August 2021 Newsletter

Long Live the Consumer

A bespoke dining experience with seasonal ingredients, a Swedish deep tissue massage, a hydration facial, a leisurely stroll along the sandy beaches of Nova Scotia's Cape Breton Island and while you're in the neighbourhood, why not test your skills at the award-winning 36-hole Cabot Links? There is no shortage of products and services we deprived ourselves of over the last 15 months, but the future is now as we slowly return to some form of normalcy.

The stimulus-induced economic recovery is transitioning to a self-supported modest expansion. As we transition, we spotlight the consumer who will play a significant role in sustaining the positive economic momentum, particularly as fiscal and monetary stimulus fades. The US and Canadian consumer represents ~60% of gross domestic product, making them the most significant contributor to aggregate demand and integral to supporting future economic activity. With such a heavy burden to shoulder, we check in on the consumer's health using a few key charts.

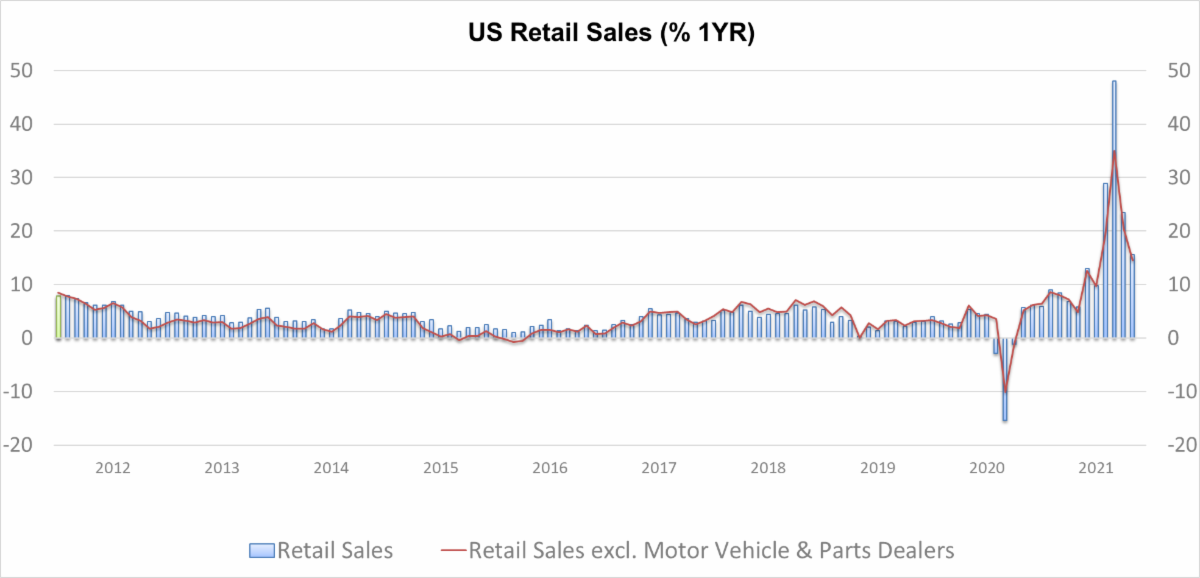

Hello Moto: Retail Sales Now Exceed Pre-COVID Levels

If one could imagine 2020 never happened, comparing the current level of US retail sales to the 2019 peak (before the global pandemic) illustrates how strong the rebound in consumer spending has been. Total US retail sales now easily exceed the levels achieved in 2019! There have clearly been winners and losers, but in aggregate retail sales have been remarkably robust.

Source: FactSet

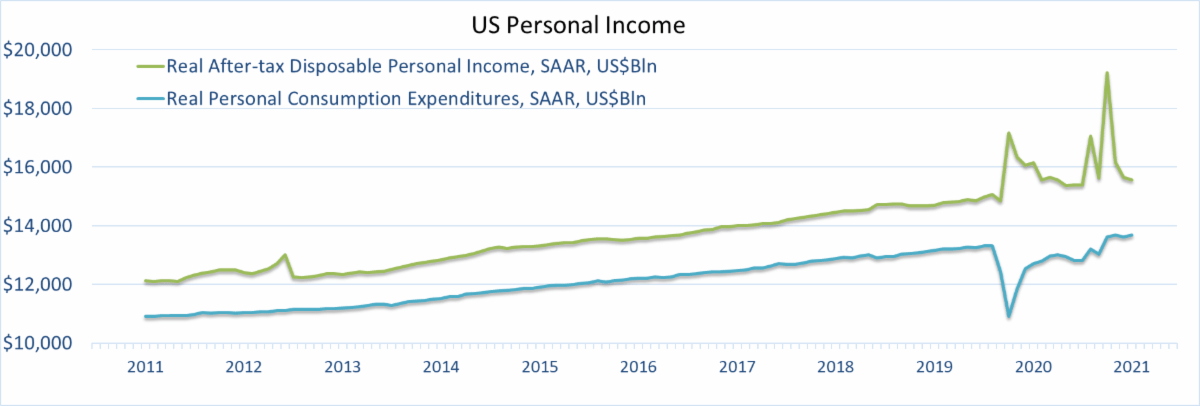

Disposable Income

The strength in retail sales is twofold. First, higher-income earners continued to spend throughout the pandemic, although there was a notable shift in spending habits to support work from home, home improvement and online services. In addition, this cohort increased savings, given limited opportunities to spend on big-ticket items like travel, and reduced childcare and transit costs. Second, lower-income earners received generous government support during the economic lockdown for the under employed or outright unemployed. In aggregate, disposable incomes INCREASED during the recession, leaving the consumer in an excellent position to support the economic expansion.

Source: FactSet

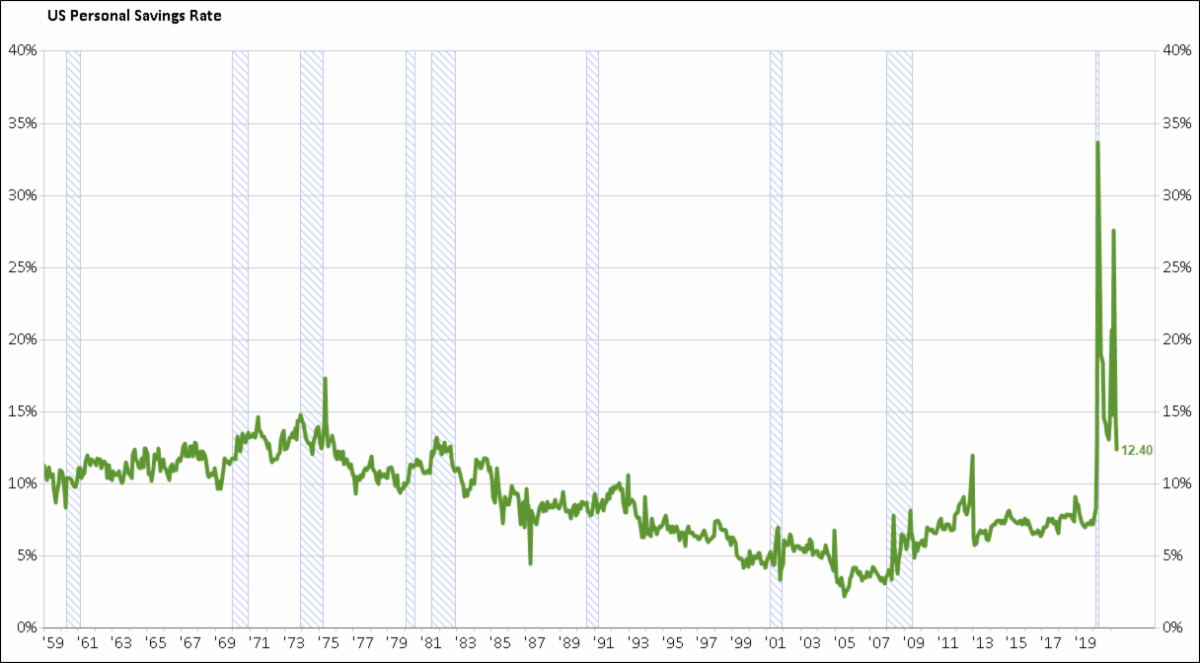

A Penny Saved

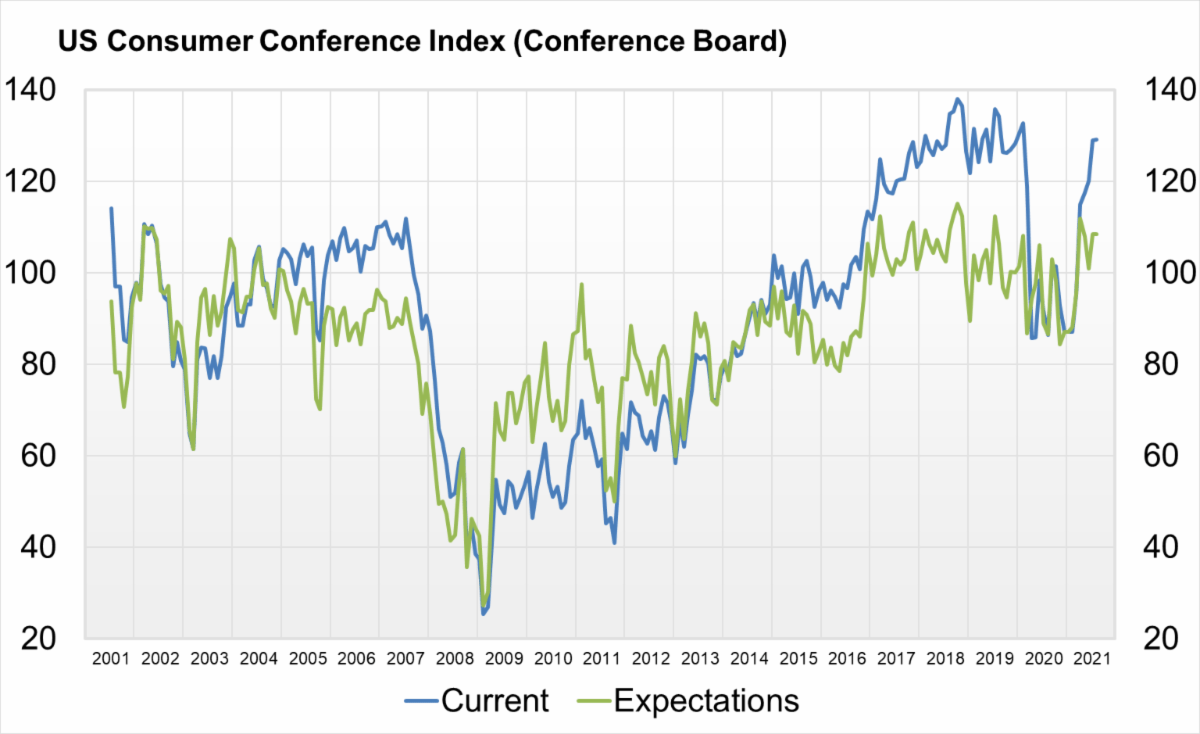

Similarly, savings rates jumped to record highs, given the limited spending opportunities for consumers. This "dry powder" and a drawdown to historical averages will provide a tailwind for consumer goods and services in the coming quarters, as long as confidence remains high. Recent consumer confidence surveys point to a certain level of conviction about the economic outlook.

Source: FactSet

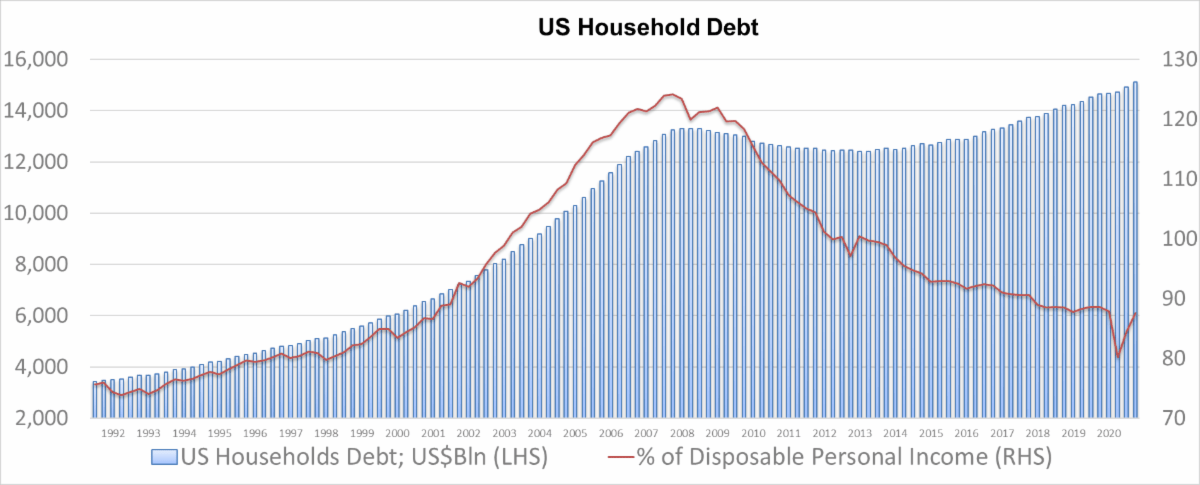

Debt Servicing Costs

Short-term interest rates are near zero across most developed market economies; we experienced this before following the 2008-2009 Financial Crisis. What is different this time is long-term interest rates in North America have also touched new all-time lows allowing borrowers to refinance at historically low rates. In aggregate, debt servicing costs and debt as a percentage of disposable income point to the consumer's ability to take on additional debt, if desired.

Source: FactSet

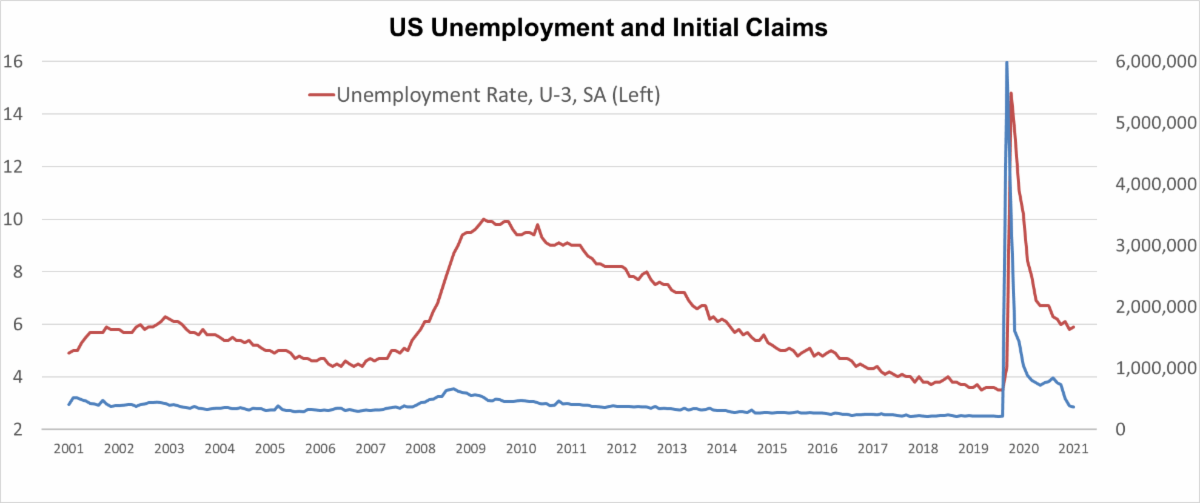

Employment

We have made significant progress on the employment front; the US unemployment rate peaked at 14.7% last year but currently stands at 6.7%. While further improvement is required, we see September as a potential catalyst to lower the unemployment rate. September will mark the end of enhanced US unemployment benefits, potentially incentivizing the unemployed to return to the labour market. Children returning to school will also allow parents to return to the labour market. With a record number of job openings, continued progress in the labour market should be made in the coming quarter. However, some lingering concerns of skill mismatches might explain the significant number of unfilled jobs.

Source: FactSet

Bottom line: the US consumer is in good financial health and will play an essential role in supporting the economic expansion as economies fully re-open. As further employment headway is made and confidence remains high, demand for consumer goods and services will remain elevated. This natural demand and an improvement in the labour market will give corporations additional confidence to invest in their business, fueling the positive feedback loop and sustaining the economic expansion. There are two universal truths in the investment world; Don't fight the Fed, and don't bet against the consumers' willingness to spend.

Charts of Interest

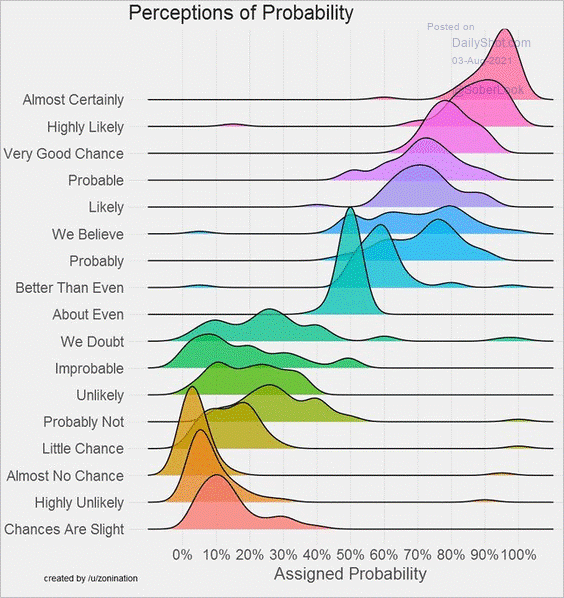

Perceptions of probability; Cloudy with a Chance of Meatballs.

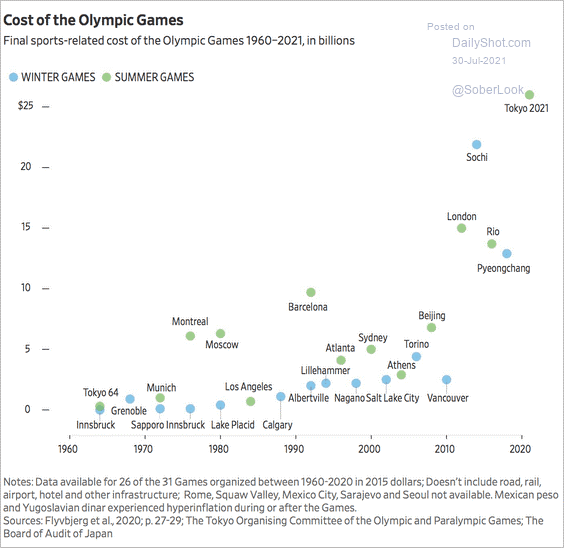

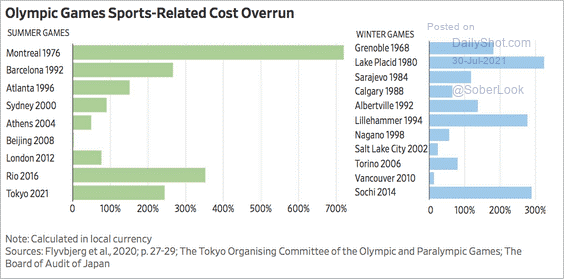

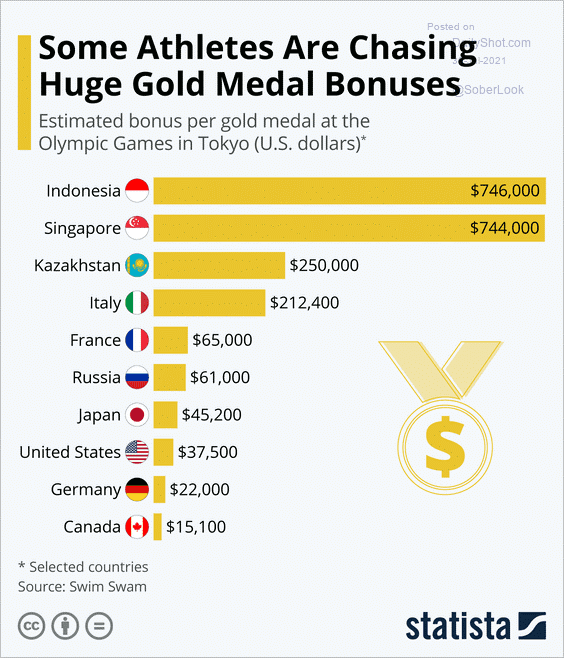

Winning Gold in Tokyo, priceless… but it may also afford you a one-bedroom 560 sq. ft Vancouver condo.

Tokyo wins Gold, Sochi Silver and London Bronze, but Montreal tops all for cost overruns.