June 2021 Newsletter

Be a Contrarian This Summer and Buy Winter Tires

1973, the Montreal Canadiens won Lord Stanley's cup, construction on the CN Tower began, the Miami Dolphins completed the first and only perfect season, Richard Nixon was sworn in for a second term that eventually would be cut short, Pink Floyd's The Dark Side of the Moon was released, and Johnny Carson sent a wave of panic across America, setting off a run on toilet paper.

Fast forward to 2020, and we are no strangers to toilet paper shortages. It was almost 12 months to the day that consumers were inexplicitly snapping up Cashmere double roll 2-ply. Today, this irrational run on toilet paper has morphed into shortages of a laundry list of goods and services. Welcome to the "everything shortage".

Last month, we spoke to a client involved in the auto industry that highlighted the supply chain issues holding back auto manufactures. A lack of semiconductors has forced auto manufacturers (and many other sectors) to curtail production and shelf unfinished units until microchips are received. The next challenge may be securing tires to roll vehicles off the production line in the coming months. Tire manufacturers have faced many supply challenges in Q1 – the Texas winter storm, Suez Canal blockage, and an outright shortage of shipping containers. However, things may take a turn for the worse later this year amid a lack of natural rubber, though tire manufactures have been quick to play down these concerns. Perhaps this is not an immediate concern facing the auto industry, but it is for the golf industry. A shortage of golf grips has left many amateur diehards a few clubs short of a complete set, as we start the 2021 season.

The shortages don't stop with semiconductors. Home Depot (HD-US) has struggled to maintain lumber on shelves, despite a quadrupling in some lumber prices, amid insatiable demand. Interestingly, the traditional price elasticity equation would suggest higher prices would negatively impact lumber demand; however, this relationship appears distorted due to pandemic stimulus spending. Elsewhere, TFI International (TFII-CA) and Parkland Fuels (PKI-CA) have discussed their challenges due to driver shortages for their trucking and delivery fleets. Similarly, Starbucks (SBUX-US) said it is "experiencing some labour shortages, but not a widespread issue at this time." Bottom line, it is hard to get your hands on some products and services, which is driving up consumer prices. This upward price pressure is the "transitory" inflation central banks talk about and presume will recede once the global supply chain catches up. The key to sustained inflation above central banks' desired levels will be widespread wage inflation, which we monitor.

As Home Depot's lumber challenges illustrate, we are in a weird economic fog where standard economic theory proves to be less helpful in predicting future behaviour. Yet, with historically high savings rates and pent-up demand burning a hole in the consumers' collective wallet, what is clear, is demand in the coming months will be robust. The question is whether the supply chain can meet demand; a savvy consumer may wish to shop for winter tires this summer rather than a new BBQ for the backyard.

Portfolios

In May, we initiated a new position in Innergex Renewable (INE-CA). Having held this name in the past but exited due to our view that renewable stocks were a rather crowded trade and valuation levels untenable, we reestablished at a much more reasonable valuation. INE engages in the development, acquisition, and operations of hydroelectric facilities, wind farms, solar photovoltaic farms, and geothermal power generation plants in North America and Europe.

We also exited Scotia Bank (BNS-CA) ahead of the bank's quarterly results amid concern that the slow vaccine rollout across LATAM may negatively impact near-term financial results. We continue to like the Canadian banks for their income characteristics, reasonable valuation and leverage to an improving economy, as such we increased the model allocation to Bank of Montreal (BMO-CA) to maintain exposure.

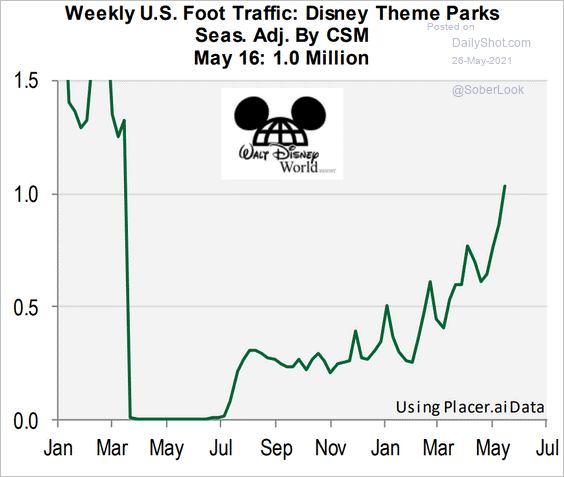

We initiated a position in Walt Disney (DIS-US) in the Income Growth and Select models, while also increasing our weight in the U.S. Select model. Shares of DIS slipped as much as 10% in April; we believe the market was overly focused on the slower user growth of Disney+ (its online streaming service). We prefer to focus on the upside potential from Disney's theme park, media and entertainment as economies reopen; the current forecast growth is 14% YoY in 2022. To fund the purchase of DIS, we sold Verizon Communications (VZ-US) across the models.

Charts of Interest

Disney theme park foot traffic

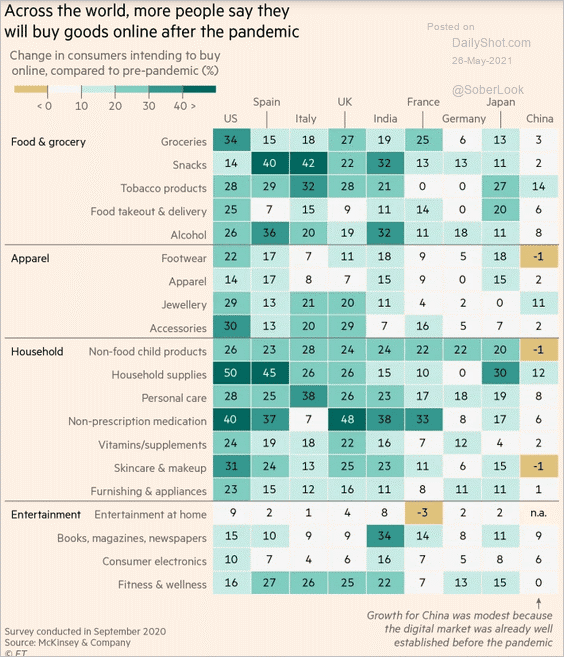

Buying goods online

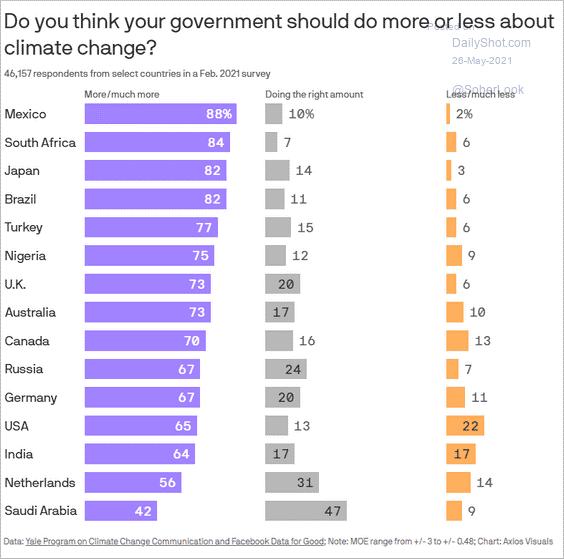

Opinions on government role in climate change

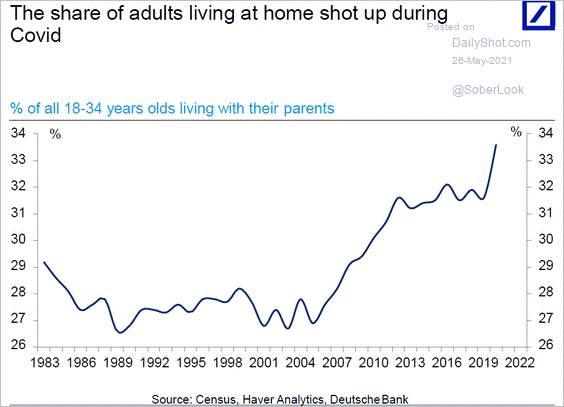

Young adults living with parents

Tips from Tanya: Converting to a RRIF

Q: Should I wait until I’m 71 to convert my RRSP to a RRIF?

A: Every situation is unique and the answer to this question is dependent on many financial factors such as whether you currently receive a pension/employment income or whether your income is likely to change in the future. It’s also always important to have your advisor conduct a scenario analysis of your projected income and tax situation as it relates to your retirement years as well as conduct eligibility for government benefits like Old Age Security (OAS). Generally, if you’re retired and don’t have other pension income, it may make a lot of sense to convert your RRSP to a RRIF early to receive the pension tax credit ($2,000/year after age 65). If your spouse is younger, you may also base your withdrawals on your spouse’s age to lower your minimum withdrawal rate, not to mention the ability to notionally split 50% of your RRIF withdrawals with your spouse; a key tax planning strategy for retirees. This question requires specific analysis of your situation so please contact me to learn more.

Team Feature: Mallory Pearson

This month, we are proud to introduce Mallory. Mallory Pearson is an associate financial planner at the Cadence Financial Group and works diligently to ensure that our clients receive the best possible service. As a CERTIFIED FINANCIAL PLANNER® professional, Mallory holds the most widely recognized financial planning designation globally, which is considered the standard for the profession. Her main focus is to provide advanced financial, tax and estate planning strategies to our clients, focusing on areas such as tax mitigation, maximizing government benefits and overall financial planning education and advice. She is also available to our clients for all of their high-level service needs.

While earning her Bachelor of Commerce at the University of Saskatchewan, Mallory worked at a major Canadian bank developing industry knowledge and superior client service. Although she enjoyed the opportunity, following graduation Mallory left the banking world in order to experience a year of solo backpacking through South America and Asia. After returning to Canada, Mallory moved from her home province of Saskatchewan to British Columbia and joined Raymond James and is now a part of the Cadence team.

When she is not in the office, Mallory’s hobbies focus on getting outdoors and enjoying the natural beauty of B.C. She spends much of her summer biking, hiking, or playing pitch and putt at Stanley Park. Her favourite winter activity is snowboarding, and she makes a habit of going up to Cypress Mountain several nights a week.

Cadence Gives Back

In May, we hosted our client and community appreciation month to give back to our clients and community. Our team members from our Vancouver and Kelowna offices participated in two events to give back to the communities where we all work and live.

In Kelowna, our team headed to the Kelowna City Park to “pitch in” and cleanup the shoreline. In Vancouver, we put together and delivered care packages for the women and children from the Dixon House, fleeing domestic violence. We look forward in continuing our charitable endeavours - stay tuned for more updates.

We Want to Hear From You!

What burning financial planning or investment questions do you have? Let us help. Click below to submit your question and have it answered in our next “Tips from Tanya” article.

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.

“We have been working with Seth Allen and his team for 14 years. Being in business myself, I appreciate not only the dedication and thoughtful attention paid to my family's well-being, but also helping us to navigate volatile markets while ensuring our financial needs are met. Their work is professional and delivers results. I always feel confident in referring my friends and business associates over the years as I know they are in capable hands.”

–K.B.