Weekly Market Comment October 16 2020

Homer Simpson complaining to his wife: Marge, what’s the point of going out? We’re just going to wind up back here, anyway.

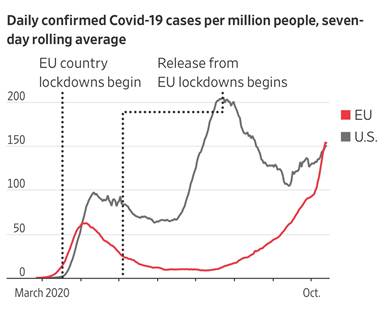

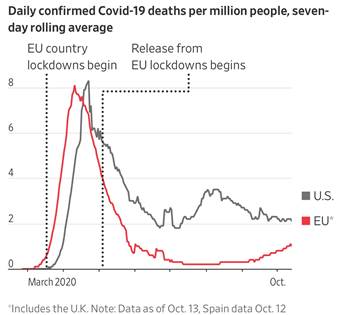

The world daily coronavirus count now hovers at a record 330,000 of new reported cases per day. Europe has now surpassed America’s daily new coronavirus case count even as almost a dozen US states report record daily counts. Cold weather is driving people indoors. Also, colder temperatures drive down humidity in the air which facilitates viral spread (perhaps because less water in the air allows for more virus, though the exact reason isn’t clear).

The good news is that daily deaths per capita have fallen dramatically from the early days of the pandemic. More informed medical community, less congestion in hospitals, viral mutation are all possible contributing factors and experts are not sure if the improvement is permanent or a blip.

Nevertheless, we continue to distance peak fear, registered back in March. The easiest visual manifestation of this is traffic. September also clocked its fifth month in a row of recovering consumer spending, as retail sales grew 1.9% from the month before (according to the U.S. Commerce Department). Car sales, home improvement, restaurant outings remain on the mend.

Unleashing the awesome power of Apples (yes, that’s also a reference to The Simpsons)

Apple announced four new phones with an all-new design reminiscent of the original squared-off design. Though one of the new phones is a “Mini”, akin to the tiny first iPhone, these new designs all 5G enabled. That means faster everything once 5G gets rolled out en mass later this year and into next.

That is if you live in America because only American iPhone 12 models will come with mmWave 5G antenna on its side. Rogers, Bell and Telus offer a sub-6GHz 5G network that will offer a 10-15% speed increase (depending on where in Canada one lives). That’s not going to be the far faster mmWave 5G Apple discussed.

But there are still good reasons to update, especially if your phone is three years old as is the case with your author’s. The biggest is the camera and video improvements, especially in low-light settings. The OLED screen is more crisp and easier to read on. Should you upgrade? This Popular Mechanics article sums up the changes nicely.

As for the stock, we hope to buy it back but at a more reasonable valuation than 36 times earnings.

Chief Wiggum is on the case

While Twitter and Facebook controversially try to better police themselves, the U.S. House Antitrust Subcommittee released recommendations to reduce the power and influence of the largest tech firms. While the details of what to do will be hotly debated across the political isle, there is general consensus between Republicans and Democrats that Silicon Valley giants Facebook, Apple, Amazon.com and Alphabet (Google) have grown too monopolistic. Being discussed in the 449-page report are updating the Sherman Act to include limits of 30% market share for sellers and 25% for buyers. Changes will likely take years to sort out but is widely expected to happen quicker if Democrats have their way.

Silicon Valley is minimally regulated and that is going to change. But many legal experts predict modest antitrust reforms will ultimately result.

And that’s ultimately the best scenario for investors. Markets prefer evolution, not revolution.

Noteworthy links:

- Covid-19: China’s Qingdao to test nine million in five days

- B.C. election 2020: Poll shows NDP lead, Greens gaining momentum

- U.S. budget gap tripled to record $3.1 trillion as federal government spending almost doubles government revenues

- Tiny condos in Toronto sized at 500 sq. ft plummet in value

- 5 minutes that will make you love Baroque music

- Van Halen live at the Pacific Colosseum in 1979

- Did The Simpsons predict the coronavirus, too?

Musings Beyond The Markets

The Bank of Canada has said that because of Covid-19 accelerating online shopping, they are working on a digital currency. Think Bitcoin or any of the other 1,000 virtual currencies in existence today, only it would be a government sponsored digital currency. Because of the proliferation of various digital currencies, the BoC is like any other central bank not wanting to lose power and influence to competitors. Yet, the central bankers also noted that would hold widespread consultations with Canadians to better understand what their need for one would be before one gets issued.

What does this all mean? It means the Bank is made up of human beings no less prone to dubious trends and half-baked speculative vehicles that float around in society. Bitcoin is 12 years old now and you and I are still nowhere even remotely close to being willing to hold material assets in it, let alone use it to buy a car or a house. Not only is Bitcoin expensive to buy and sell (commissions can be over 10%!) but it is rife with security problems. For example, if a hacker successfully steals your Bitcoins, you have near zero recourse.

Contrast that to your current bank account. If it were to get hacked, the bank would cover you. Not just because your account is insured but because the bank cannot afford the reputational damage.

Today, consumers can move around their Canadian dollars sitting in their bank virtually (via the internet) to any vendor anywhere thanks to amazing smartphone bank apps where bills can be paid free of charge. Companies like PayPal let us use our bank accounts and credit cards without PayPal sharing your details with vendors. Bitcoin can’t touch the existing infrastructure our digitized dollars enjoy today.

And while it is not as anonymous as Bitcoin, it’s as anonymous as it needs to be. For example, do you know what your neighbour’s bank balances are and do you suppose he knows yours? Can you see where he spent money last month and how much? Bitcoin does keep secrets from the government but most Canadians don’t have illicit cash to hide nor are they interested in cheating on their taxes.

In other words, the Canadian dollar already enjoys all of the benefits of a digital currency because it has already been digitized and you and I use it in the virtual world all the time.

Word of the Week

craptacular (adj.) – a word invented by Bart Simpson that is far less than excellent; a contraction of something or someone that is “spectacularly crappy”. “A cockamamie A.I. can predict which cratacular words you’ll find funny.” – Science Magazine