Weekly Market Comment: May 15th

Inflation is taxation without legislation

Consumer prices have jumped their most since 2008, as the pandemic fears lift and demand rises. Supply-chain shortages and bottlenecks are making goods more scarce. An easy illustration is used-car prices jumping about 10%. New car manufacturing is being slowed by a global shortage of computer chips and more expensive raw materials, labour and shipping costs.

There is an ongoing debate about how durable this uptick in inflation will be, with some arguing that the record spending lavished on society will find those dollars pushing prices higher for a while. Others suggest pandemic disruptions to supply chains won’t last, as well as the fact that year-over-year prices look especially large because they were abnormally depressed a year ago (David Rosenberg also cites government debt acting as a lid on inflation).

Our view is to hope for the best but plan for the worst.

In the short-term, stronger inflation data is bad for price to earnings (P/E) multiples. Over time, it doesn’t tend to have a durable negative effect on stock prices. The biggest reason is that inflation has a tendency to drive earnings higher. Inflation is also often associated with a strong economy. So, pivoting to owning more financials and cyclicals (as we have) is a good idea, but what investors don’t want to do is panic and sell off their investments.

Having children is like living in a frat house – nobody sleeps, everything’s broken, and there’s a lot of throwing up.

Hiring workers is proving to be a challenge for many businesses, as illustrated by the Wall Street Journal in “U.S. Job Openings Reach Record High Despite Hiring Slowdown”. They cite the example of a small business owner, a manufacturer of plastic and rubber components in rural Park Hills (about an hour drive from St. Louis). He’s trying to add 15 trade positions to bolster his 140 person company, raising his offered wage to $30 from $25 to attract more applicants.

“We have heard many times, ‘why go back to work if I would only get a dollar or two more than benefits?” on an hourly basis, said the owner.

Like with most things in economics, the full explanation is broader and more nuanced.

As the Wall Street Journal points out, enhanced unemployment benefits work out to a wage equivalent of $15 per hour. He’s offering double, plus health benefits and vacation. That’s a lot more than “a dollar or two more”. So what’s the problem?

Many of the town’s local high-school students are electing to get a post high-school education instead of taking up training in trades. And there aren’t as many high school graduates in Park Hills due to the town’s tiny population of 8,544.

Also, grade school is the most common form of child care in the Western world. A third of American households have children 14 or younger, forcing many parents to stay home instead of go to work. This past year was the first time in modern history schools have been physically closed around the world.

Finally, there remains the fear of contracting Covid-19 at the workplace, which is going to take a little more time to resolve.

Time to pay the piper

This past weekend, Colonial pipeline fell victim to the virtual, modern day version of a bank heist. A shadowy group of cyber criminals named DarkSide inflicted ransomware on Colonial’s systems.

“We are apolitical…our goal is to make money, and not creating problems for society,” claimed the shadowy group.

Several U.S. governors declared states of emergency while the White House has vowed to prosecute those involved and signed an executive order that directs the Commerce Department to implement cybersecurity standards for all software venders selling to the U.S. government. Expectations are for such standards to be implemented by the private sector globally, especially for critical systems. According to the FBI, Colonial did a flimsy job protecting its systems.

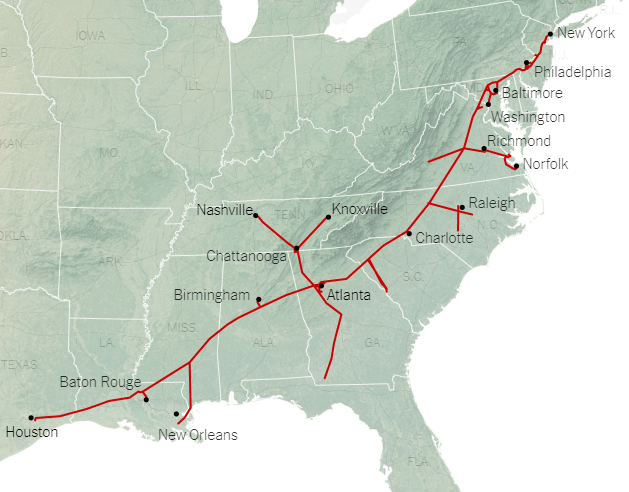

Their pipelines (pictured below) can handle 3 million barrels a day over 5,500 miles from Texas to New York City and handles about 45% of the transport fuel used on the Eastern seaboard. Thousands of gas stations have run out of fuel, in part due to panic-buying by motorists.

Here's the good news: Colonial hired the cybersecurity firm, Mandiant, which traced the theft to a server owned by a New York hosting firm. That server got shut down quickly last weekend, blocking the ability of the hackers to export the data. Bloomberg has reported that Colonial did make a $5 million payment to the thieves.

(source: Wall Street Journal)

Asperger’s has an impressive new public face.

“Ah, so it’s a hustle,” concluded the Saturday Night Live news anchor trying to get Elon Musk to explain Dogecoin this past weekend.

“Yeah, it’s a hustle,” Elon Musk jokingly admitted. Joke or no joke, it tanked the real-life Dogecoin price 30% in minutes.

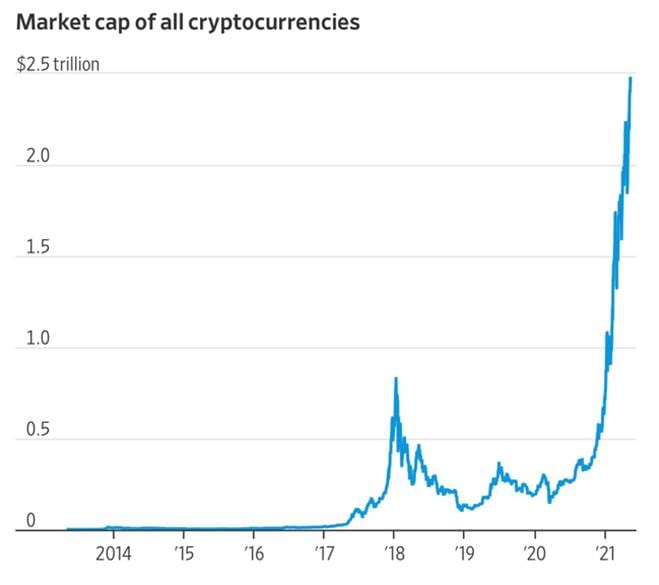

The siren song of Dogecoin has been sung no louder than Tesla’s fearless leader. Ethereum is up over 1,000% this year, as over $2.5 trillion has flowed in to crypto currencies.

(source: Wall Street Journal)

Desperate to not miss out on the next big digital currency, retail investors had been diving in to Ether, Dogecoin and others. Bitcoin’s market share of crypto has fallen from 70% to 43% this year alone.

“Even if you don’t invest in the space, this is worth tracking,” wrote an analyst at DataTrek, adding “a meaningful reset lower could also affect more traditional financial assets like equities.”

JPMorgan warned of “froth” and that prices can drop “pretty quickly”.

Most telling of all was Musk tweeting that Tesla is no longer planning to allow customers to pay with Bitcoin, citing environmental concerns.

By the way, in his opening monologue, Musk disclosed that he has Asperger’s, claiming “I’m actually making history tonight as the first person with Asperger’s to host ‘Saturday Night Live’ – or at least the first to admit it.”

In fact, the Canadian comedian and former SNL cast member Dan Aykroyd was the first in 2003.

Noteworthy Links:

- The secrets of the world’s greatest jailbreak artist

- FDA authorizes Pfizer coronavirus vaccine for adolescents 12 to 15 years old

- Photos of the week

Musings Beyond The Markets

Below is the second instalment of Adam Grant’s essay “There’s a name for the blah you’re feeling: It’s called languishing” . Grant is an organizational psychologist at Wharton and author of “Think Again: The Power of Knowing What You Don’t Know.”

Psychologists find that one of the best strategies for managing emotions is to name them. Last spring, during the acute anguish of the pandemic, the most viral post in the history of Harvard Business Reviewwas an article describing our collective discomfort as grief. Along with the loss of loved ones, we were mourning the loss of normalcy. “Grief.” It gave us a familiar vocabulary to understand what had felt like an unfamiliar experience. Although we hadn’t faced a pandemic before, most of us had faced loss. It helped us crystallize lessons from our own past resilience — and gain confidence in our ability to face present adversity.

We still have a lot to learn about what causes languishing and how to cure it, but naming it might be a first step. It could help to defog our vision, giving us a clearer window into what had been a blurry experience. It could remind us that we aren’t alone: languishing is common and shared.

And it could give us a socially acceptable response to “How are you?”

Instead of saying “Great!” or “Fine,” imagine if we answered, “Honestly, I’m languishing.” It would be a refreshing foil for toxic positivity — that quintessentially American pressure to be upbeat at all times.

When you add languishing to your lexicon, you start to notice it all around you. It shows up when you feel let down by your short afternoon walk. It’s in your kids’ voices when you ask how online school went. It’s in “The Simpsons”every time a character says, “Meh.”

Last summer, the journalist Daphne K. Lee tweeted about a Chinese expression that translates to “revenge bedtime procrastination.” She described it as staying up late at night to reclaim the freedom we’ve missed during the day. I’ve started to wonder if it’s not so much retaliation against a loss of control as an act of quiet defiance against languishing. It’s a search for bliss in a bleak day, connection in a lonely week, or purpose in a perpetual pandemic.

So what can we do about it? A concept called “flow” may be an antidote to languishing. Flow is that elusive state of absorption in a meaningful challenge or a momentary bond, where your sense of time, place and self melts away. During the early days of the pandemic, the best predictor of well-being wasn’t optimism or mindfulness — it was flow. People who became more immersed in their projects managed to avoid languishing and maintained their prepandemic happiness.

An early-morning word game catapults me into flow. A late-night Netflix binge sometimes does the trick too — it transports you into a story where you feel attached to the characters and concerned for their welfare.

While finding new challenges, enjoyable experiences and meaningful work are all possible remedies to languishing, it’s hard to find flow when you can’t focus. This was a problem long before the pandemic, when people were habitually checking email 74 times a day and switching tasks every 10 minutes. In the past year, many of us also have been struggling with interruptions from kids around the house, colleagues around the world, and bosses around the clock. Meh.

Fragmented attention is an enemy of engagement and excellence. In a group of 100 people, only two or three will even be capable of driving and memorizing information at the same time without their performance suffering on one or both tasks. Computers may be made for parallel processing, but humans are better off serial processing.

Word of the week

siren song (n.) – something that is very appealing and alluring on the surface but ultimately deceptive, dangerous, or destructive. Siren literally refers to the mythical mermaid that, in sailing lore, can either bestow lucky weather or angrily sink ships by conjuring a bad storm. “Her sound is a siren’s song, calling me to the rocks.” – Michelle Hodkin.