One Step Forward, Two Steps Back - March 2023 Newsletter

A quick housing-keeping note, we're launching our first equity pool next month. Check out the section Cadence Select Equity Pool for more information.

Now back to your regularly scheduled newsletter.

The Fed has historically tightened until something breaks, so we suppose we can put a checkmark next to Silicon Valley Bank (SVB) and Signature Bank failures over the weekend – mission accomplished. However, as we outline below, the troubles facing the US regional banking industry are both a risk and perhaps a silver lining.

SVB's failure marks the second-largest bank failure in US history, but it was somewhat of a unique situation and offered a lesson on why diversification is a key ingredient in mitigating risk.

SVB focuses on cash-hungry technology start-ups that need their money on demand and, unfortunately, invested the majority of those on-demand cash deposits in long-dated bonds. This ended up being a toxic combination or, in industry terms, a mismatch between assets and liabilities.

As technology firms faced more challenging capital markets, they began to draw down more rapidly on deposits at SVB. Deposits at the bank accounted for about 90% of funding versus 65% for the average bank, leaving SVB susceptible to funding shortfalls.

To meet the shortfall, SVB unloaded long-dated US treasury bonds at a significant loss, which spooked deposit holders and caused a run on the bank. While US treasuries are safe, if an investor sells before the bonds mature, it can result in a loss.

Essentially, SVB was taking in on both sides, as tech firms needed cash, and at a time, SVB investments were severely impacted by the rapid increase in interest rates.

In the wake of SVB's failure, two more regional banks receive the US government's pledge to protect all deposits. This knock-on effect is what the Fed wishes to avoid – a further loss in confidence among regional bank deposit holders, which could spiral into a banking crisis. Clearly, we all wish to avoid this outcome, and currently, it appears the Fed's and Treasuries' actions have stopped the bleeding.

While the regional banking crisis appears to be contained, the big money-centred banks are benefiting from the flight to quality. JPMorgan Chase (one of your core bank holdings) and other big US banks are seeing increased requests from clients who are trying to transfer their money from smaller, regional banks, according to the Financial Times.

The bottom line is that we're now seeing the real impact the Fed's rate hikes are having on the real economy.

Hypotheticals

SVB underscores the importance of our multi-disciplined approach. If one had relied solely on analyst opinion, SVB would be considered a buy or at least a hold. Ahead of the bank's collapse, only one analyst had a sell on the stock, and 96% of analysts had a buy or hold up until SVB's demise!

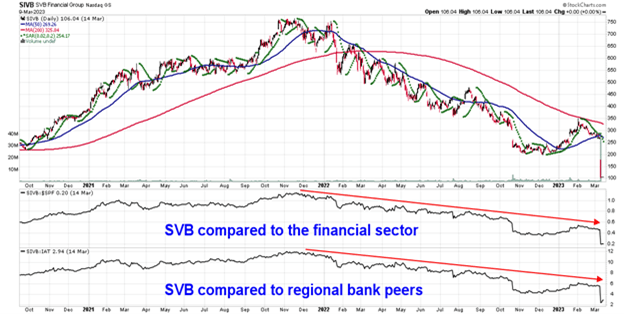

Besides doing our own fundamental analysis, price can often give some early warning signs. Comparing the stock's relative performance to that of the US financial sector and regional peers, we can see significant underperformance since late 2021.

This would have been a yellow flag for us and compelled us to understand why this underperformance persisted. At a minimum, if we owned SVB, we would be apprehensive about adding to a position that is showing such relative weakness.

SVB Underperformance versus US Financials and Peers

SVB also reminds us why we largely stick with large-cap market leaders in their respective spaces. Why own a small bank when you can own Royal Bank (RY-CA) and JP Morgan (JPM-US) as core positions and Scotia Bank (BNS-CA) as our tactical mean reversion recovery trade? Each bank boasts strong balance sheets supporting dividend yields ranging from 3.0-6.2%.

Silver Lining

The Fed has a dual mandate—to pursue the economic goals of maximum employment and price stability. A good old-fashioned bank run would have severe negative implications for both employment and price stability, so it's in the Fed's best interest to avoid such a crisis of confidence.

To keep the recent failures from spilling over in the rest of the US regional banks, the Fed announced a new emergency lending program, the Bank Term Funding Program (BTFP), designed to ease pressure on the banking system.

Further, the US Treasury implied all deposits, insured and uninsured, at all banks are safe (moral hazard is alive and well).

These steps should go a long way toward being a circuit breaker in the current panic creeping into the financial system. Still, this will come at the cost of greater oversight and higher capital buffers, and guess who this will benefit. Big banks, like JP Morgan, that have been dealing with greater oversight and regulations for years.

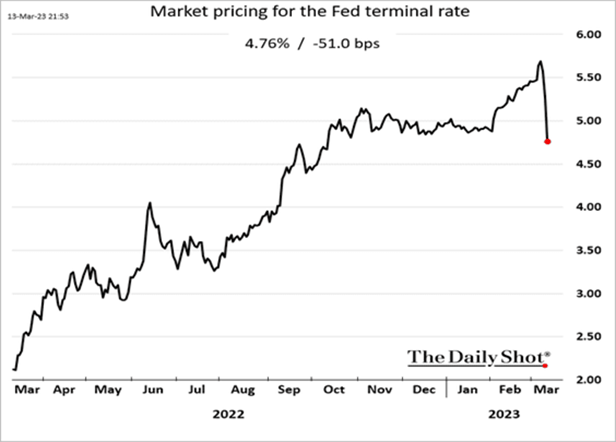

The next step in rebuilding confidence will come on Wednesday. The Fed now has a good reason to slow or even pause its rate hiking cycle. A 50 bps rate hike on Wednesday is now most likely off the table, a face-saving 25 bps a more likely scenario, but we can't rule out a no hike scenario.

The market has massively repriced Fed rate hike expectations as the terminal rate has fallen from above 5.5% to 4.76%.

Recall the Fed's blunt instrument (interest rates) takes considerable time to impact the real economy. We estimate ~60% of the current rate hikes have been digested, which is why so many economists and strategists have called for the Fed to pause and allow the economy to adjust, particularly in light of inflationary pressures showing signs of easing.

Why The r Matters

There are many drivers of asset prices, but the two key ingredients are interest rates (r) and earnings.

If market participants know the Fed is done raising rates and they're reasonably comfortable with earnings expectations, they can punch these estimates into their excel models to arrive at fair value for the market.

The table below illustrates the potential fair value for the S&P 500 based on the historical relationship between earnings per share and the US 10-year yield. The current US 10-year yield is 3.6%, and S&P 500 estimated EPS is $221.59. If we are comfortable that these values are reasonable, this would suggest a fair value for the S&P 500 of 4,788.

To be conservative, we can assume 4% on the US 10-year yield and earnings are revised lower by 5% over the next few months to $210. This would place the fair value at 4,303.

S&P 500 Fair Value Ranges

Million Dollar Question

When will the best-telegraphed recession in the history of recessions happen?

Recession predictions are all over the map, from we're in a recession now, to there will be no recession. It's hard to conclude we're in a recession right now, given employment and consumer spending data. We have concluded that a recession is more of a 2024 story, but we came across some new research that suggests perhaps 2025!

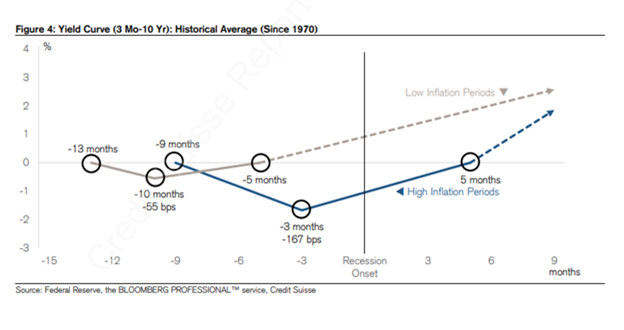

The shape of the yield curve tends to be the best predictor of recession. More specifically, over the past 50 years (excluding the pandemic period), the curve has inverted six times, with recessions followed by 11 months on average, with no false positive or negative indications.

Segmenting yield curve data into high and low inflation periods suggests that when inflation is high, recessions begin five months before the curve uninversion.

Based on bond futures, the yield curve inversion may occur in the late 2025, suggesting the onset of a recession in mid-2025, roughly 2 ½ years from today.

Yield Curve Behaviour in Low & High Inflation Periods

Cadence Select Equity Pool

We're excited to announce the next evolution in Cadence Financial Group's investment solution. In April, we will launch our first equity pool.

The Cadence Select Equity pool follows the same investment process we have used to manage client portfolios but will allow clients to benefit from the scale that occurs when combining assets, similar to a mutual fund.

By participating in the pool, clients will reap the benefits of value-added pricing on foreign exchange, enhanced income opportunities and simplified tax reporting with one slip.

To address any questions, we have attached our FAQs.

For clients leveraging our Income Growth and Select portfolios, please get in touch with us if you'd like to schedule a call to discuss moving your accounts to the pool.

Want Trade Alerts?

If you're interested in learning what we're buying and selling, plus the reasons why, please click here to subscribe to our distribution list.