January Newsletter

"Okay campers, rise, and shine, and don't forget your booties 'cause it's cold out there… it's cold out there every day."

~ Groundhog Day

Happy New Year!

Groundhog Day is just around the corner, and if you're feeling a sense of déjà vu, you're not alone. In the 1993 film Groundhog Day, Phil Connors (Bill Murray) becomes stuck in an infinite time loop, forcing him to relive February 2 repeatedly (there is much speculation about how long Phil spent trapped in the loop, estimates range from 10 to 80 years). He only managed to escape the endless loop after discovering the virtues of empathy, compassion, kindness and generosity. While the fast-moving Omicron virus is forcing many of us to relive last winter, many signs suggest we are nearing the end of our “Groundhog Day” and that life will return to our new normal this year.

In other good news, from a market perspective, investors are little phased by the latest variant. Instead, investors are digesting the prospects of tighter monetary conditions in the coming months. In our December newsletter, we cautioned that investors "should be careful not to extrapolate the last two years to 2022. If history repeats itself, 2022 will present more headwinds for equity markets. We see the ending of the Federal Reserve's bond-buying program and the pace of interest rate hikes presenting headwinds."

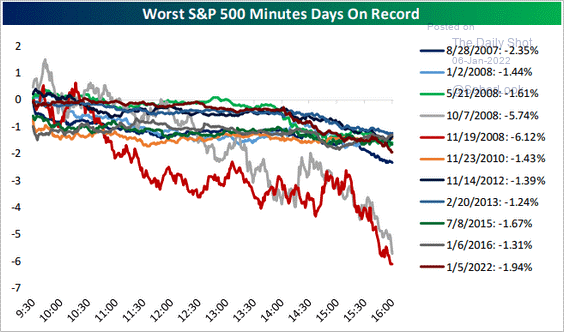

The market tends to overact when monetary stimulus is removed, like a baby throwing a mini temper tantrum after a parent takes away their candy. We've experienced these hawkish "trial balloons" in the past; the market will adjust expectations, refocus on the underlying economic strength and robust earnings outlook, and move on. It's only a matter of time. To put the market's tantrum into perspective, January 5 (which kicked off the recent weakness) is consistent with past hissy fits.

S&P 500 Reaction to US Federal Reserve Minutes

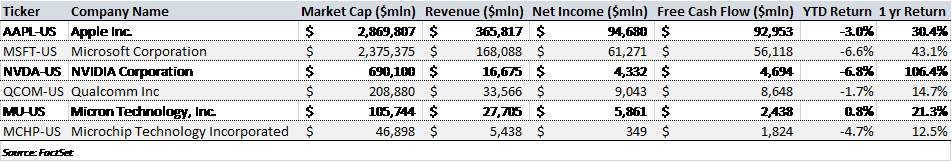

A slightly different story played out for the richly valued technology sector. The NASDAQ slipped 2.9% on January 5 and has continued to trade heavy. That being said, not all technology stocks are built the same. There are plenty of money-losing firms in their infancy (you'll find many of those names included in Cathie Wood's ARK Innovation ETF) that are extremely vulnerable to interest rate changes. But, many successful tech titans are still generating significant revenues, profits, and cash flow – Apple, Microsoft, Qualcomm, NVIDA, Microchip Technology, and Micron Technology to name some. Tighter monetary conditions will act as a near-term headwind for these tech stocks (as it does for all stocks), but a few rate hikes will not derail their business models. If these names sound familiar, it's because they are held across our client portfolios.

Fed Tinkering Tanks Tech Titans

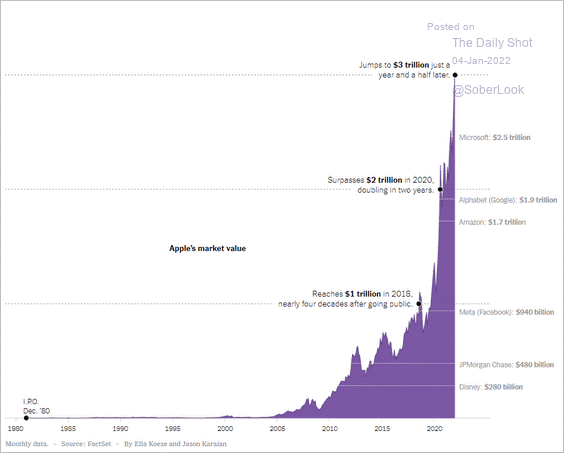

While we're on the subject of technology, Apple achieved yet another milestone this month. Apple's market capitalization crossed the trillion-dollar market in 2018, two trillion in 2020 and for a brief moment, on January 4, 2022, hit the three trillion-dollar mark -- the first company to achieve such a milestone! At this rate, Apple may be a four trillion-dollar company before this newsletter hits your inbox 😊.

To put three trillion into perspective, adjusting for currency, Apple is worth more than the entire market capitalization of the S&P/TSX (~$3.1 trillion). Meaning, Apple is worth more than all 241 companies that make up Canada's main benchmark index. And if that doesn't impress you, Apple is also worth more than the entire annual GDP of Canada (US$1.6 trillion in 2020)!

It's hard to imagine one company's value exceeding the entire output of our country. But, with approximately 745 million paid subscriptions generating recurring revenue and customers more than happy to refresh their hardware every few years, one can begin to see why Apple is the most valuable company in the world. Once you're in the Apple ecosystem, it is almost impossible to leave, making Apple's revenue stream very sticky, dare we say utility-like.

Portfolio Changes

Santa Claus came through at the end of the year, at least for US markets. The S&P 500 and Dow Jones Industrial Average hit record highs, while the S&P/TSX hovered just below its record. It was a good year for the markets and our portfolios.

As we looked ahead to 2022, we made a few final year end adjustments in December. In fact, December was an active month for the portfolios; below are a few notable trades:

- Big Blue. We switched up our Canadian bank batting order by trimming Bank of Montreal and adding to Royal Bank. BMO was the best performing Canadian bank in 2021, gaining 40.7%. Over the last 27 years, BMO has never ranked first in consecutive years. Royal Bank was the worst performing bank (gaining 28.4%), history suggests it could be among the best performing banks in 2022. Additionally, we see 2022 as a more challenging year, so moving up in quality also informed our decision to increase RY allocation.

- Midas touch loses its lustre. We exited our gold positions. Our expectations for inflationary pressures to moderate (from an elevated level) in 2022 plus interest rates to rise will present a headwind for precious metals. Surprisingly, precious metals have done very little in an environment where they should shine. With the proceeds, we added to companies with built-in inflation protection, particularly Brookfield Infrastructure, which has inflation protection built into most of its funds from operations.

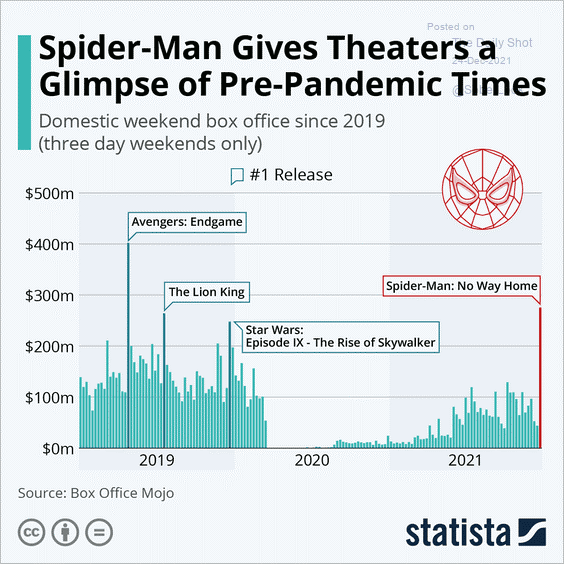

- Dog of the Dow. We are fans of Walt Disney. Unfortunately, 2021 was not the year for the Mouse House, as Disney slipped 14.5%, making it one of the "Dogs of the Dow." We took the opportunity to add to our position given 20 films are expected to be released in 2022 (Spider-Man: No Way Home delivered for Disney in December, see Charts of Interest), Direct-to-Consumer Disney+ reached 118 mln subscriptions (forecast to grow to 230-260 mln by F2024), and exposure to reopening (theme parks).

- Semis make the world go round. After we built a position in Qualcomm over the last couple of quarters, QCOM delivered in Q4, jumping over 50%. We took the opportunity to harvest the gains and diversify the proceeds into two other semiconductor names – Microchip Technology and Micron Technology –which have different end market exposures.

- Health Care Trifecta. We trimmed AbbVie after the stock advanced 30% in Q4 to make room for CVS Health. We like CVS's combined business - medical insurance (Aetna), pharmacy benefit management (Caremark), and pharmacy retail locations (CVS), which creates an omnichannel healthcare provider with many levers to sustain long-term growth.

Mid-month Stretch

Next week, we will introduce a new mid-month newsletter with fun, light and easy to consume topics. To quote George Costanza, the letter is about "NOTHING!"

Tax-Free Savings Account (TFSA) & RRSP Contribution Reminder

TAX-FREE SAVINGS ACCOUNT

- Annual contribution limit for 2022 is $6,000, and the cumulative total as of 2022 is $81,500.

- Investment income generated within a TFSA is not taxable.

- No deadline for contributions.

- To check your TFSA contribution room, please follow the link to log on to CRA’s My Account

- Please note, not all contributions or withdrawals may have been recorded with the CRA in a timely manner. If you have multiple TFSAs or past withdrawals, we suggest double checking the contribution room against your own records.

REGISTERED RETIREMENT SAVINGS PLANS

- Check your Notice of Assessment from CRA to find your contribution limit or log on to CRA’s My Account.

- Contribution limit is equal to 18% of earned income in the previous year minus an individual’s pension adjustment, to an annual limit.

- Maximum contribution for 2021 is $27,830, assuming no prior year carry-forward room exists.

- Deadline for contributions is March 1, 2022.

To request a contribution, please email us at cadence@raymondjames.ca

Charts of Interest

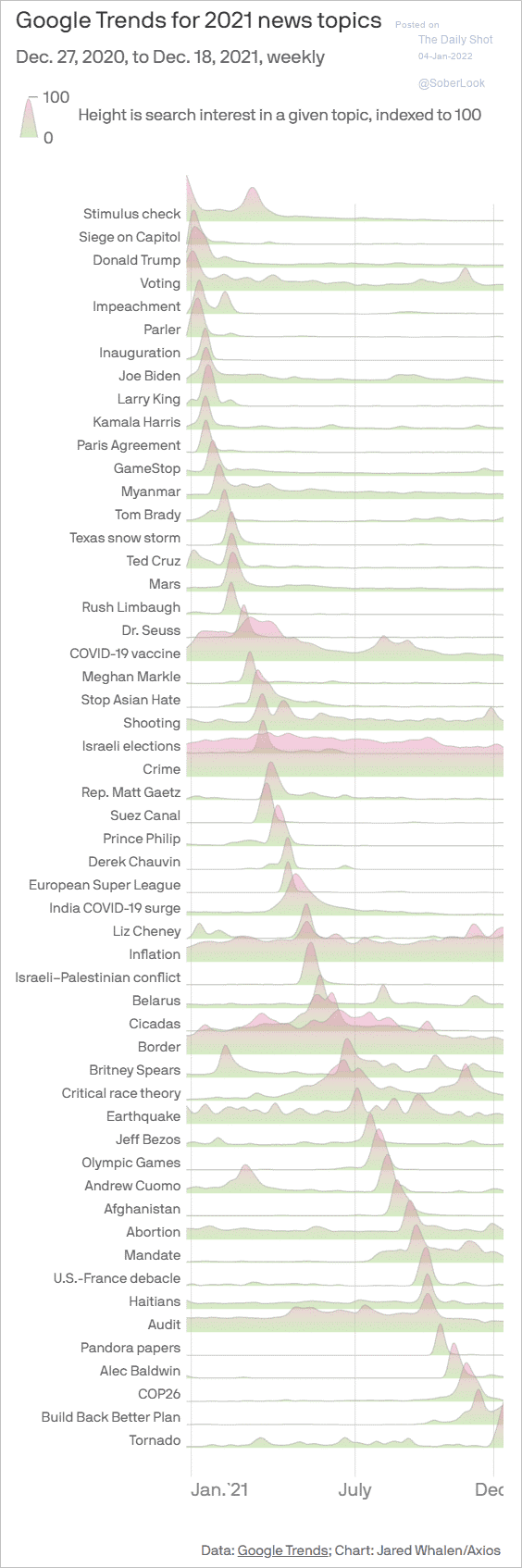

Your 2021 news cycle via Google Trends.

Apple’s remarkable run, or perhaps remarkable leap, to three trillion dollars.

Spider-Man draws pandemic weary consumers to the weekend box office. Recognize a trend here? All four of the top box office movies were produced by Walt Disney.

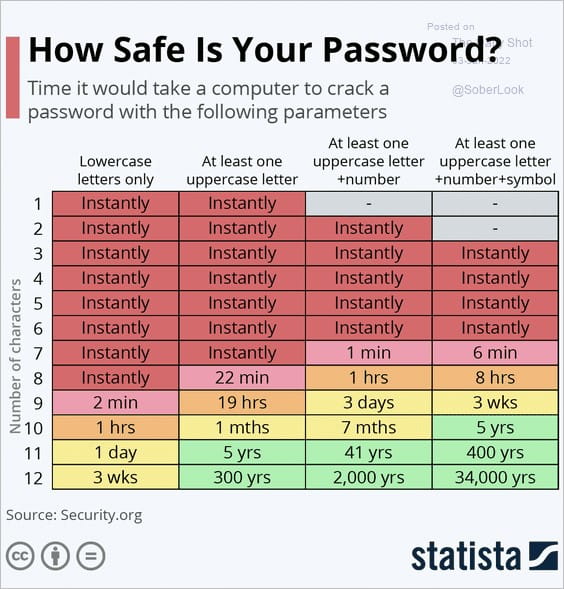

123456, picture1 and password just won’t cut it. Let’s do a simple password exercise:

- Unacceptable: password

- Better: Myonepassword

- Best: My1andonlypassword

- Nailed it: My1&onlypa$$word

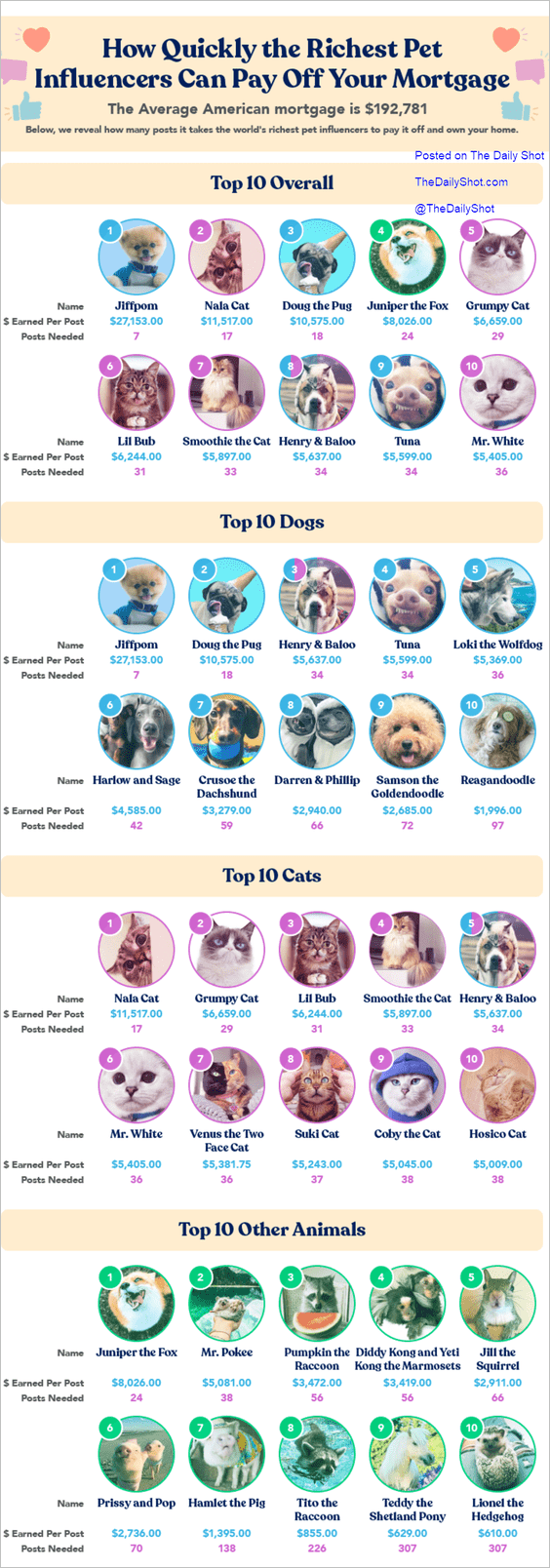

In need of a side hustle? You could be sitting next to Jiffpom. Richest pet influencers.

Market Update Webinar: Tuesday, February 1st

On Tuesday, February 1st, 1:30pm PT, Seth Allen and Jason Castelli will be hosting their next market update webinar. In this webinar, we will discuss the outlook for 2022 including the underlying economic trends and risks to the outlook.

Click below to register for our webinar [link to https://us06web.zoom.us/webinar/register/WN__yJTCzFuSzuOVz_yUIofuQ

]- RSVP is required. Please submit any questions that you would like addressed to laura.furtado@raymondjames.ca prior to the meeting.