If it don't make dollars it don't make sense

Just past the midway mark, earnings season have averaged an average 86% beat on earnings (the highest since Q4 of 2009) and a 21% increase in revenues (a record). As importantly, these results are on average 18% stronger than analyst expectations, which is way above the typical 3-5% earnings beat, according to Refinitiv.

Tech-tonic plates underpin the world's economy

Big tech earnings continued to crush expectations, as Apple, Microsoft (both of which we own in our Cadence portfolios) and Alphabet collectively posted $57 billion in combined profits.

Microsoft’s revenues hit a record, Alphabet (parent of Google) saw revenues jump their most in 14 years, while Apple posted its best Q3 ever as iPhone sales (half of their revenue) surpassed all expectations.

Qualcomm, another name we own, saw revenues jump 63% from a year ago as earnings per share over doubled. Though ‘base effect’ played a role, it’s an impressive recovery in chip sales, one that jumped the stock 6% yesterday.

Not all tech giants are thriving. China’s unprecedented crackdowns caused Tencent to crumble $170 billion in market cap this past month, dropping 23%. The Chinese ride-hailing company Didi, which recently listed on the New York Stock Exchange only to have its app banned in China, is rumored to be contemplating take-private to appease the mainland dictators.

That was gross

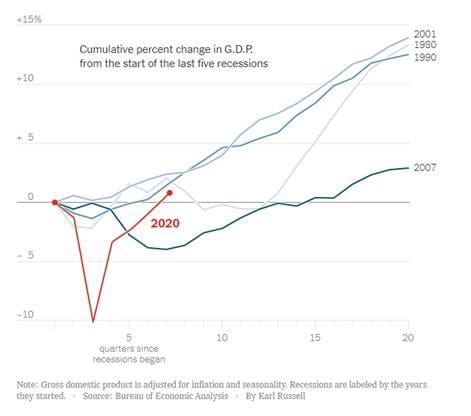

Gross domestic product (GDP) is the most encompassing measure of economic output and the second quarter saw a 1.6% growth from Q1, a 6.5% annualized rise. The good news is that this recovery has been the fastest on record. The bad news is that the drop was by far the worst, and it’s got a lot more ground to recover relative to the past five previous recessions:

Hold on to your ghutra's!

We participated on a long Zoom call with mCloud Technologies’ new partners in Saudi Arabia named Urbsoft to discuss their grand plans to advance the Kingdom’s Vision 2030 goals. Urbsoft’s customers and relationships include over two dozen of the largest Saudi oil, petrochemical and commercial giants of this nation of 55 million people. What became rather clear is just how far advanced many of their collective initiatives are to work with companies like Aramco (the world’s largest) and Sabic (their state-owned petrochemical behemoth and far larger than any Canadian petrochemical company).

Here is a short interview with mCloud’s CEO Russ McMeekin and Urbsoft’s CEO Dr. Ahmed Alkadi. The audio is poor but notice the litany of names they cite as clients to target for mCloud’s AssetCare services.