Market Comment: August 14th

"Honey, why do you keep hiding money under the mattress?"

Headline inflation rose 5.4% in June over last year, the largest jump since 2008. But this time is also expected to see inflation fall toward a more normal 2% rate as the supply side wakes from its lockdown slumber.

“It’s new, used and rental cars. It’s airplane tickets. It’s hotels,” Fed Chair Jerome H. Powell said last month, referring to sectors that have seen steep price bumps. “Each of those has a story attached to it that is — it is really about the reopening of the economy. So we look at that, and we think that those are temporary things, because the supply side will respond. The economy will adapt.”

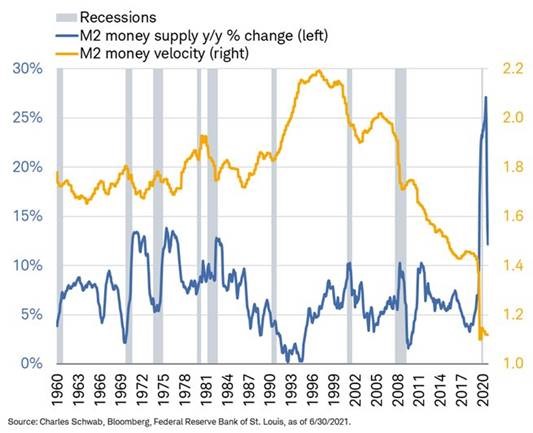

Money supply is shrinking off its pandemic-rescue spike. At the same time, the velocity of money (how quickly a dollar moves around from pocket to pocket) remains at multi-decade lows as it turned even lower these past few years.

Both are disinflationary in and of themselves. Throw in more normal supply chains and recent year-over-year inflation spikes may ease.

What’s nice to see is the rampant, incessant, and unsustainable speed of money printing is slowing to a more sober rate of expansion (see the blue line below).

We’ll also add that consumer sentiment has fallen to its lowest in almost a decade, in part due to inflation concerns. If it leads to less spending, it will be a downhill force on inflation (all else being equal).

Cryptomania meet regulatory reality?

According to U.S. securities law, an investment contract is “the investment of money in a common enterprise with a reasonable expectation of profits to be delivered from the efforts of others.” They are a type of security and all securities are under the regulatory purview of the SEC.

Last week, the SEC charged two individuals and their company Blockchain Credit Partners for having sold digital tokens. More broadly, they are targeting the DeFi market, or “decentralized finance” market. Just because Blockchain Credit Partners claimed these aren’t securities doesn’t mean they aren’t securities.

Do you remember ICOs? Effectively IPOs for newly ‘minted’ digital coins. The SEC went after a lot of those folks. And because those ICOs were deemed securities after all, the crypto exchanges that act as a trading platform for those ICOs are in effect securities exchanges, which requires an SEC license. So this week, one of those exchanges, Poloniex LLC, agreed to pay $10 million to settle the charge that it operated an unregistered securities exchange.

Many such exchanges, including Poloniex, had legal opinions in hand stating that tokens were not securities, intended as a ‘cover your rear end’ maneuver. But in the case of Poloniex, which also had such legal opinions in its back pocket, they failed to work. How many others will the SEC now go after?

This is a big challenge for crypto: what has been largely a Wild West of no regulation is now staring into the barrel of shiny star and sunglass-wearing regulators. Both America and China have stepped up oversight and it’s hard to imagine them easing off the pressure.

Protest this

The lockdowns have pushed most holiday seekers to jump into their cars instead of an airplane. If you’re wondering why prices at the pump have skyrocketed these past few months, that’s the single biggest reason.

American gasoline refineries have been starved for feedstock and, with the ugly politics surrounding pipeline expansions, guess where America is sourcing most of its oil after Canada? Believe it or not, Russia. Imports jumped 23% in the spring to 844,000 barrels per day. America buys more unrefined heavy oil from Russian than anyone else, according to the Financial Post citing government disclosures.

Life is full of unintended consequences and that is a very good example. Do protestors really prefer buying Russian oil that gets shipped instead of Canadian oil? Of course not. Of course, not many of them realize it.

The failed Keystone XL expansion was to increase sales capacity to southern U.S. refiners by the entire amount of crude supplies it buys from Russia.

We’ve said it before and we’ll say it again: “dirty oil” is oil that originates from countries that scoff at human rights and international norms. That includes environmental protections, which Canada upholds far stronger than places like Russia.

Musing Beyond the Markets

U.S. census data for the last decade was just released. The population grew by 7.4% between 2010 and 2020, the second slowest rate of growth since the decade of the Great Depression. The population ended the decade at 331 million.

The non-Hispanic white population fell by 2.6% to below 60%. Just over half the population growth was among Hispanic/Latino residents.

Also, cities continue to grow their populations while just over half of small counties experienced population shrinkage. Phoenix was the fastest growing city at 11.2%, making it now the 5th largest in the country (now ahead of Philadelphia).

“Population growth was almost entirely in metropolitan areas,” said a senior demographer for the Census Bureau.