are delighted to gift you one of our select private memberships to Living Wealth, a platform that delivers the very best of life enrichment and lifestyle content.

Raymond James and the Cadence Financial Group have determined that your data will remain safeguarded across the platform, so please go ahead and immerse yourself in a world of inspiring ideas, bespoke experiences and exclusive privileges.

Stay tuned for details on how you can sign up for your complimentary membership. Information is coming to your inbox in a few weeks. Please enjoy with our sincere gratitude.

Tips from Tanya: Charitable Giving

Q: Can I still afford to donate to the charitable causes that are important to me when I’m retired?

A: Charitable donations can be a gratifying way to give back. Being able to do so with confidence is even more gratifying and is a significant benefit of the formal financial planning process. Many of our clients have found through our analysis that they can afford their charitable ambitions without compromising their other financial goals. As an example, some have decided to take the additional OAS benefit they received in July and maximize their impact by donating to a deserving charity that supports those most impacted by the pandemic. The OAS special payment was received tax free, the donation creates a tax credit, and the charity receives that money tax free as well! If you are unsure how to achieve your charitable goals, I would be happy to offer a no-obligation discussion of your options.

April 20th: Market Update Webinar Follow-Up

On April 20, Seth Allen & Jason Castelli hosted our first market update for 2021, Where Do We Go From Here? Our main takeaways:

- Long-term market drivers remain intact;

- Investors should pay attention to inflation risks and changes in policies; and

- Our portfolios are focused on achieving long-term growth and capital preservation, while identifying near-term opportunities.

To request a copy of the webinar recording, please email laura.furtado@raymondjames.ca. Stay tuned for details on our next market update webinar being hosted in July.