Hope Springs Eternal - April 2023 Newsletter

Pool Launch

We are on track to launch the Cadence Select Equity Pool on April 17.

The strategy remains the same; what is changing is how the strategy is packaged, which will provide additional benefits, outlined in our webinar and FAQs.

Over the past month, we have heard from many of you that you wish to move to the pool. If you haven't reached out to us yet, please do (click here to schedule a call), as any subsequent purchases following the launch will have to be in cash and not "in-kind."

Quarterly Wrap Up

The first quarter is in the books, and it was not without the usual bout of market volatility. Oh, how we miss the past decade when the market steadily gained most years without a hint of volatility.

During the quarter, investors digested economic data that was too hot, then too cool for comfort. The initial upside surprise supported the Fed's aggressive rate hiking cycle and raised concerns the Fed would tip the economy into recession sooner rather than later.

January's strong gains turned to February losses as investors priced in an economic slowdown. Then, a regional banking crisis hit in March, causing a crisis in confidence, tightening financial conditions and throwing the Fed's rate hiking cycle out the window.

Silicon Valley Bank's (SVB) failure, which marks the second-largest bank failure in US history, unnerved many US regional bank deposit holders and shareholders. US regional banks experienced big deposit outflows, while large money-centered banks like JP Morgan (JPM-US) and Bank of America (BAC-US) experienced inflows. The iShares US Regional Banks ETF slipped over 30% in March.

While the banking crisis made headlines, we didn't see the same type of stress in the financial markets that was experienced during the Great Financial Crisis (GFC). To measure stress in the market, we look at credit default swaps (CDS), a measure of the probability a large financial institution is likely to default on its debt obligations.

While showing some widening/stress, CDSs did not widen to the point that suggested the market was heading toward a severe credit crunch. Thus, the situation at the moment appears manageable and contained.

That said, we continue to monitor US regional banks' long-term impact on the US economy, particularly as commercial real estate loans are refinanced in the coming quarters.

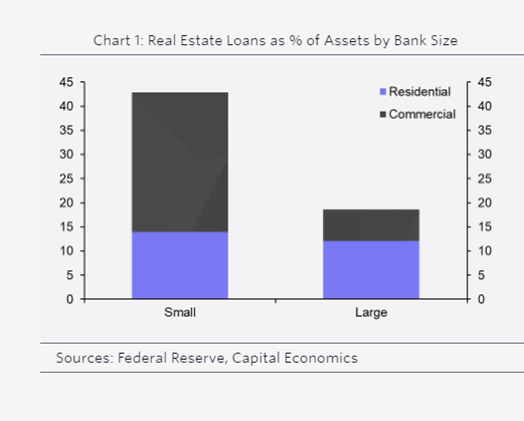

Data from the Fed that breaks out large banks and small banks (not a perfect substitute for regional banks, but a reasonable proxy) show that commercial real estate loans account for 29% of total small bank assets, whereas the same figure is just 7% for large banks.

US Regional Commercial Real Estate Exposure

Banks willing to refinance commercial real estate loans will certainly look for greater debt covenants which could be problematic for borrowers if and when the US economy slips into recession.

March Madness

One would have thought the banking crisis would have negatively impacted the market. However, that was not what unfolded. The impact of tighter financial conditions caused interest rate and inflation expectations to fall, alleviating investors' primary near-term concern that the Fed would continue to raise interest rates aggressively.

With interest rate expectations easing, investors sought the relative safety of two heavy-weights, Apple (AAPL-US) and Microsoft (MSFT-US), which advanced 27% and 20% during the quarter. Combined, Apple and Microsoft represented ~13% of the S&P 500 and helped drag the index higher.

We often talk about market breadth. To remove the effects of both Apple and Microsoft, we can look at the S&P 500 equal-weighted index (all 500 stocks receive an equal weighting). The equal-weight index finished 2.5% YTD, not as good as the market-weighted index, but still decent, considering the headline risks that battered investor confidence during the quarter.

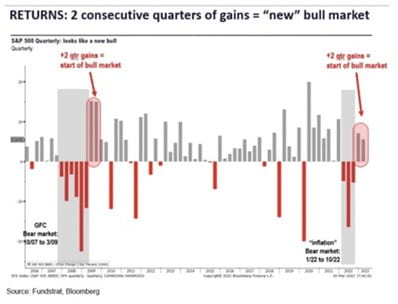

The S&P 500 and S&P 500 equal-weighted indices have now recorded back-to-back positive quarterly returns, delivering a setback to the bear camp. Back-to-back positive quarters often coincide with the beginning of a new bull market.

S&P 500 Posts Back-to-Back Quarterly Gains

You Scratch My Back, and I Scratch Yours

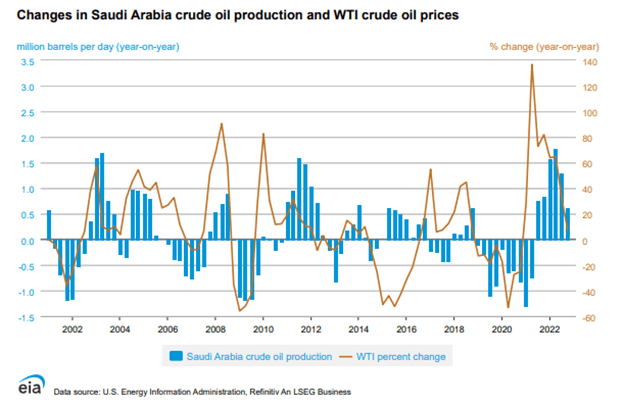

OPEC+ delivered a surprise production cut, sending the oil price back to $80/bbl. The production cut was delivered when investors were making a bearish bet against the price of oil, thus forcing many to unwind their trades and exacerbating the upside move in crude.

As for the motivation for the cut, last year, the Biden administration flooded the market with oil by releasing crude from the Strategic Petroleum Reserve (SPR) to ease national retail pump prices. Last summer, the national average was pushing above $5.00 per gallon, compared to $3.50 per gallon today. At the same time, OPEC was helping to meet demand with additional barrels.

OPEC Production and One-Year Change in Oil Prices

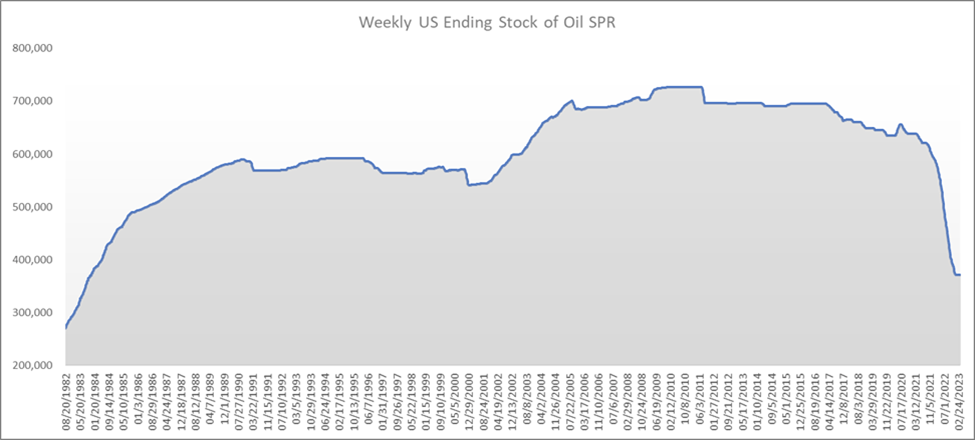

With oil falling to $65/bbl and the SPR sitting at levels last seen in the 1980s, there were expectations or perhaps an understanding that the Biden administration would replenish the reserve. They did not.

The OPEC+ production cut sends a clear message that the cartel has decided to take matters into its own hands and puts a near-term floor in the price of oil.

US SPR Sitting at 1980s Levels

Source: US Department of Energy

Bird in Hand Is Worth Two in the Bush

Our investment strategy focuses on large-cap dividend payers. There are several benefits to this strategy:

· Income. Dividends can provide a regular stream of income for investors. Many investors rely on dividends to supplement their retirement income or to fund their living expenses.

· Stability. Companies that pay dividends are often more stable and established than companies that don't. This is because companies typically pay dividends with a consistent and reliable cash flow.

· Return. Dividends are a way for investors to earn a return on their investment without selling their shares. This can be particularly important for long-term investors looking for a steady return on their investment.

· Discipline and financial health. Companies that pay dividends are generally viewed as financially healthy and profitable. A company that consistently pays dividends can be a signal to investors that the company is well-managed and has a strong financial position.

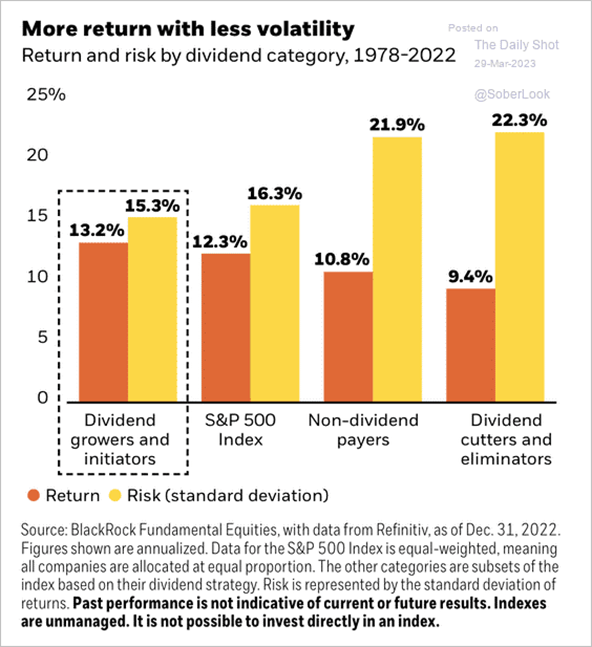

Clearly, there are periods when other investment styles outperform, but as illustrated below, the long-term benefits of a dividend-focused strategy is a winning proposition.

Dividend Pays and a Smoother Ride Along the Way

Portfolios

Broadly, we rotated from consumer staples and utilities to industrials and financials. Late in the quarter, we also took advantage of the powerful rally in the information technology sector and trimmed our positions. Apple (AAPL-US), Cadence Design Systems (CDNS-US), NVIDIA (NVDA-US), Microsoft (MSFT-US ) and Microchip Technology (MCHP-US) gained 26%, 29%, 89%, 20% and 22%, respectively, in Q1/23.

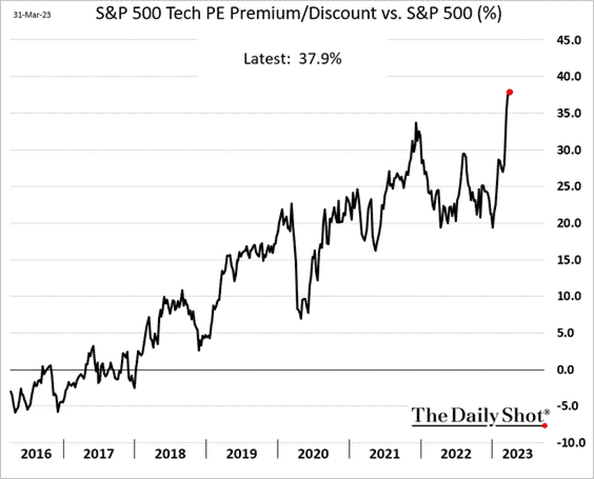

As illustrated in the chart below, technology trades at a significant premium to the S&P 500. Unsurprisingly, our tech positions were bumping up against our upside target prices, providing an opportunity to crystallize gains. Our portfolio allocation to the technology sector now ranges from 10-15%, compared to the S&P 500 technology weighting of 26%.

We continue to like all our technology positions but believe investors will use the substantial YTD gains to rotate toward other areas of the market that underperformed YTD.

During the quarter, we initiated a position in Whitecap Resources (WCP), a premier light oil-focused producer. WCP is on track to reach its net debt target by the end of Q2/23, allowing the company to raise its dividend through 2023.

In financials, we added Sun Life Financial (SLF), the third largest Canadian lifeco by market capitalization. The company offers a diverse range of life and health insurance, investment management and retirement products for both individuals and groups. SLF has a consistent track record of delivering over and above its 8-10% underlying EPS objective and consistent history of returning cash to shareholders.

We barrelled these additions in cyclical sectors by adding two health care names, Pfizer (PFE-US) and Merck & Co (MRK-US).

We believe analysts are too negative on PFE's growth prospects and see the shares well set up to exceed expectations as further pipeline developments progress throughout 2023.

Shares of MRK have broken out of a two-year sideways trading range between $70-$90. The company offers healthy earnings growth, several low-expectation pipeline updates, and significant capital deployment optionality over the next 12-18 months.

We also added to existing positions Bank of Nova Scotia (BNS), Stantec (STN) and Brookfield Corp. (BN).

Quarterly Market Update Webinar

Please join us in our quarterly webinar Hope Springs Eternal on Wednesday, April 19th at 1:15pm PST where we will review where we've been, where we are and where we're going.

This webinar will be hosted by Seth Allen and Jason Castelli. Please send any questions directly to laura.furtado@raymondjames.ca. Please register online below.