You Down With E.S.G.? Yeah, You Know Me

ESG stands for Environmental, Social and Governance. The movement has gained significant traction over the past decade, particularly in recent years, due to increased awareness of climate change and social inequality. This has placed greater importance on corporate leaders to articulate a strategy to address these issues. While recent events have been a contributing factor, in our view, the key elements that have increased interest in ESG are: 1) greater awareness and understanding by investors of the risks associated with a particular investment, 2) tilting investment strategies towards sustainability-focused companies, 3) corporate leaders recognizing that ESG can impact a company's valuation and ignoring the fact that ESG poses financial risks, 4) increased capital investment directed towards addressing the E and S issues, and 5) greater investment flow allocated towards sustainable investing.

BlackRock's (BLK-US) CEO, Larry Fink, has played an instrumental role in advancing the ESG movement. As the world's largest asset manager, BLK has the financial clout to promote and accelerate the adoption of these principles. As in the past, Larry Fink's annual letter urges corporations to articulate "a plan for how their business model will be compatible with a net-zero economy" and "how this plan is incorporated into your long-term strategy and reviewed by your board of directors."

ESG, It's Complicated

As in the infancy of any new methodology, there are always challenges. While not an exhaustive list, we identify areas that investors should consider when investing using an ESG lens.

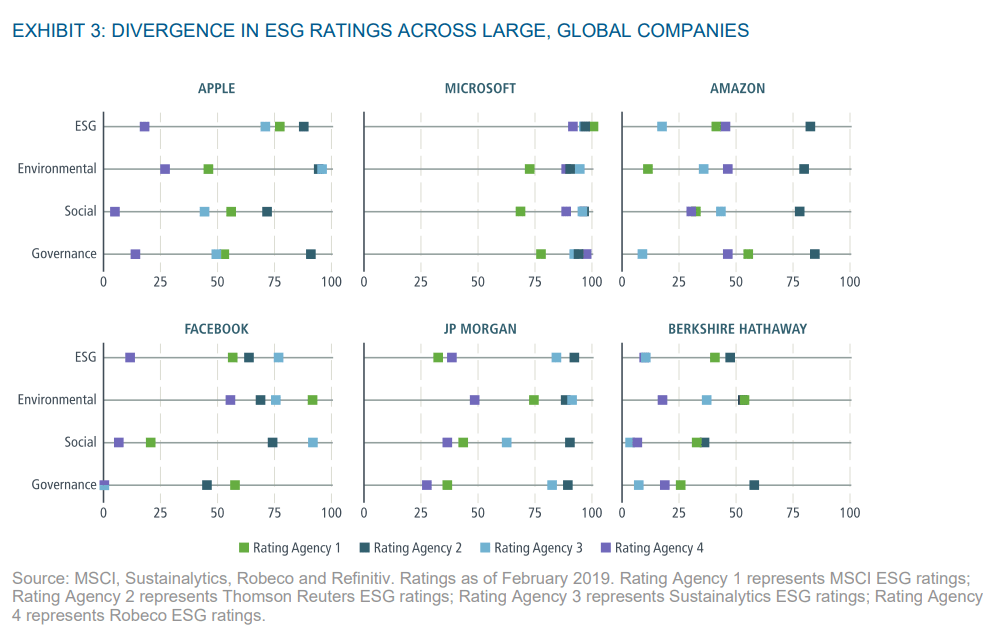

- No measurement standard. There are several independent ESG providers such as Sustainalytics, Refinitiv, MSCI and S&P Global; however, there is no standard methodology in arriving at an overall ESG score. The inconsistency across providers is caused by each rater using different data sources, procedures and often emphasizing different aspects of the companies' behaviour to arrive at an aggregate score. Investors recognize these inconsistencies, with many, including Larry Fink, advocating for a standard methodology. As he states, "we strongly support moving to a single global standard, which will enable investors to make more informed decisions about how to achieve durable long-term returns."

- It's all relative, most of the time. When analyzing ESG scores, an investor needs to understand that they usually reflect the company's ESG performance relative to its peers. Comparing companies in different sectors is like comparing apples to oranges; for example, an oil and gas company could have a better ESG score than a healthcare company, even though the former has a more significant impact on the environment. Therefore, it's best to use ESG scores to identify industry leaders. Then again, some ESG providers assess the company on absolute risk based on a firm's material exposure to ESG issues.

- Scale matters. Due to the complexities of collection and reporting ESG data, larger companies are better positioned to absorb the added costs and reporting requirements. Consequently, ESG-focused funds will tend to have a large-cap bias and may inadvertently exclude many firms making progress in advancing ESG principles.

- Spurious correlation. Many ESG funds have performed exceptionally well over the past two years. Is this because of their ESG focus or because of their significant allocation to information technology? It is true that many technology firms, particularly software and internet companies, score well from an ESG perspective, but are these companies actually advancing ESG? There is also the issue of "greenwashing," which is the process of funds claiming to follow ESG principles, but in reality, they are not. In April, the SEC warned of possible regulatory actions against such greenwashers.

ESG and Investment Process

There is no shortage of mutual funds, ETFs and individual corporations focused on ESG. Nearly US$17 trillion in US assets were held in 2020 by investors applying ESG criteria to their portfolios, according to the Forum for Sustainable and Responsible Investment. This begs the question of how do we incorporate ESG into our investment process?

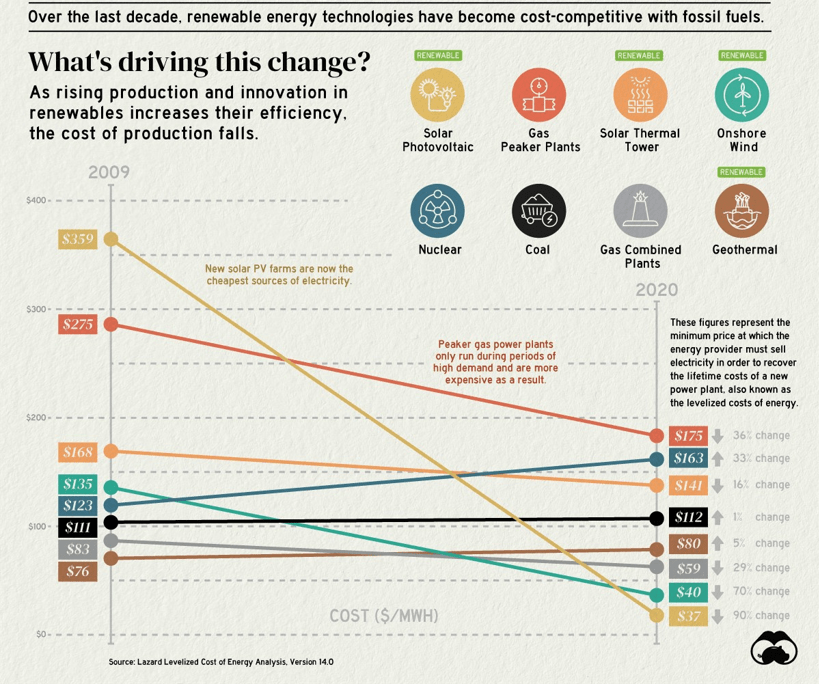

Given there is no standard, it's difficult to simply rely on an ESG provider's quantitative measure for individual equities, which makes us skeptical of adding an ESG-focused fund. However, we can incorporate ESG within our investment process, leveraging qualitative measures to judge whether management is moving in the right direction. For example, Capital Power (CPX-CA), one of our utility holdings, is a North American power producer with a strategic focus on sustainable energy. The utility has made significant carbon capture investments to reduce its carbon impacts and has committed to be coal-free by 2023. We view this as an excellent example of a company transitioning from traditional fossil fuels to renewables while having positive environmental and social impacts. Companies undergoing these transitions have positive ESG momentum and, as mentioned above, the market may award them a higher valuation multiple because of their investment.

Mcloud (MCLD-CA), also held across our portfolios, is an example of a small-cap technology firm involved in improving the E in ESG. Given its size, ESG providers do not cover the name. Yet, the company is actively pursuing technologies to improve building energy efficiency (E), improve office air quality (S), support renewables infrastructure, and improve outcomes for traditional energy producers.

Bottom Line

We often say we like to focus our attention on owning quality companies that act in the best interest of their shareholders. In doing so, we find these companies often have exhibited many of the attributes the ESG movement is attempting to measure. Go figure; good companies tend to have good ESG scores!

Charts of Interest

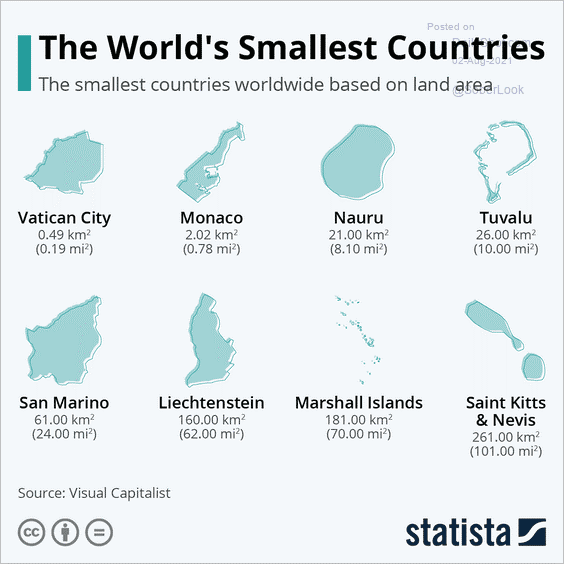

It's a small world after all

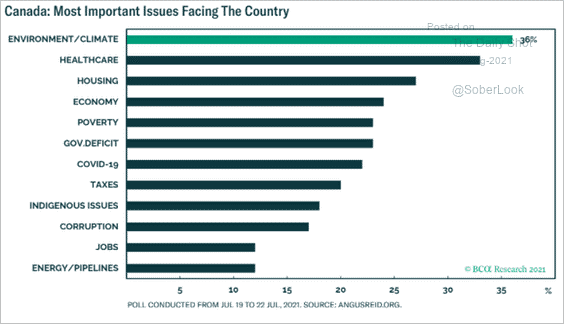

O' Canada

Going "green"

Electricity from renewables is now cheaper than ever

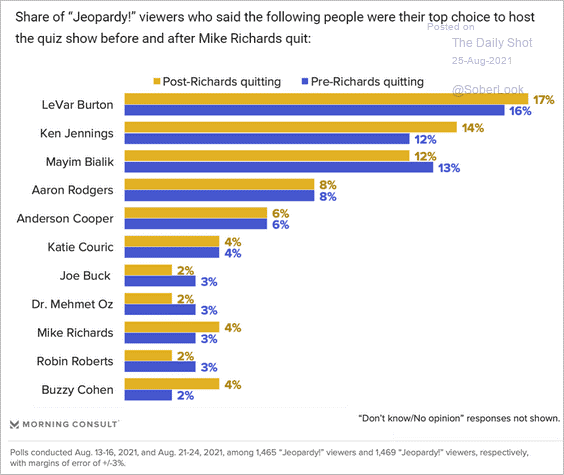

Top choices to host Jeopardy

ABC's of RESPs

An RESP, also known as a registered education savings plan, is a powerful savings tool for Canadian parents. Investments inside the account can grow tax free, with no tax on dividends, interest or capital gains. As well, the government offers the Canada Education Savings Grant; they will kick in up to $500 a year. Parents can contribute up to $2,500 per year, over 18 years, to maximize this credit.

Yet, if you have a good investment strategy in place, it may make sense to make a one-time contribution of $50,000 up front. Though you won’t reap the benefits of the government grants in future years, by investing a lump sum upfront you will be able to experience potentially higher returns through compound growth. RESPs are marketed highly to new parents. If someone unsolicited contacts you shortly after your child is born, be wary of investing in their long-term “savings bond“. It will limit the flexibility of the RESP and take away the robustness of a good investment strategy.

Team Member Feature: Ryan Cha

Ryan Cha is an Associate Financial Advisor at the Cadence Financial Group. He has a long list of responsibilities but all under the specific heading of helping our clients in every way he can. He holds a Financial Advisor and Chartered Investment Manager (CIM®) designation. Whether it is conducting client portfolio reviews, market updates and transaction orders, or overseeing the opening of accounts, tax information packages or the generation of special reports, Ryan helps make it happen.

Prior to joining Raymond James and Cadence, Ryan worked at a major Canadian bank. While completing his BA in Economics at Simon Fraser University, he worked in the public sector, where he began developing his expertise in client service. Following graduation and two years of unfulfilling work, Ryan decided to go backpacking. During those five months, while thinking about his long-term future and knowing he wanted a career where he could apply his education and be of service to real people at the same time, he decided to enter the investment management industry.

When he’s not in the office juggling tasks, you can probably find Ryan at the gym, where you’ll see him bobbing and weaving in the boxing ring.