Market Comment: September 10th

Sayonara Canada

Canada’s GDP contracted unexpectedly in the second quarter, falling at a 1.1% annualized rate. At the same time, inflation is running at a 10-year high.

What the heck is going on? Well, a pandemic, yes. We’ve also got a government that has freely lavished CERB (Canada Emergency Response Benefit) funds to whomever wants to claim it. Heck, there have been reports of millionaire real estate brokers collecting CERB. The support was necessary for a time, but there are still too many jobs going unfilled because many lower-wage workers prefer to keep their incomes below $2,000 per month so as to not disrupt their government handouts. This may be contributing to the lackluster economic performance besides the obvious pandemic challenges.

And what was supposed to be an opportunistic snap election called by the PM and favouring the PM has now led to polls suggesting the Conservatives have the lead going into the Sept. 20th election. Who would have guessed just a couple of months ago? Certainly not the PM.

Namaste Canada

The lockdowns were bad for most clothing retailers but demand for comfortable yoga and athletic wear went crazy, even when yoga and working out wasn’t much on the buyer’s mind. According to the Globe and Mail, athleisure sales jumped 23% in the 12 months ending June while women’s apparel sales shrunk 12%.

Lululemon’s sales in the second quarter, sending shares soaring by 13% on Thursday to new highs. Online sales jumped 8% in the quarter. The trouble with the stock up here is that it’s going to be very difficult for them to replicate that growth. More tangibly, the price-to-earnings multiple sits at about 65 times.

But more competition is coming. The Gap’s Athleta line, a competitor to the Vancouver-based Lululemon, announced last week that it would be offering its wears in Canada in fall 2021. First online, with two retail locations to follow. The price point is noticeably cheaper and sizes go higher than LULU, up to size 26.

More competition will be great for Canadian consumers but is risky for competitors.

Governing for the governed or the governors?

Chinese stocks have lost roughly $1 trillion worth of market cap since February, as the government has stepped up its pace of regulation. But crackdowns are happening across Chinese society, from the country’s wealthiest actress having her movies and press scrubbed from the internet to a ban on for-profit tutoring. The government doesn’t want parents obsessing over educating their kids around the clock. At the same time, they are pressuring gaming apps to limit how long junior is allowed to play.

Some of these moves seem sensible while others surely do not. But it begs the question: can any one ruler/leader be trusted to make all the best decisions on their own. Xi Jinping risks overreaching with all these dictates, possibly doing more harm than good. The economist Milton Friedman had a point when he once wrote, “the government solution to a problem is usually as bad as the problem.” Certainly when that government is a dictatorship.

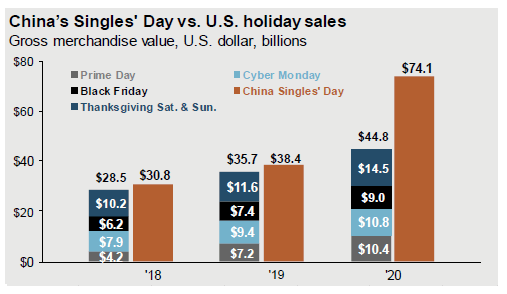

Nonetheless, the current regulatory crackdown has presented opportunities to gain exposure to a country with a growing middle class and one that has placed greater emphasis on consumption lead GDP growth (China Singles’ Day now exceeds the combined US holiday sales). Taking a long-term approach, we recently added Alibaba Group (BABA-US) to the portfolios based on view the Chinese consumer will continue to drive revenue and earnings growth for the e-commerce giant. The investment is not without risk, but with the stock off some 60% from its peak and valuation at all-time lows, we believe there a margin of safety for investor with a long-time horizon.

Source: JP Morgan

Another government “own goal” was the UK falling out of Germany’s top 10 largest trading partners. That won’t be easy for pro-Brexit supports to spin as positive, of whom there are fewer and fewer.

Musing Beyond the Markets

Anyone that has ever been audited by CRA knows how aggressive they can be as they try to extract money from you.

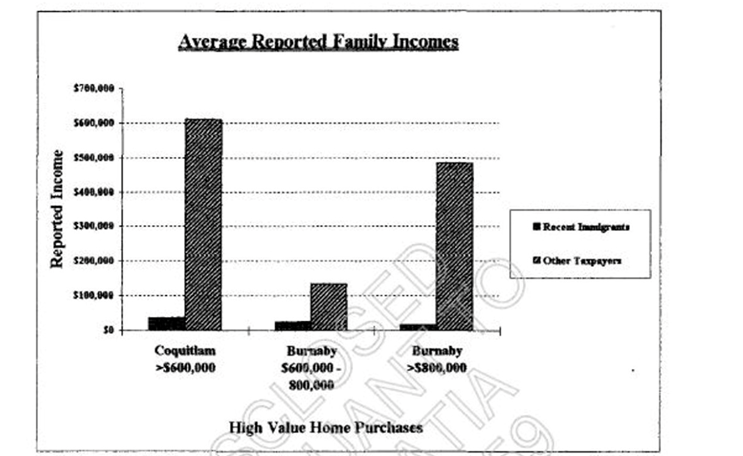

Yet, as recently revealed in a freedom-of-information request, the CRA’S upper management buried its own damning internal study which they didn't want the public to see. They knew 25 years ago that wealthy migration and foreign buyers bought over 90% of the Vancouver luxury housing while claiming laughably unrealistic global income so as to avoid Canadian taxes.

For example, one sample of 46 high-end home purchases in Burnaby ($800,000 or more) found that 72% of them were bought from recently landed residents who reported an average total global family income of $16,000. Long-term residents owning similarly priced homes reported an average $263,701 income.

“It should be noted that an obvious large discrepancy exists between the average total family incomes for long-term Canadian residents and newer Canadian residents,” the author of the memo wrote to his CRA boss. “Furthermore, based on lifestyle and average age of these taxpayers, it is likely that many of these new Canadians still have active business activities, but are not reporting all their sources of income.”

Instead, the former head of CRA and now an economist at the IMF in Washington, Susan Betts, buried the study from public release. It appears they did not want to upset all the money these immigrants were bringing into Canada, including interest-free loans to Ottawa. Documents reveal that Betts spent dozens of pages worth of emails discussing this matter internally yet when asked about it recently claimed “that’s a long time ago. I don’t really remember”.

The documents were finally released after a Chinese newspaper sued under freedom-of-information laws. It took the CRA five years to comply with the request, the massive delay being described by one expert as a ‘tragedy’.