Roger, Roger. What’s Our Vector, Victor?

When we set out to write our newsletter, we aim for a balance providing market commentary with insightful but easy-to-consume material. Given the challenging market conditions, the last few newsletters have been very market-heaving. As a result, for this Mid-Month Stretch, we aim to keep it light.

Well, markets have a way of upending even the best-laid plans. The volatility this week, in both equity and fixed income markets, requires us to take a slight detour (there is a pun here, you'll see) before we get into the meat of this month's commentary.

As a preamble, we offer some insights into this week's volatility, which we will expand on during our quarterly webinar next month.

Why Are Markets So Volatile?

- Last week's inflation report was a setback in the peak inflation narrative. The narrative has now shifted to inflation is plateauing, but more time is needed to confirm the plateau, which means more near-term uncertainty.

- Persistent inflation has increased the odds of further aggressive rate hikes. The uncertainty surrounding where interest rates will ultimately peak is causing volatility in every asset class.

- The higher rates go, the higher the likelihood the Federal Reserve will induce a recession that likely will occur in 2023.

Bottom line: persistent inflation increases the market and economic uncertainty. Markets don't like uncertainty.

How Are We Doing?

- Our portfolios are defensively positioned in high-quality equities and bonds.

- Our portfolios have experienced significantly less downside compared to major indices.

- We have made relative switches, taking a barbell approach, which we outlined in our last newsletter, THE MORE THINGS CHANGE, THE MORE THINGS STAY THE SAME.

- Our cash position has hovered around 10 per cent. However, since the inflation data, we have reduced equity market exposure bringing cash levels to around 15 per cent.

- The companies we hold have been reporting strong quarterly results, offering positive forward guidance, but the market is telling us caution is required. We must listen to and respect the current downward trend.

Bottom line: our portfolios have experienced much less volatility than the broader market and have outperformed year-to-date. With very few places to hide, we're increasingly focused on minimizing downside participation from a relative perspective.

Now back to our regularly scheduled commentary.

Planes, Trains and Automobiles

The pandemic may have forever changed the travel industry, but it hasn't changed our desire to travel. While we're aware of a few lucky families who managed to slip away between COVID waves, the vast majority of us have been relegated to dreams of pristine white beaches and pool-side pina coladas.

No longer. Travel is back! But anyone who has booked a trip recently knows things are not cheap. Surging demand and labour challenges have travellers willing to pay almost any price to get that needed rest and recreation or R&R.

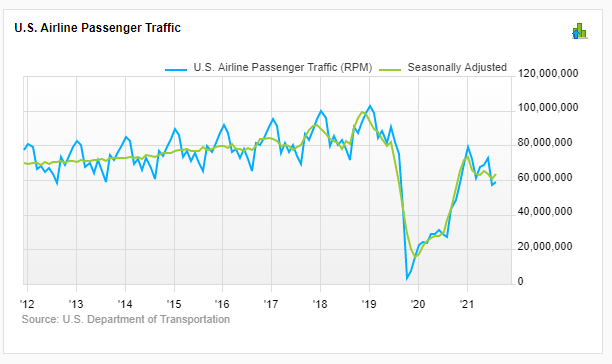

Look no further than the airline industry. Passenger traffic remains below pre-pandemic levels, but insatiable demand has handed airlines tremendous pricing power.

Delta Airline's CEO Edward Bastian highlighted the following point,

"I think demand is coming in every constituent, it’s coming with leisure, it's coming with premium consumer, it's coming with businesses, coming with international.

It doesn't matter what the category is, the demand is off the charts. And the only thing we can do in this environment in order to protect seats and protect inventory is pricing. It's the only lever you have, candidly in this market or else we'd sell everything out.

Pricing is also very, very healthy. We expect pricing this summer to be up probably somewhere between 25 per cent and 30 per cent on average.

And that's – we've never seen anything, anything of that scale. The markets that we're seeing that are opening internationally, we're seeing the same experience that we're seeing domestically.”

Interestingly, Delta's CEO comments were made at the same conference Jamie Dimon, JP Morgan's CEO, said a "hurricane" is on the horizon.

Apparently, the doom and gloom narrative attracts more eyeballs than "demand is off the charts."

When the markets are struggling, the media pushes the negative narrative, and when euphoric, the positive narrative.

U.S. Airline Passenger Traffic on the Mend

Check Out This VRBO

2022’s Deloitte Travel Outlook highlighted the changing dynamic of travel. Remote work has opened new opportunities for "laptop luggers" to work and travel. But it's also changed the duration and type of accommodations.

More than half of laptop luggers tend to take more vacations, adding three or more days to the duration of their longest leisure trip and increasingly turning to private rentals for their accommodation needs.

In short, the changing work environment is adding to the already high demand for a family getaway, but this also means travel may become a larger component of a family's annual budget.

Booking Holding's (BKNG-US) CEO Glenn Fogel highlighted the booking strength experienced this year saying,

"And we talked about looking at our summer numbers, and we've said that the bookings were 15 per cent ahead of where they were the same point 2019 for our summer season, our peak summer season … It's impressive, we're happy, we're pleased."

Marriot's (MAR-US) CEO Anthony Capuano also underlined the consumer's desire to travel. He pointed to deep pockets of pent-up demand and pivot from goods to services as primary drivers. He stated the following,

"With some of the perspective headwinds out there, whether it's fuel prices, rising interest rate environment, inflationary environment, that this wonderful run may come to a bit of an end. We're just not seeing it in our data.

You look at Memorial Day weekend here in the U.S., again, our largest market, RevPAR was up 25 per cent over Memorial Day weekend in 2019. The forward bookings for Fourth of July and Labour Day look similarly strong.

In the first quarter, we talked a little bit about our luxury portfolio with rate increases of nearly 30 per cent. And so, we're just not seeing it."

This Is Your Captain Speaking. We're Just Going to Hold Here for a Few Hours

We've all had a lousy service experience. There are millions of examples we could have pulled off the internet, but as we were searching, we came across a real gem. A for the classic 1987 film Planes, Trains and Automobiles.

Airlines face challenges in meeting the insatiable demand in an environment where many have left the workforce. Boeing's 2021 Pilot and Technician Outlook highlighted the challenge facing the industry; many furloughed airline workers simply did not return.

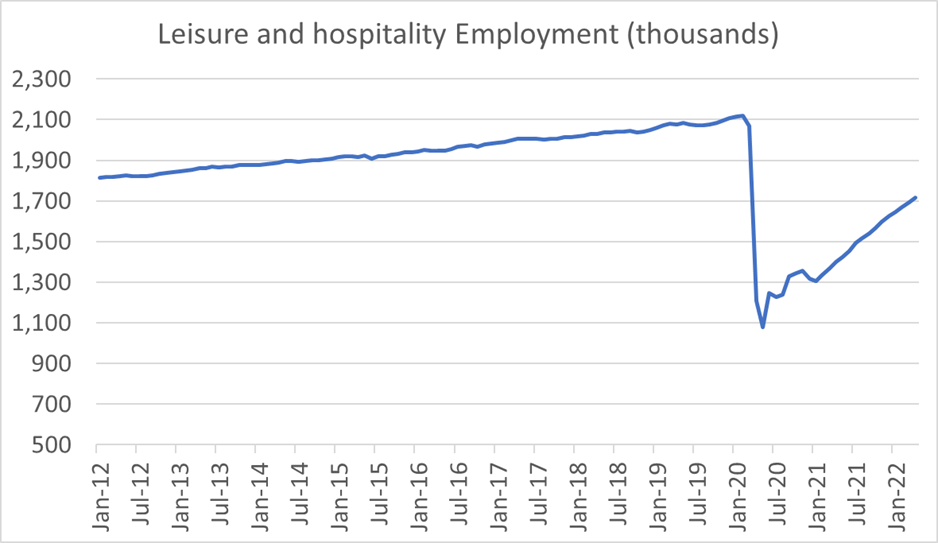

The airline industry is not alone. The entire hospitality industry is feeling the pinch of burnt-out service workers permanently checking out. According to the U.S. Bureau of Labor Statistics, as of April 2022, there were 360,000 fewer workers in the leisure hospitality industry compared to 2019.

Source: U.S. Bureau of Labor Statistics

Labour shortages will eventually be solved through the higher adoption of automation and robotics.

However, in the short run, the hospitality industry is labour intensive, so there are only so many tasks that can be automated (online and kiosk check-in, automatic complimentary room upgrades and some food preparation).

Boeing's 2021 Pilot and Technician Outlook also pointed to a looming commercial aviation labour shortage over the next 20 years: 612,000 new pilots, 626,000 new maintenance technicians and 886,000 new cabin crew members.

Again, automation will solve some of these issues, but good, old-fashioned labour is required in most cases (we don't know anyone who would get into a plane without a pilot…at least not yet).

Take It Home

"A ship in the harbour is safe, but that's not what ships are built for."

― John A. Shedd

Travel and the demand for services are two data points conflicting with current market behaviour. Equity and fixed income markets suggest the consumer is much worse than CEOs' reporting, and their commentary is juxtaposed to consumer confidence reports that hover around a multi-decade low.

The conflicting data creates a highly challenging investment environment.

Central banks and the government stimulus of 2020 provided a nice tailwind for markets, but the marine fog is now rolling in. Steering the ship safely out of the harbour will require all our experience, situationally awareness and sticking to our investment process to navigate past the rocky shoreline.

Charts of Interest

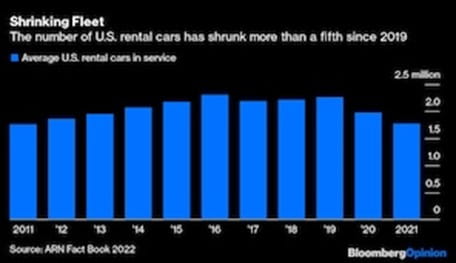

Rental Car Apocalypse

Rental car operators shrank their fleet, netting a handy profit given used car prices, but left them scrambling as demand returned.

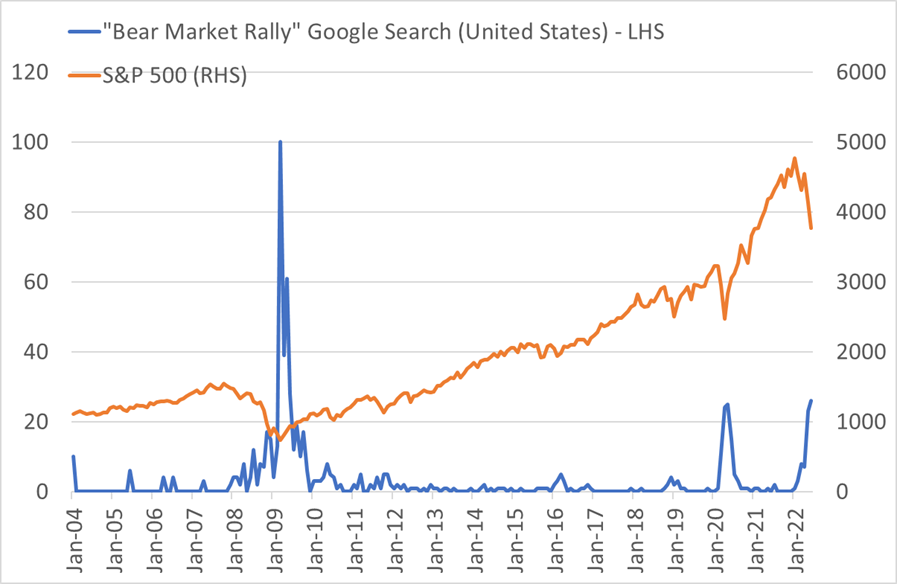

Google searches for "Bear Market Rally" have exceeded that of 2020. Peak pessimism?

Source: Factset, Google Trends

Source: Factset, Google Trends

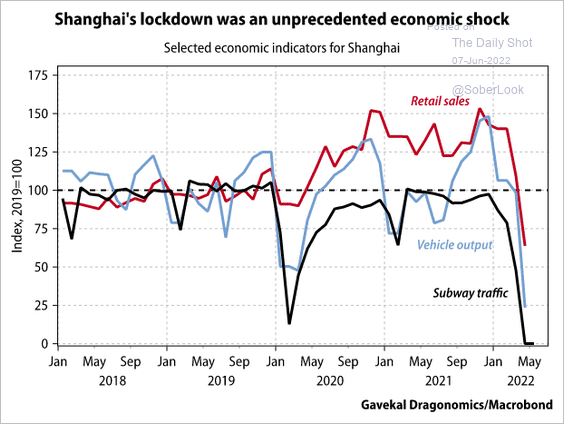

China's COVID lockdowns have added to the global economic uncertainty but have also had a significant negative economic shock on those cities under lockdown.

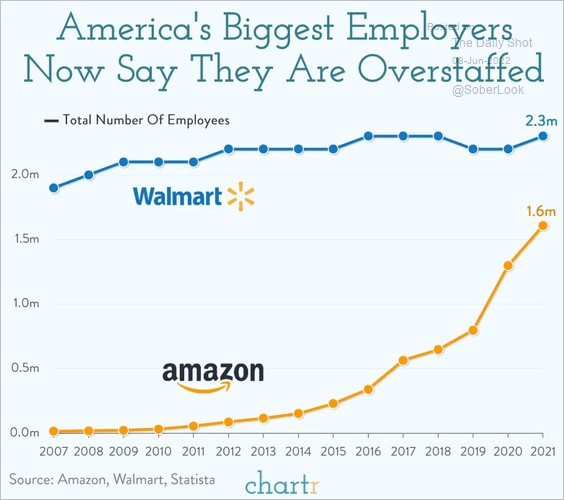

The biggest U.S. employers are now overstaffed. Wage pressure should ease as separations increase.

On Wednesday, July 20th 1:30pm PDT, Seth Allen and Jason Castelli will be hosting their next market update webinar.

Click below. RSVP is required. Please submit any questions that you would like addressed to laura.furtado@raymondjames.ca prior to the webinar.