November Newsletter: Inflation, A “Hot” Topic

In April, we highlighted that inflation would become a “hot” topic:

“There is no doubt in our minds; we will see higher inflation in 2021. This is a simple math equation as we lap the deflationary period of the 2020 global pandemic. The larger debate among economists is whether this year’s inflation will stretch into 2022 and beyond.” ~April Newsletter 2021: Growth When Growth is Scarce

We pointed to a policy shift by central banks to allow inflation to run hot and underlying trends such as higher commodity prices, environmental considerations (ESG) and supply chain issues that would put upward pressure on prices.

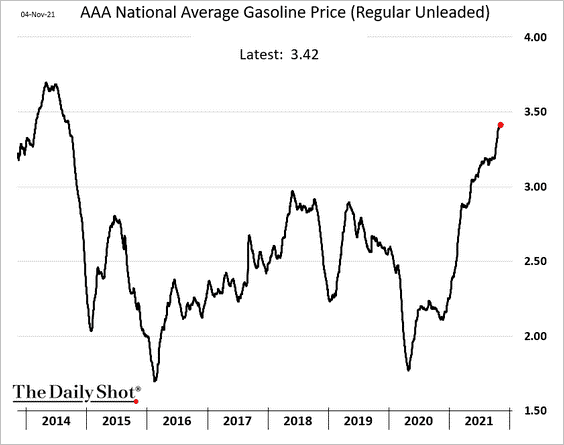

For many of us, working from home has sheltered us from some of the inflationary realities faced by the average Canadian. Anyone not driving a Tesla will surely have noticed the sharp increase in gasoline prices, which jumped 32.8% year-over-year (y-o-y) in September. Transport costs were in fact the largest contributor to September’s 4.4% increase in the Consumer Price Index, but all eight major components saw varying degrees of increases (similarly, US inflation jumped 6.2% in October, the fastest y-o-y price gain in 31 years). The “transitory” inflation camp has softened their position, recognizing higher prices may stick around longer than expected. However, to fully acknowledge that inflation has become more troublesome, we would need to see sustained upward pressure on employee wages. Presently, Canadian average weekly earnings gained 2.6%, which is consistent with the trend prior to the pandemic, but anecdotal evidence suggests wage pressure may become more persistent in the coming quarters.

Clearly, our central bank has become more concerned about the inflation outlook. Bank of Canada governor Tiff Macklem most recently said, “…we will be considering raising interest rates sooner than we previously thought” because “interest rates don’t need to be as low for as long to get that full recovery and get inflation back.”

The timing of this potential first-rate hike is expected in mid-2022, earlier than what economists had predicted. However, inflation is difficult to forecast as many items are working counter to each other. The evolution of the inflationary outlook will hinge on:

Inflationary pressures

- Strong consumer demand, supported by an under-leveraged consumer balance sheet and significant savings rate

- Higher minimum wage and upward pressures on low-income earners

- High level of unfilled jobs

- Environmental movement & ESG trend increasing demand for metals and raw materials, and increasing the cost of energy

- Supply constraints due to lack of investment

- Shift away from fossil fuels to more costly sources

- Expansive monetary and fiscal policy

- Central bank policy shift to average inflation targeting

Deflationary pressures

- Resolution of supply chain issues (timing uncertain)

- Plenty of spare economic capacity

- High unemployment rate

- Innovation and technology

- Demographics and ageing population

- Elevated sovereign debt levels

- Base year effects in 2022

|

Inflationary pressures |

Deflationary pressures |

|

• Strong consumer demand, supported by an under-leveraged consumer balance sheet and significant savings rate • Higher minimum wage and upward pressures on low-income earners • High level of unfilled jobs • Environmental movement & ESG trend increasing demand for metals and raw materials, and increasing the cost of energy • Supply constraints due to lack of investment • Shift away from fossil fuels to more costly sources • Expansive monetary and fiscal policy • Central bank policy shift to average inflation targeting |

•Resolution of supply chain issues (timing uncertain) • Plenty of spare economic capacity • High unemployment rate • Innovation and technology • Demographics and ageing population • Elevated sovereign debt levels • Base year effects in 2022

|

We are watching inflation closely as we believe it is fundamentally crucial in the evolution of the current bull market. In the near term, while inflation may run hotter than what most central banks are comfortable with, the “transitory” argument will allow market participants to look past these concerns. However, as we move through 2022, if it becomes clear that pricing pressures are not so transitory, and inflation remains well above trend, we would expect a negative effect on equity markets.

Inflation and You

If you’re interested in seeing what your own personal inflation rate is, StatsCan offers a helpful calculator that estimates the price change in your unique basket of goods, click here.

Cadence Portfolios

During October, we were active in the portfolios, putting cash to work and taking advantage of the equity market weakness experienced in September (the S&P 500 and S&P/TSX slipped 4.8% and 2.5%, respectively). Broadly, we added to economically sensitive sectors such as financials (Goldman Sachs, Bank of Montreal and BlackRock), consumer discretionary (Estee Lauder and BRP Inc), information technology (Apple and Qualcomm) and industrials (Canadian Pacific Railway). In addition, we added to positions that we believe the market was discounting unfairly (Facebook and Allied Properties REIT).

In the coming days, the Managed Equity portfolio will receive funds from UBS Merger Arbitrage Fund sales. We will use the proceeds to add to geographic regions we believe to be underpriced.

Quarterly Conference Call Replay

If you missed our live quarterly call, don’t worry, click here (Passcode: PuJ9+ZjT)

Canada’s 2021 Top Financial Advisors

Last weekend, the Globe and Mail, in partnership with Shook Research, announced Canada’s Top Financial Advisors. I was privileged to be included in this distinguished group of financial professionals. With any individual success, we all know there is an amazing team that has made it possible. Over the last xxx years, I’ve been honoured to be surrounded by a team of high-performing individuals that put clients’ interests above all else. I know my success and the excellent service you expect of us could only be achieved with the help of such an outstanding team.

We strive every day to demonstrate and reaffirm why you chose to work with Cadence Financial Group. I would like to personally thank you for partnering with us and allowing the team to plan, profit, and protect your financial wellbeing.

Charts of Interest

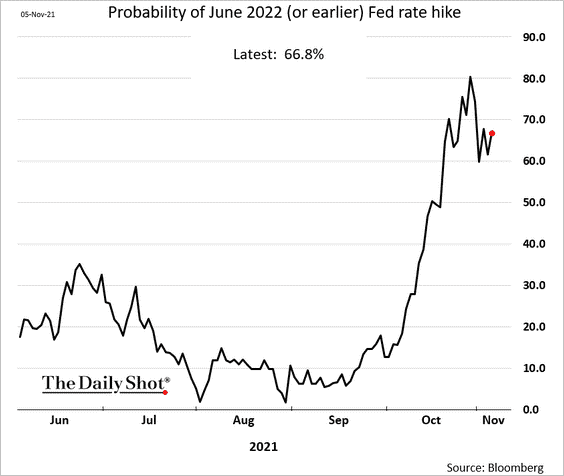

Increasingly, the market is pricing in a Fed rate hike in 2022.

Americans face higher retail gasoline prices, which will weigh on consumer sentiment and present challenges for the Democrats during the mid-term elections, should prices remain elevated.

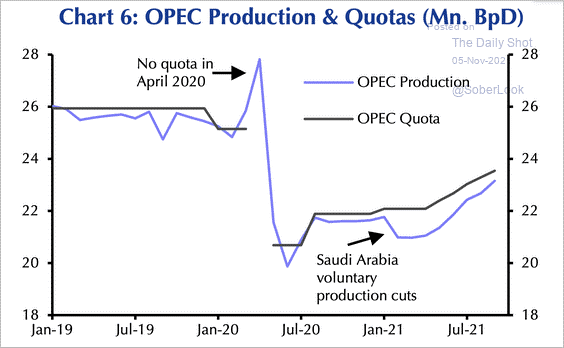

Higher gasoline prices are partly being caused by oil prices. For the oil bulls, OPEC+ has failed to deliver on its own conservative quotas. Is this by design or is this a potential supply issue? Time will tell.

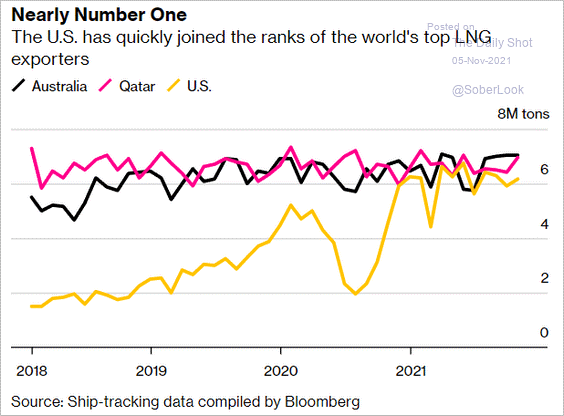

The transition fuel of the future, natural gas. The US is now a major exporter of LNG.

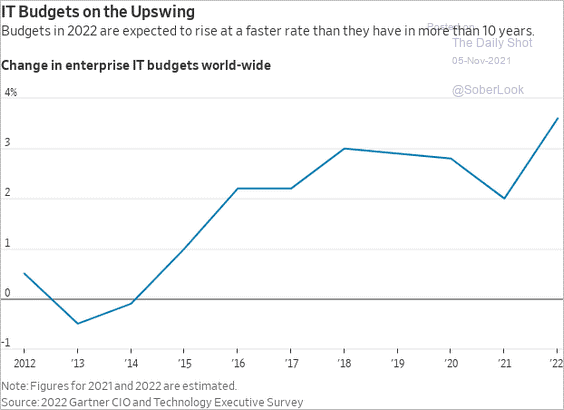

A future catalyst for equity markets is a ramp up in capital investment, which we can see with enterprise IT budgets on the rise.

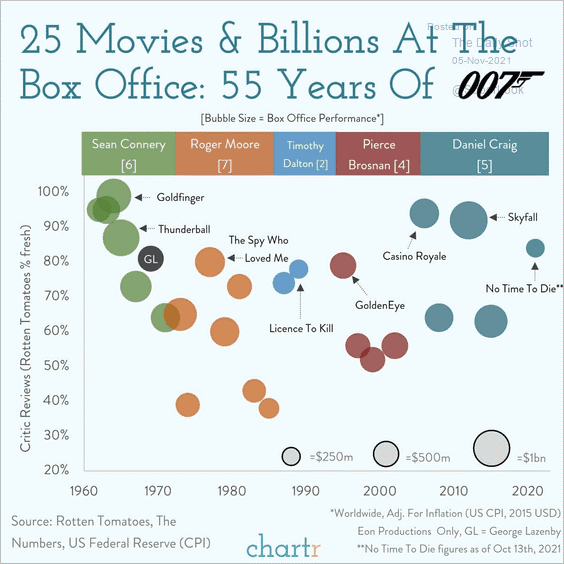

“You expect me to talk?”

“No, Mr. Bond, I expect you to die.”