December Newsletter

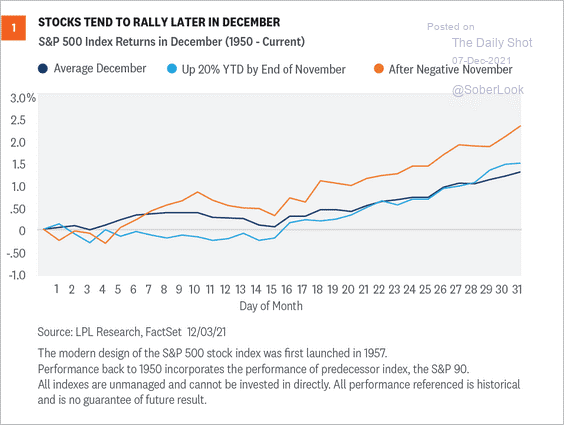

While market volatility picked up in Q4, 2021 is looking like a "normal" year. The number of +/- 1% daily moves in the S&P 500 is 47; the average over the past ten years is 45 days, so a relatively "average" year. What has been somewhat unusual is the oversized gains experienced year-to-date; however, when markets exit a crisis they generally post strong returns. Thinking back to the financial crisis, equity markets posted double-digit returns in 2009 (+23.5%) and 2010 (+12.8%), followed by a flat year in 2011, then double-digit annual return from 2012-2014.

Broader equity markets appear set to finish 2021 on a high note buoyed by easy monetary and fiscal policy, steady employment gains, a healthy consumer flush with cash, and a robust earnings recovery. Investors should be careful not to extrapolate the last two years to 2022. If history repeats itself, 2022 will present more headwinds for equity markets. We see the ending of the Federal Reserve's bond-buying program and the pace of interest rate hikes presenting headwinds. On the political front, US mid-term elections may present headline risks. At the time of writing, we view that the market can recover and is unlikely to derail the current bull market. Any temporary setback must be viewed against the long-term reasons we favour equities:

- Actions taken by governments and central banks have left the vast majority of corporations and personal finances in a much better position. Corporate earnings’ growth remains healthy, and consumer savings rates and personal incomes support economic activity.

- Waning stimulus measures will act as a minor headwind, but monetary and fiscal policy remains supportive of the economic expansion. Central banks have committed to maintaining interest rates at abnormally low levels, aware that small changes to interest rates can have a more meaningful impact on economic activity given debt levels.

- Inflation is arguable the most significant wildcard we're monitoring. However, there is evidence that inflationary pressures are easing as supply chain issues are resolved. A tame inflationary outlook will give central banks greater leeway to raise interest rates slowly and steadily – the preferred scenario compared to a more rapid increase.

- While a distance probability, the unwinding protectionist measures could remove billions of dollars in unnecessary costs shoulder by consumers and corporations.

- Corporations, flush with cash, have resumed share buybacks, returning cash to shareholders via dividend increases and have been active in mergers and acquisitions. We anticipate corporation will increasingly divert cash toward capital investment.

- Stocks are still more attractive than bonds for investors willing to accept equity market risk and volatility. Capital has little choice but to look towards equities relative to bonds, given the current yield environment. This could change as the interest rate environment evolves, but equities are the preferred asset class in the near- to mid-term.

We wish you all a happy and safe holiday season and hope that you enjoy our year-end Christmas classic, with a financial twist, of course.

'Twas the Night Before Christmas

'Twas the night before Christmas, when all through the House

Not a member was stirring, not even Senator Strauss;

Congress was preparing to pass the Build Back Better bill with care

As the Republican Senators wished not to be there;

Portfolio managers were nestled all snug in their beds,

While visions of fiscal stimulus danced in their heads;

And analysts in their' kerchief, and managers in their caps

Had just settled their trades for a long winter's nap,

When out on the exchange there arose such a clatter,

They sprang from their beds to see what was the matter.

Away to the floor they flew like a flash,

Turned on their terminal stations and threw up the sash.

The moon on the breast of new spreadsheets

Gave way to high-frequency data sure to beat the Streets,

When, what to the managers' wondering eyes should appear,

But Jerome Powell and eleven colleagues sharing in some holiday cheer.

A lawyer by practice, so lively and quick,

Managers knew in a moment Powell could be like St. Nick!

His hair how it shimmered, so white and so slick,

Managers paused for a moment, "could this be another dovish trick?"

But, with Yellen now at the helm of the printing press,

Managers knew they would have very little stress.

More rapid than eagles his coursers they came,

And Powell whistled, and shouted, and called them by name;

"Now, WILLIAMS! Now, BOWMAN! Now, GEORGE and BULLARD!

On, QUARLES! On, EVANS! On CLARIDA and BRAINARD!

To the top of the porch! To the top of the wall!

Now ease away! Ease away! Ease away all!"

As early-cyclicals that before the wild storm fly,

When they meet with more liquidity, mount to the sky.

So up to the highest level they flew,

As managers pondered what further Powell could do.

And then, in a twinkling, they heard on the roof,

The prancing and pawing of each Fed head's hoof.

As managers drew in their head, and turned around,

Down the chimney Chief Powell came with a bound.

He was dressed in Canali, from head to his toe,

His clothes glistened, as if he had worked with Daniel Loeb;

A briefcase full of data he had flung on his back,

And he looked like a peddler just opening his pack.

His eyes-how they twinkled! His dimples how merry!

His cheeks were like roses, his nose like a cherry!

With one simple word he could make the market glow,

Yet, it was no secret why the markets were well off its low.

The stump of a pen he held tight in his teeth,

And his hair looking like a bright Christmas wreath;

He had a broad face and a little round belly,

That shook at pressers like a bowlful of jelly.

He was well within his term, a right jolly old Fed Chief,

And managers laugh'd in spite of their belief;

A wink of his eye and a twist of his head,

Soon let them know there was nothing to dread;

He spoke just a word, and went straight to his work,

Offering a dovish outlook; then turned with a jerk.

And laying his finger aside of his nose,

And giving a nod, up the chimney he rose;

He sprang to his chair, to his team gave a whistle,

And away they all flew like the down of a thistle.

But I heard him exclaim, 'ere he drove out of sight,

"MERRY CHRISTMAS TO ALL, AND TO ALL A GOOD-NIGHT!"

Charts of Interest

“Here comes Santa Claus, here comes Santa Claus, right down Santa Claus Lane.”

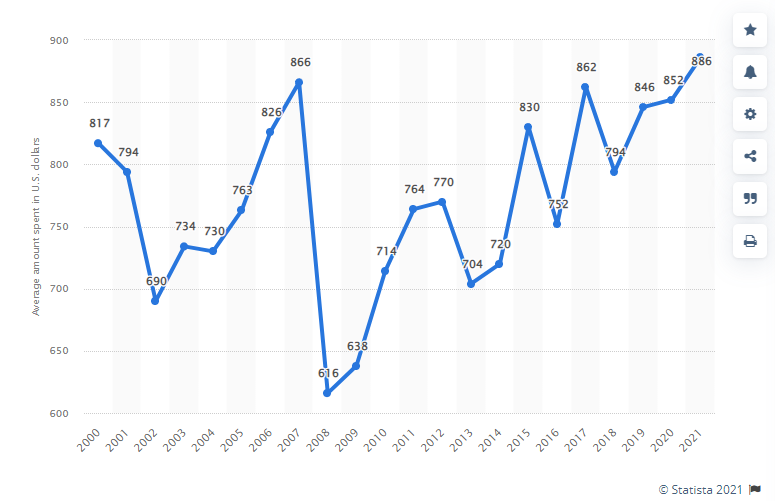

The kids are going to clean up in 2021 – Christmas gift spending on the rise (in US dollars).

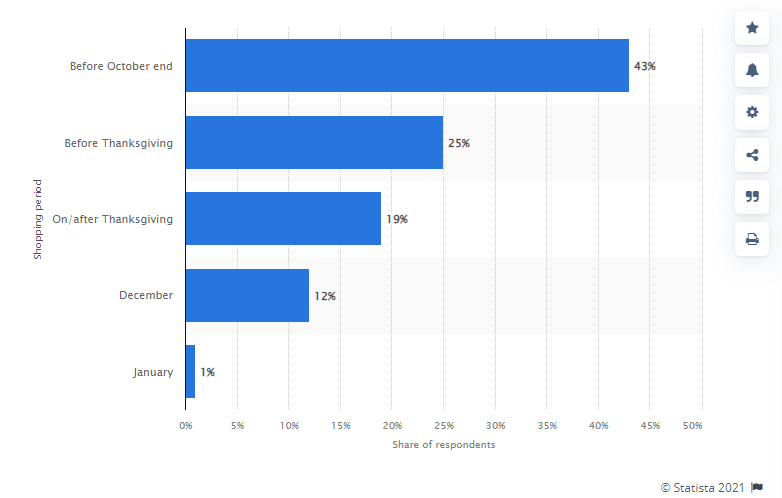

You're behind the curve if you're waiting until December 24 to start your holiday shopping.

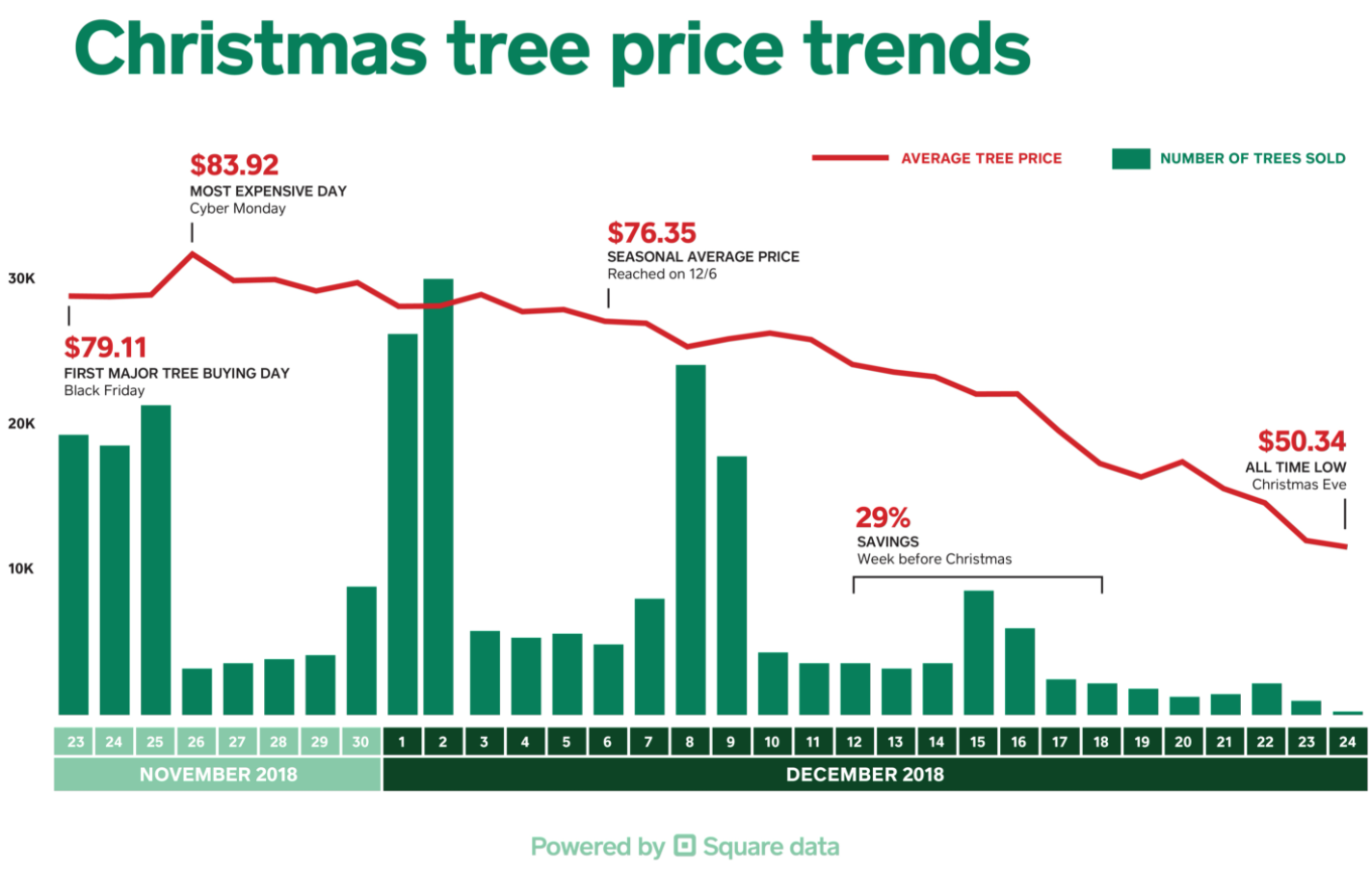

There are a few simple rules to trading derivatives and futures markets. Rule number one: sell your Christmas tree futures BEFORE January!