October Newsletter

Showdown at the O.K. Corral

It’s been an eventful September, a September to remember, as they say. The federal election dominated Canadian headlines, and after spending over $600 million, the Liberals picked up two additional seats but failed to gain a majority—no reason to spend much time here; not much has changed. We’ve seen the future, and it looks very similar to the present. The Liberal government will find a dance partner with the NDP to pass many of their common goals, anticipate continued spending on social programs and support for greening the economy, partially offset by revenue gains from higher taxes.

September also reminded investors that markets don’t always go up. Investors faced a rising wall of worry; concern about one of China’s largest property developers posing a systemic risk garnered many headlines late in the month. In Washington, anxieties over the debt ceiling, a government shutdown, and the slow progress on two large legislative bills provided additional headline risks. Both situations weighed on sentiment, sending the S&P 500 2% lower, marking the worst single day since May 12. However, none of these change our bullish outlook on the market, even though markets are likely to be more volatile in Q4.

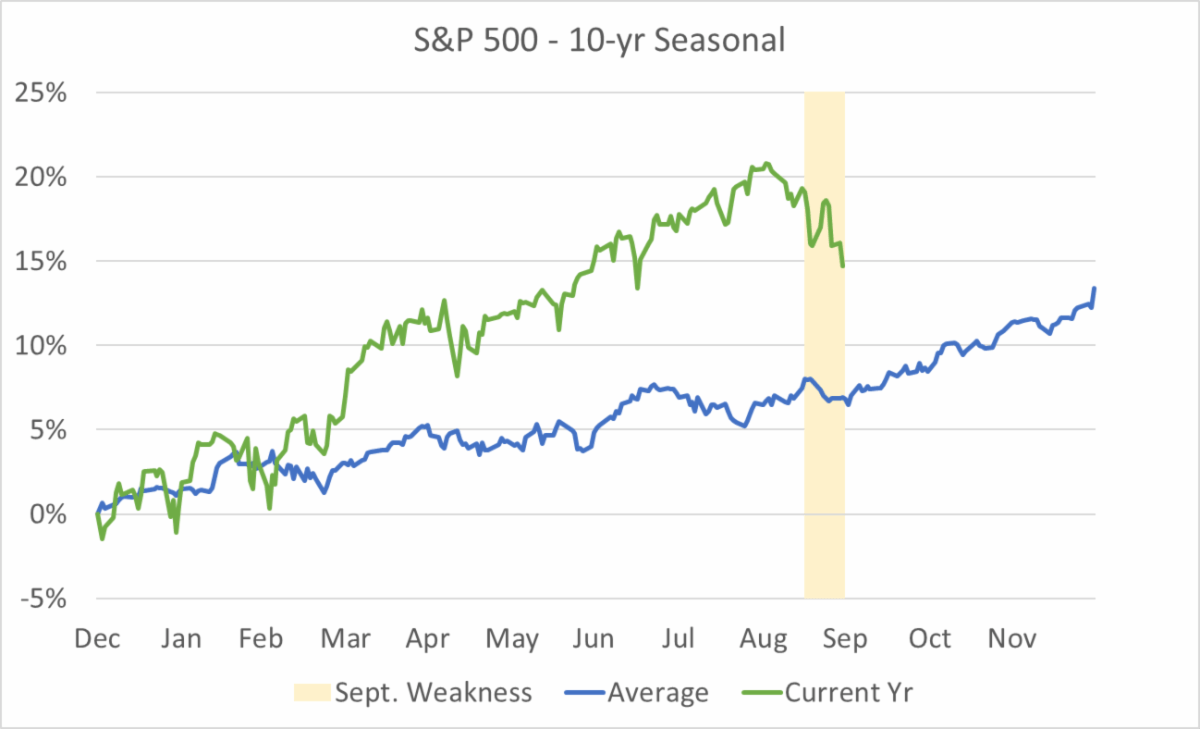

Speaking of volatility, it’s not unusual for the markets to struggle in September. As illustrated in the chart below, over the last 10 years, the final two weeks of September have tended to be a volatile period, on average.

Source: Cadence Financial Group, FactSet

While we acknowledge that history doesn’t always repeat itself, we are comforted that the market has entered its strong seasonal period – historically, the S&P 500 returned 38x more in the November-April period, compared to May-October period. Nonetheless, it’s worth reviewing the potential headwinds that may impact the outlook:

- Showdown at the O.K. Corral. In what has become a regular occurrence in Washington, Congress will take the US to the brink of defaulting on its debt obligations by playing chicken over the debt ceiling. Anyone who has watched Congress in recent years know they only act in the 11th hour, so we expect continued headline risk, but compromise will eventually come. We highlight a government shutdown was avoided with a last-minute vote to fund the government to December. Additionally, two significant pieces of legislation are working through Congress – a $1.2 trillion infrastructure bill and a sweeping $3.5 trillion reconciliation bill. We are of the opinion both will pass before year-end but at a reduced size. Bottom line: Congress will find compromise in the 11th hour, removing a near-term overhang on market sentiment.

- Follow the Money. There has been uncertainty about the path of interest rates and the US Federal Reserve’s (Fed) bond purchases. On September 22, the Fed alleviated any lingering concerns indicating a moderation in the pace of asset purchases “…if progress continues broadly as expected”. The path of interest rates is higher, eventually. Fed members were evenly split on whether there will be a rate hike in 2022, but nearly all officials now see a rate increase by the end of 2023. The asset purchases and rate forecast were largely in line with market expectations. Bottom line: monetary policy remains supportive of risk assets.

- Big Trouble in Little China. Highly indebted Chinese property developer, Evergrande Group, potential failure spooked investors in September; however, we believe the issue can be contained for the following reasons: 1) Chinese officials will act, if necessary, to ensure Evergrande’s failure does not negatively impact the broader Chinese economy (and thus global growth), 2) financial contagion risks have been reduced due to regulations set in motion nearly 12 months early that reduced leverage within the banking system and among property developers. , 3) and Evergrande foreign debt is held by well-capitalized financial institutions that can easily absorb losses. The most significant risk, in our view, would be a sharp downturn in Chinese housing prices; however, there is little evidence of this at this time. Bottom line: Chinese officials will act to protect their economy, watch housing prices for potential risk of a more severe economic slowdown.

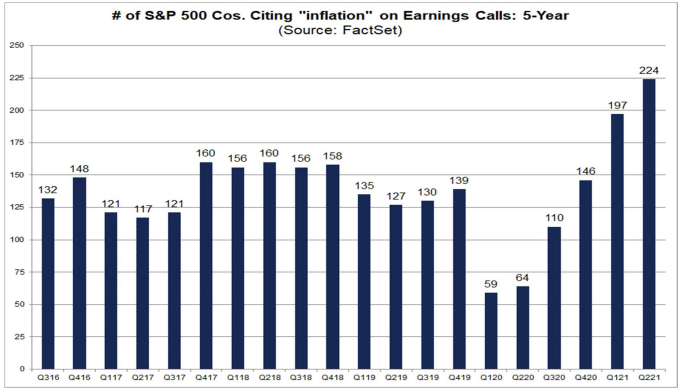

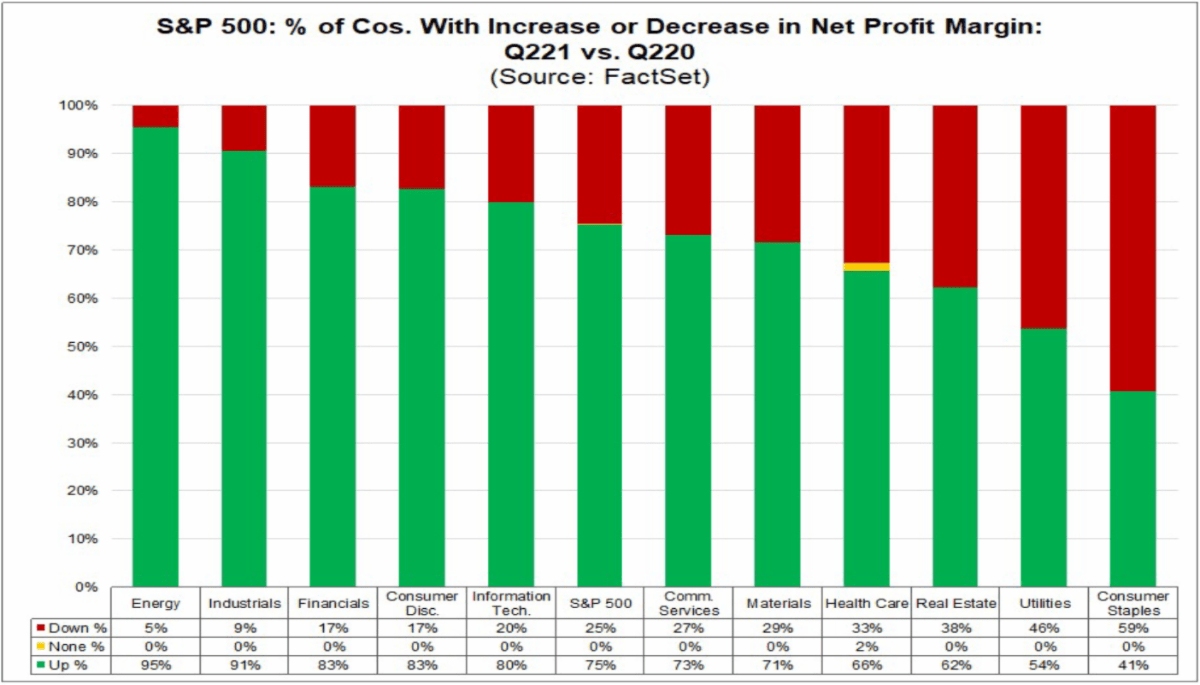

- The Big Squeeze. The largest risk to equity prices is earnings or a lack thereof. Supply distributions, higher input prices and rising wages have weighed on a handful of companies – FedEx cited higher labour costs, US homebuilder, D.R Horton, cut Q4 guidance due to supply chain issues and a tight labour market, and 3M cited higher input costs that outpaced price increases. As you can see in the chart below, inflationary pressures are top of mind for corporate managers, and key for individual companies will be their ability to manage and pass on higher costs.

Despite the one-off company challenges, the broader earnings picture remains very robust. For Q3 2021, the estimated earnings growth rate for the S&P 500 is 27.8%, 3.6% higher than what was forecast 3-months ago (earnings estimates have been revised higher throughout the current quarter). If 27.8% is the actual growth rate for the quarter, it will mark the third-highest year-over-year earnings growth rate reported by the index since 2010. Bottom line: earnings remain robust, but rising input costs may weigh on margins.

Portfolio

US and Canadian markets slipped in September, marking only the second month this year where both finished in the red. We made two relative switch trades during the month and put cash to work by adding three new names to the portfolios.

- We trimmed Superior Plus (SPB-CA) within our utility holdings to increase our allocation to Innergex Renewable (INE-CA). INE is a well-established participant in Canada’s renewable market, with a growing asset base in the US, France and Chile. The renewable energy producer has ~3,700MW of net generation capacity and aspirations to grow to ~5,555MW by 2025, which in turn should drive ~10% annual adjusted EBITDA and FFO growth.

- We trimmed Pembina Pipeline (PPL-CA) within our energy holdings to add to Parkland Fuel (PKI-CA). PKI is in the market and distribution of petroleum products throughout North American and the Caribbean. Despite management reiterating their long-term goal of doubling EBITDA by 2025, shares have become abnormally cheap to ignore.

- New additions to the portfolios include BRP, Inc (DOO-CA), Estée Lauder Companies (EL-US) and Emerson Electric (EMR-US). The addition of BRP, a leading manufacturer of various powersports vehicles and marine products, and Estée Lauder Companies, a manufacturer of skincare, makeup, fragrance and hair care products, increases the portfolio’s exposure to the consumer and reopening themes. The addition of Emerson Electric, a global technology and engineering company, provides exposure to an anticipated increase in corporate expenditure/investment.

The portfolio’s cash levels were abnormally high, at ~12%, during September due to the sale the UBS Global Merger Arbitrage Fund. We are actively looking to deploy the cash into positions we believe are best positioned heading into year-end.

Charts of Interest

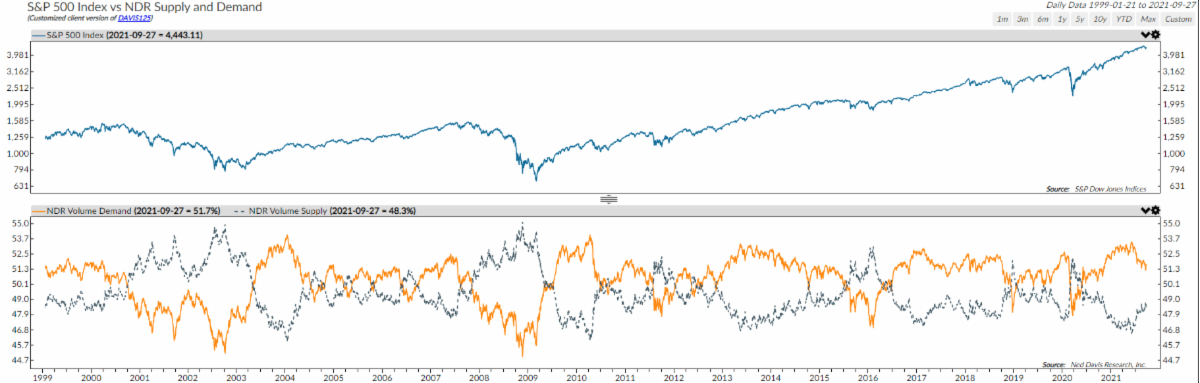

Market supply (blue line)/demand (gold line) imbalance remains favourable for higher equity prices as demand outstrips supply by a wide margin.

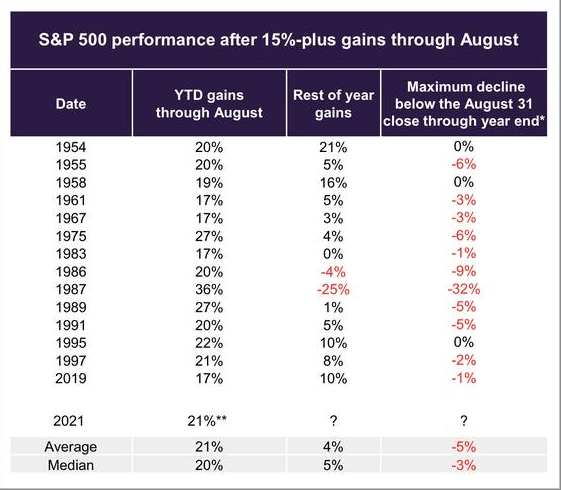

Stocks tend to add to gains by year-end when posting strong returns through August, albeit with minor pullbacks along the way.

Source: The Daily Shot

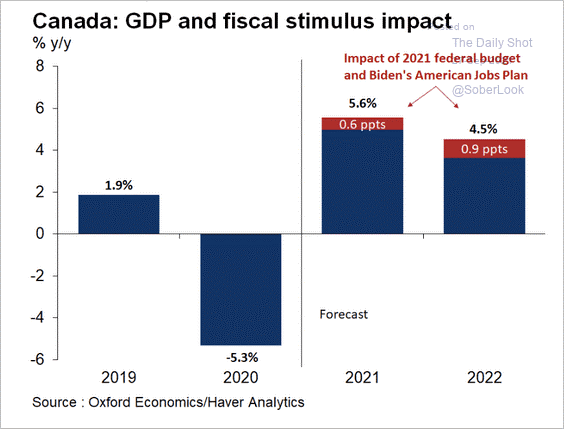

Fiscal stimulus will support GDP growth next year.

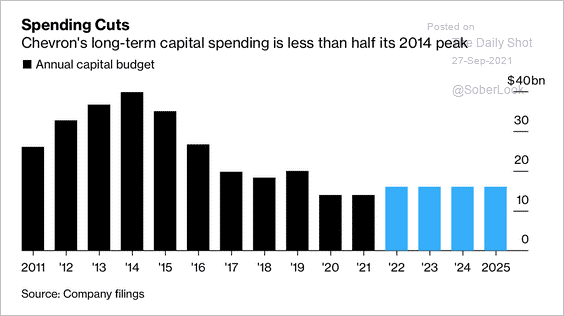

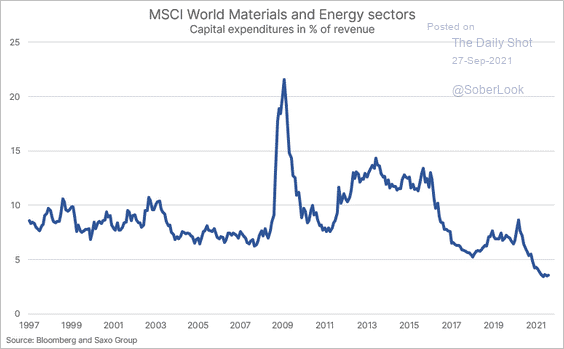

Get ready to pay a lot more for gas at the pump. Capital expenditures at many oil and gas firms is expected to remain subdued, which will further tighten energy markets and boost prices.

Ditto that for other commodity producers, capital expenditure as a percentage of revenue at decades low.

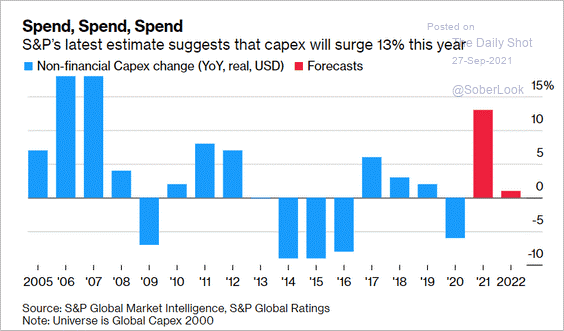

Non-financial capital expenditures are anticipated to surge this year.

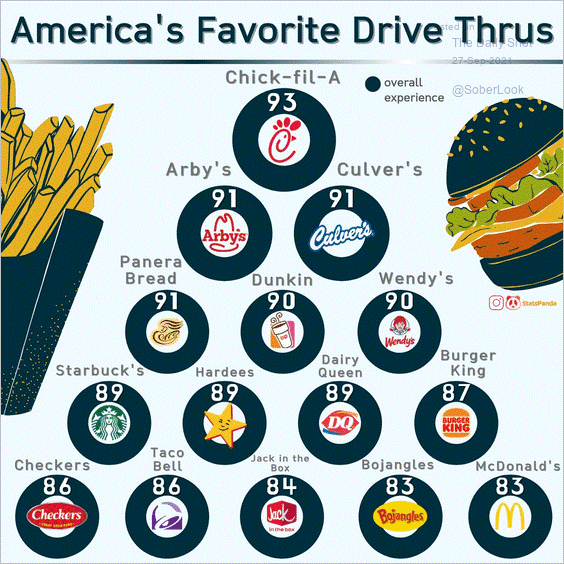

Food for thought, US drive-thru rankings.

Q4 Outlook Webinar: Santa Claus Rally or a Lump of Coal?

Please join us on Thursday, October 28th for a market update zoom webinar with Seth Allen and Jason Castelli. If you have any specific questions you would like us to address, please email them to Laura.Furtado@RaymondJames.ca, prior to the webinar. Pre-registration is required.

Date: Thursday, October 28th

Time: 1:15PM PST

*Registration required

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.