March Newsletter

Focused on the Future

“Change is the law of life and those who look only to the past or present are certain to miss the future.” —John F. Kennedy

Cadence Financial Group embarked on an exciting evolution this year to ensure our service offering meets your future financial needs. We welcome new partners and associates to the Cadence family, expanding our depth and financial acumen. Partnering with Brendan Willis, Tanya Wilson and Jason Castelli will ensure Cadence is well positioned to deliver the highest level of service you have come to expect while also expanding our depth in financial and tax planning, cross-boarder money management and planning, investment strategy and portfolio management. As we all look forward to a return to “normalcy” in 2021, we are laser-focused on ensuring we position client assets to take advantage of the current investment environment. Undoubtedly there will be challenges ahead, but we are confident with proper planning and positioning we can achieve your financial objectives. In recent days, Canadian and U.S. markets have touched new all-times highs, climbing the proverbial “wall of worry” as markets look past the present economic challenges and towards a bright future.

So Long 2020, Hello 2021

This year started as last year ended with U.S. politics dominating the headlines. Politics overshadowed much of the fourth quarter and made one final headline-grabbing push in January.

From a market perspective, U.S. politics was simply noise that often distracted from the more important drivers of market direction. With all the “noise” it often seems markets beat to their own drum, but they (as they always have been) are driven by factors like corporate earnings outlook, market liquidity, interest rates and overall investor sentiment. With these in mind, let’s check in on these drivers.

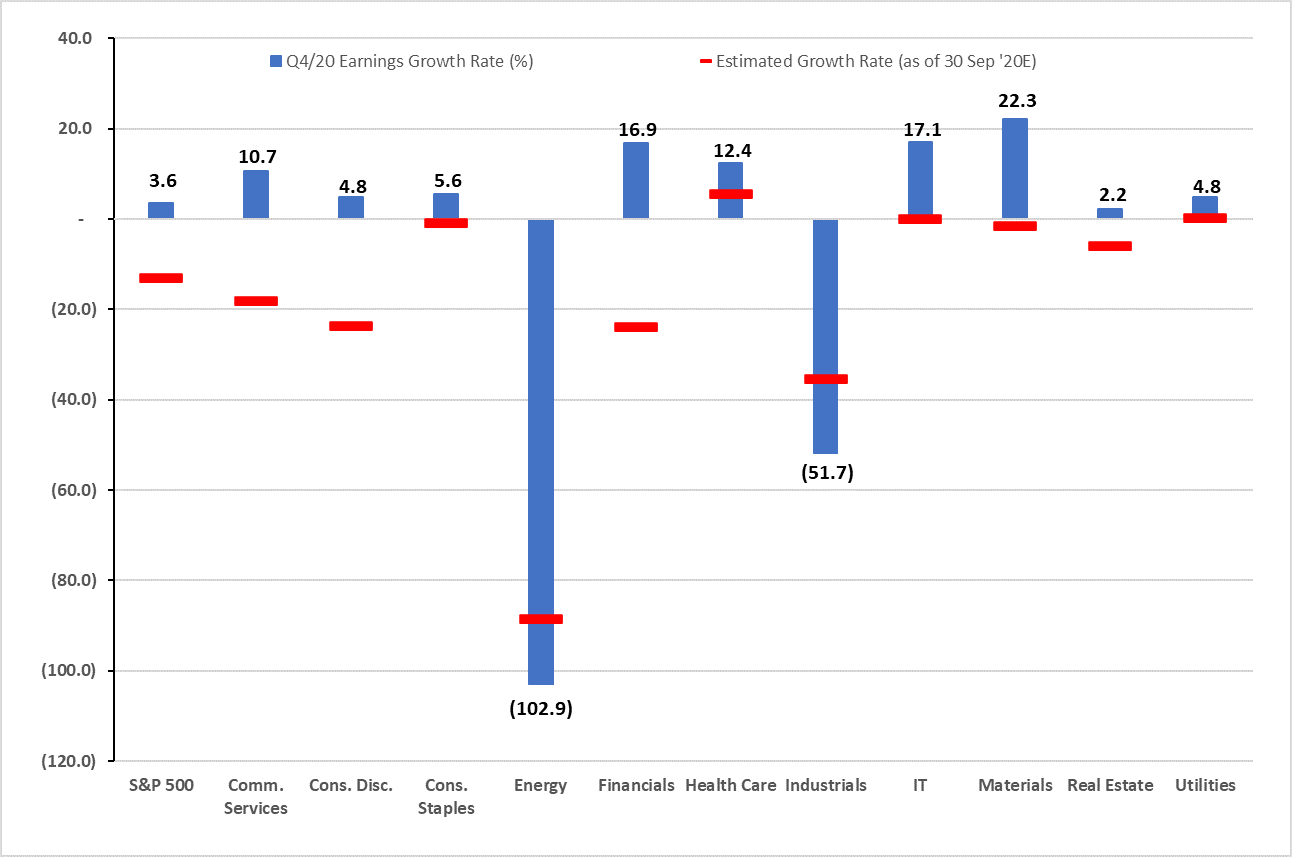

U.S. Earnings Season

U.S. earnings season has concluded on a high note. At the beginning of the Q4, S&P 500 earnings were anticipated to slip 13%; however, analysts aggressively revised estimates higher over the past few weeks to the point year-on-year growth was projected to be flat. With reporting season completed, companies have surprised to the upside with earnings growth looking to finish up 3.6%. The full-year earnings picture for the S&P 500 has 2021 earnings forecast to grow 24.4%, the most robust earnings recovery since 2010.

S&P 500 Q4/20 Earning Season: Sector EPS Growth Actual versus Predicted

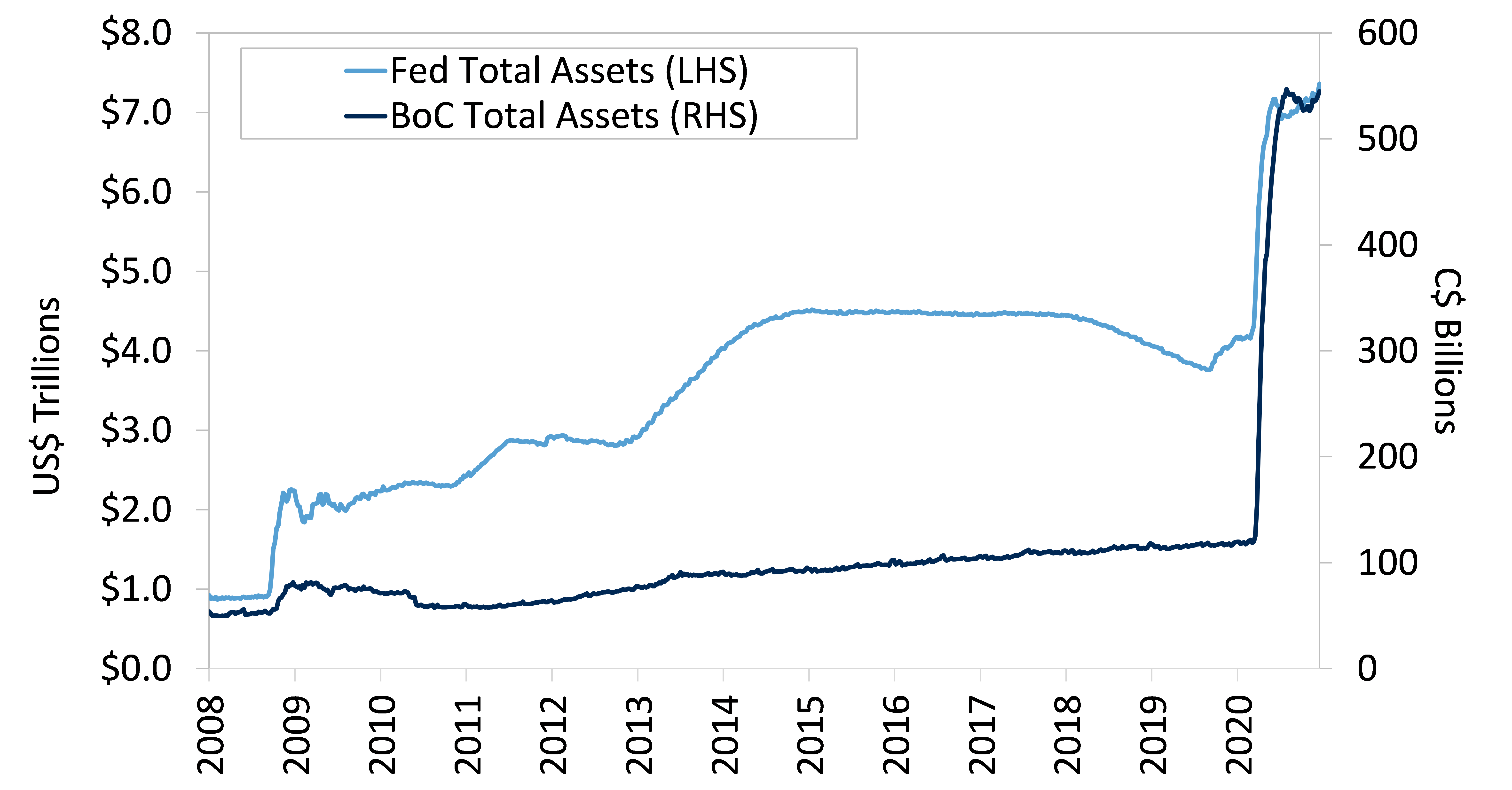

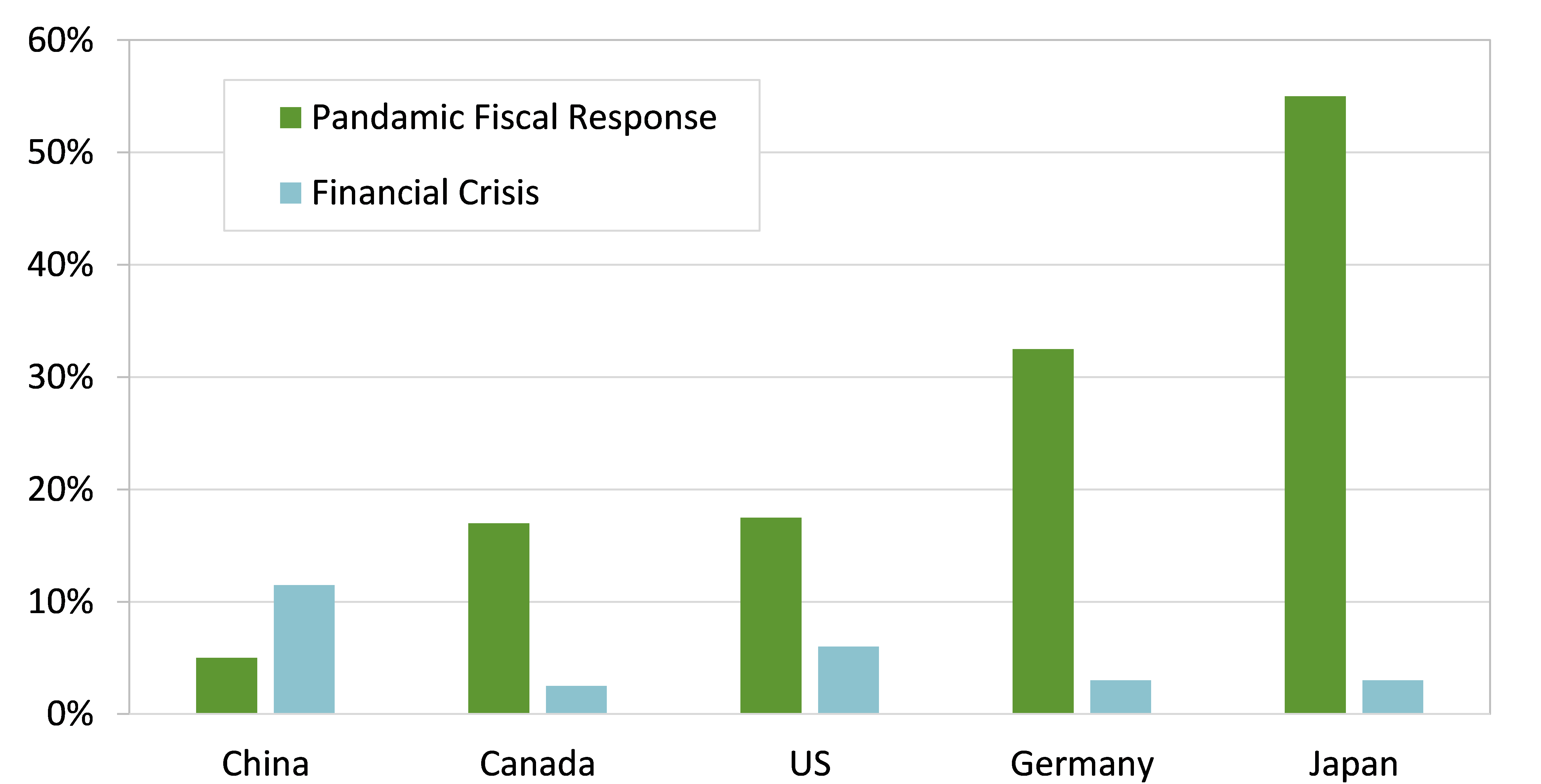

Fiscal & Liquidity

Much of the stellar earnings season can be attributed to the adoption of a "whatever it takes" attitude by governments to get the economy through the other side of the pandemic. Significant fiscal relief and spending programs have supported corporate earnings, and millions of individuals that experienced job loss or reduced hours have left the consumer in a relatively good position coming out of recession. In the U.S., an additional fiscal spending package of US$1.9 trillion will cement a robust recovery in 2021 and beyond.

Federal Reserve & BoC Balance Sheet Expansion

Source: Federal Reserve, Bank of Canada, Cadence Financial Group

Fiscal Stimulus as % of GDP

What are Valuation Levels?

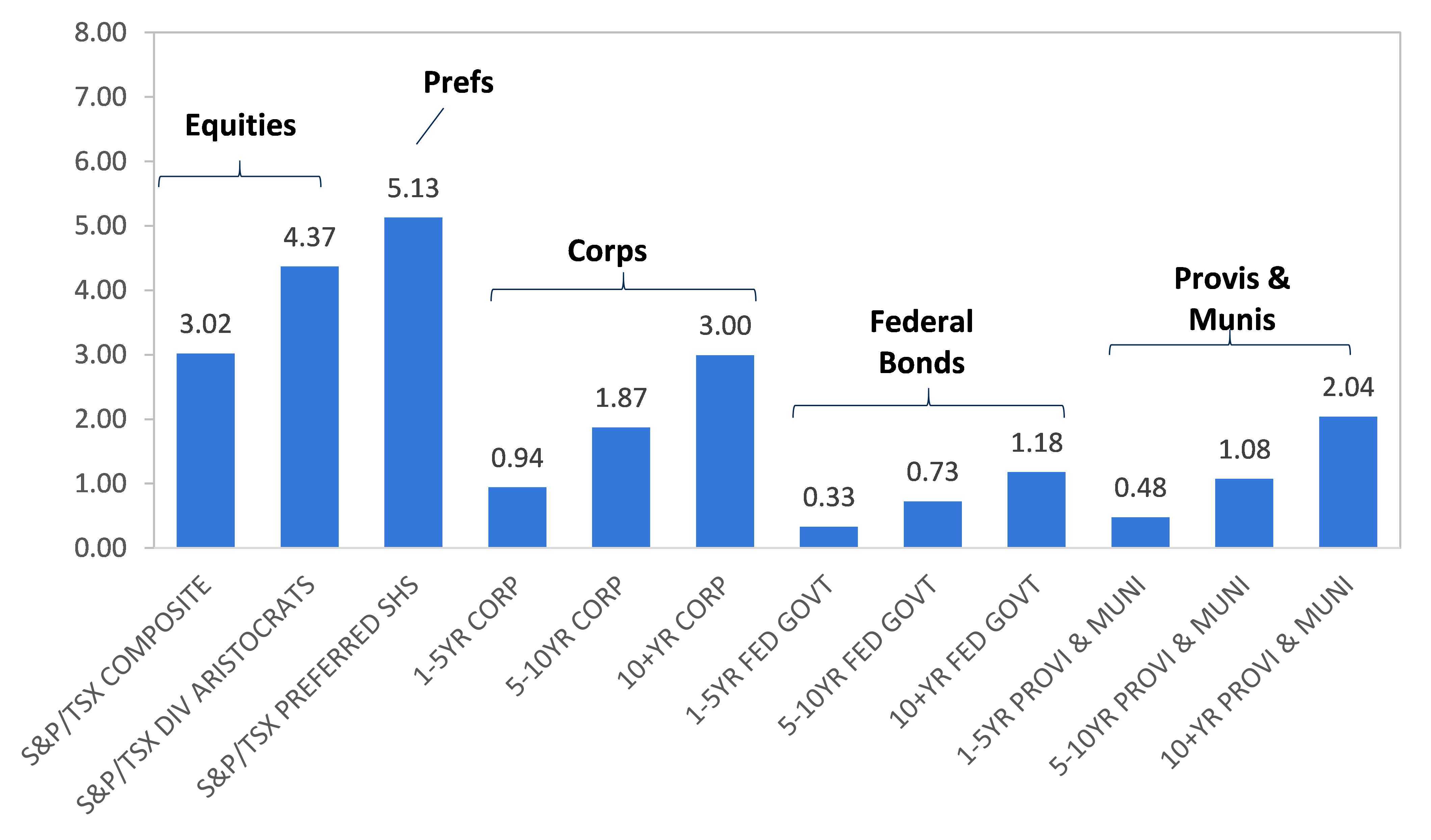

It is a question often asked given the S&P 500 trades at an elevated price-to-earnings multiple. In normal times, this would be cause for concern, but these are not normal times. To understand why valuation levels are "reasonable" and may become even more stretched, we must take a holistic approach. Equity market valuations cannot be viewed in isolation and must consider the alternative. In a world where investors decide to deploy capital to a particular asset class, the choice is clear – equities are more attractive than bonds for investors with a long-term investment horizon.

Limited Options of Income

O Canada

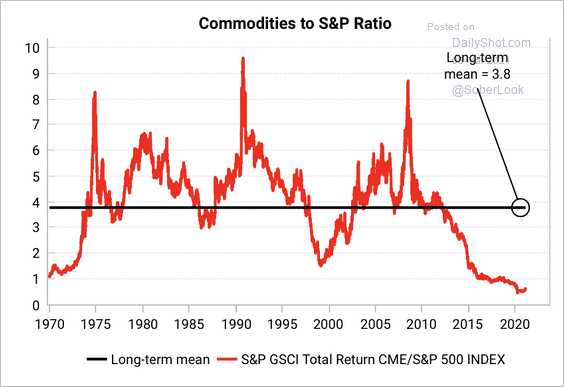

Our commodity-centric market should fair well in 2021. While we are focused on buying sustainable business and generally wish to avoid pure price takers, as these companies are inherently volatile, we do find the potential that the decade long commodity bear cycle may have ended intriguingly (see charts of interest).

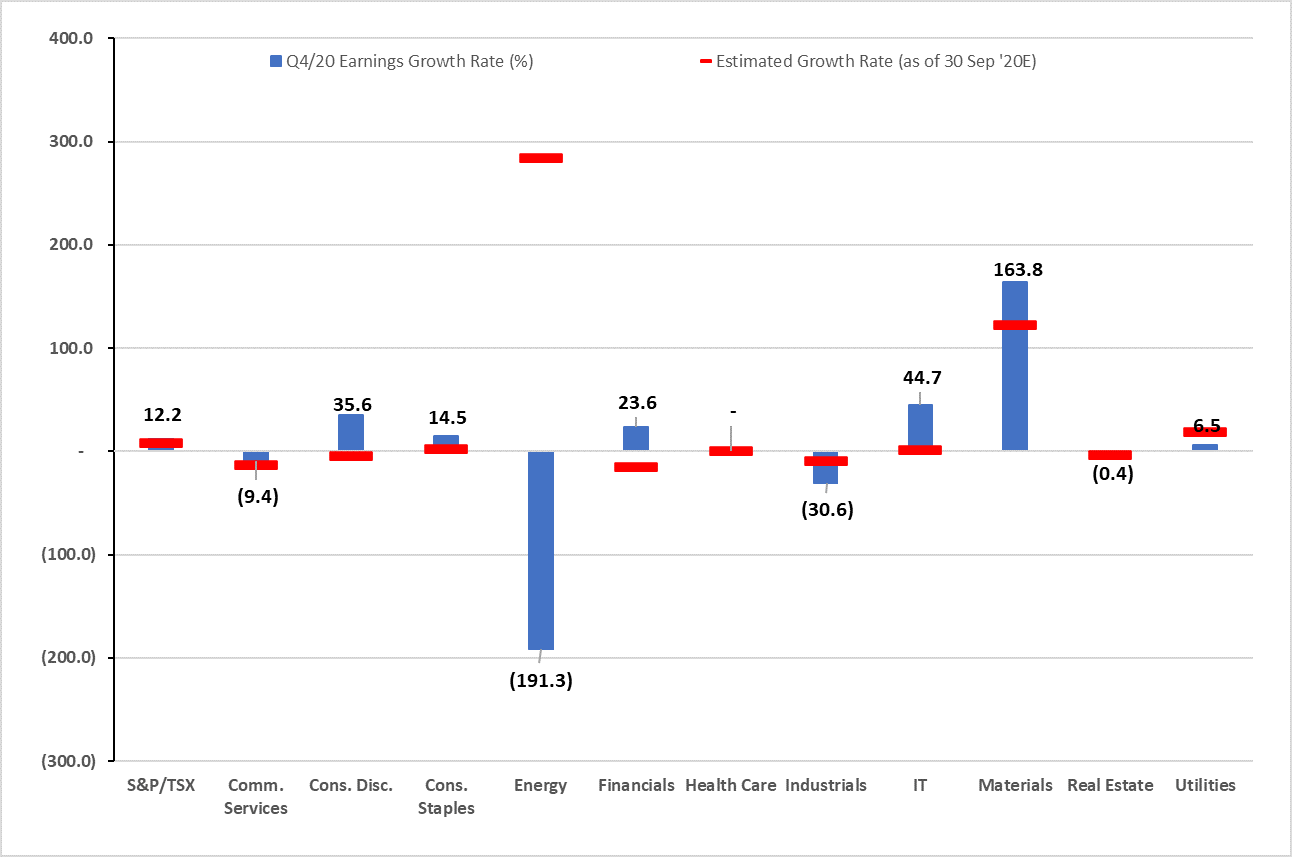

Consider Canada’s quarterly earnings season where we see an improvement in commodity prices developing the prospects for the material sectors. About 70% of the S&P/TSX has reported, at the beginning of the year, analysts’ anticipated year-on-year earnings growth of 8.2%. However, like the U.S., Canadian earnings season has surprised the upside, with earnings tracking toward 12% growth. We are seeing large earning surprises coming from the more economically sensitive sectors: consumer discretionary, financials, technology, and materials. For the full year 2021, S&P/TSX earnings are forecast to grow 55%.

S&P/TSX Earning Season – Cyclicals Lead the Way

Positioning

With the 2020 RRSP season behind us and cash to put to work, many investors are likely wondering where we are seeing value. This is especially true after the meteoric rise in North American equity markets - the S&P 500, Nasdaq 100, and S&P/TSX index have all advanced ~80% on average since the March 2020 lows.

- Early in the quarter we took profit on renewables after the space traded at extremely rich multiples. With a correction underway, the space is looking more attractive, and we are actively looking at rebuilding our positions.

- Within the U.S. health care space, we see good value in large cap biotechnology and medical devices. We continue to look for opportunities in this space as we see select providers benefiting from the reopening.

- We believe in the economic recovery. Long-term interest rates will drift higher benefiting cyclical areas of the market. We added to financials last year and are seeing the benefits today, trimming some winning positions (JPMorgan, Bank of American and Scotia Bank). We continue to look for opportunities in economically sensitive areas of the market.

- We are bullish on precious metals, but we see near-term headwinds for gold. As such, we trimmed our bullion exposure during the quarter.

- As rates moved higher, investors shifted from COVID winners to reopening trades. This pushed the technology stocks into correction territory during the quarter; we took the opportunity to initiate positions in high-quality technology names where valuation levels became more attractive.

- At the same time, we believe long-term rates have move too far too fast and see a tactical trade on adding interest sensitive securities that are trading discounted valuations (we added American Tower, Allied Properties and US 20-year Treasuries).

TFSA Contributions – Always a Good Time to Top Up

Tax-free savings accounts allow you to take after tax dollars, and have any returns on your investments, sheltered from future taxation. For anyone with investments sitting in a non-registered account, make sure you have used all your TFSA contribution room; you are just giving money away to taxes if you do not. For 2021, this means $6,000 for the year, for a lifetime total of $75,500 if you were 18 years of age or older in 2009 and never contributed before. This is a fantastic way to save for supplementary retirement savings or a rainy-day fund. If you have not yet made your 2021 TFSA contributions, please contact Ryan Cha or Madison Chlum.

Market Update Webinar

On April 20, 2021 1:30PM PST we will be hosting a Q1 market update educational webinar with Seth Allen and Jason Castelli. This is a great opportunity to get introduced to our new partner, Jason, and to gain insight into the recent market volatility. If there are any specific questions that you would like to be addressed, please send them to Laura.Furtado@RaymondJames.ca.

To RSVP for the conference call, please contact Laura Furtado.

Charts of Interest

Commodities are near a 50-year low relative to the S&P 500.

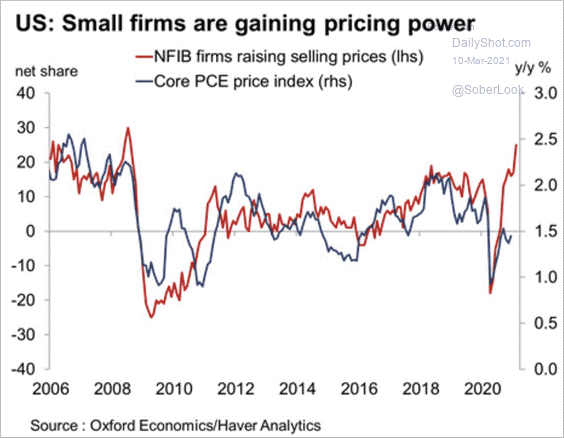

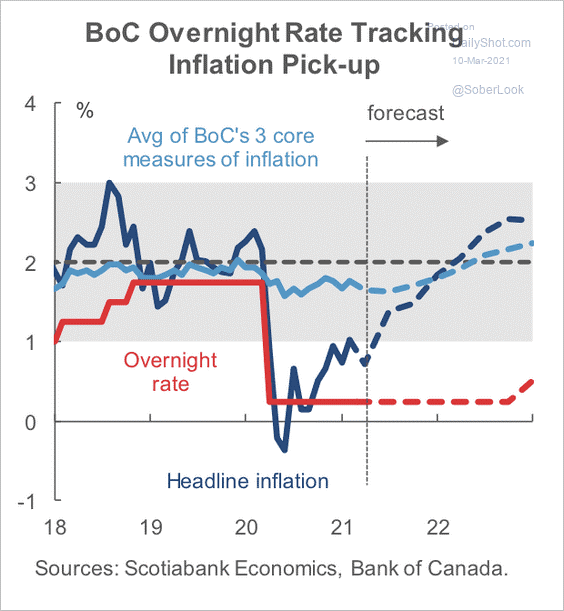

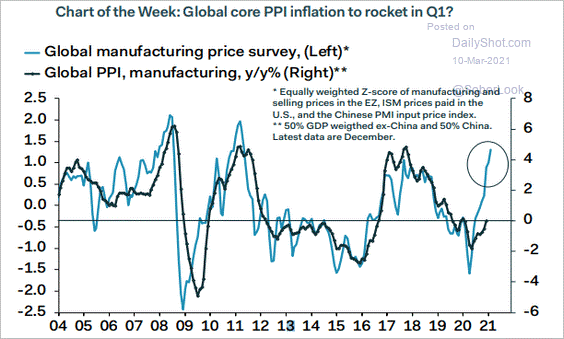

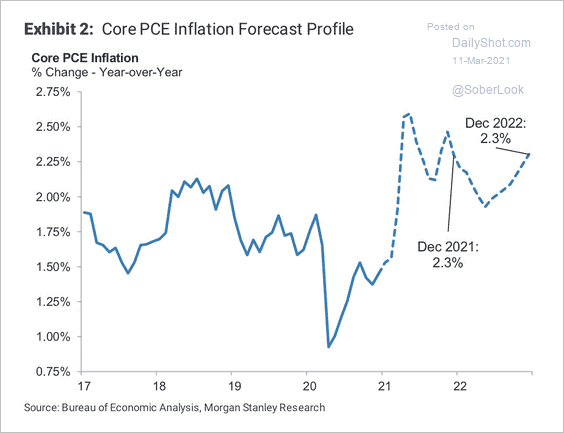

Inflationary pressures are building.

The real question will be if headline inflation creeps into core inflation beyond 2021.

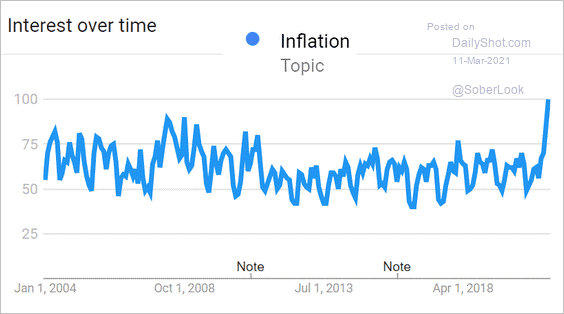

The public’s interest in inflation has spiked this year. Here is inflation-related Google search activity since 2004.

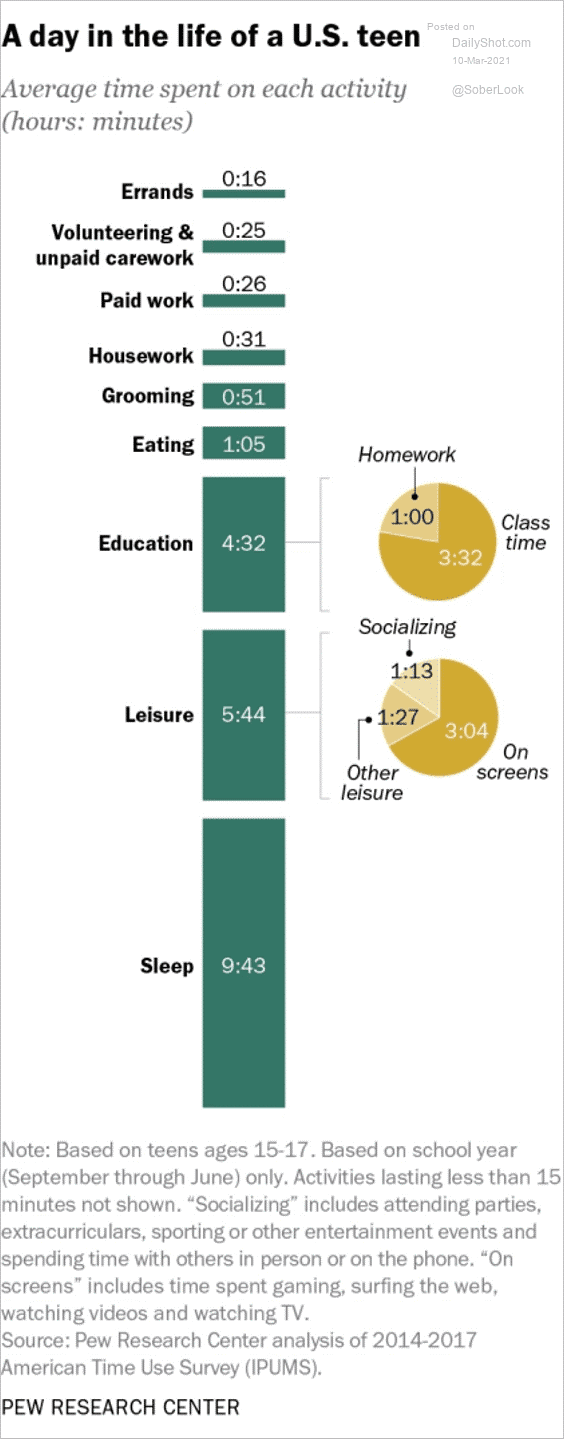

How does your teenager compare?

Financial Planning: Tips from Tanya

Q: What is an estate plan and do I need one?

A: Estate planning can be an often-neglected part of financial planning. Yet, for many people, it can be one of the most important planning considerations for their family. The purpose is to plan for the effective enjoyment, ownership, management and disposition of your assets during your life, upon your death and after death. Fundamental to the process is the maximization of inheritance to heirs through the process of minimizing taxes, probate fees and other expenses. Thus, estate planning is the creation, preservation, and conservation of wealth at the time of death. It is vitally important that every individual review their estate plan and have, at the very minimum, an updated will. If nothing else, it will give you the peace of mind in knowing that your loved ones and the causes most important to you will be looked after.

I would be happy to help you review your plan to protect your assets and to ensure you are in control of all that you have worked for and accumulated in your life.

Partner Feature: Jason Castelli, CFA

We would like to introduce a new partner to the Cadence Financial Group, Jason Castelli. Jason started his career in multinational investment bank and financial services, progressing to a Canadian banked-own brokerage until moving to Raymond James Ltd. in 2015. Jason’s experience and expertise primarily lies in understanding macro trends, identifying market opportunities and reflecting his views and strategies within an appropriately diversified portfolio. As Vice President, Head of Investment Strategy at Raymond James Ltd., Jason was the chair of Investment Advisory Strategy Group, responsible for setting the firm’s long-term strategic view on both capital markets and asset allocation. In his role, Jason also focused on providing Raymond James Ltd. financial advisors and their clients with market insights, actionable investment strategies, security recommendations and portfolio strategies. As registered Portfolio Manager (PM) and Lead Manager for Raymond James Ltd. Canadian Income mandate, he successfully implemented a disciplined investment approach leveraging quantitative, fundamental, and technical analysis. Over the period he oversaw the mandate, it achieved a top quartile ranking three out of five years. In March 2021, Jason joined the Cadence Financial Group as part of a natural progression in his career; he is passionate about the markets and helping individuals. Joining Cadence allows him to focus on what he loves, delivering market insights and strategies to achieve clients’ financial objectives.

Industry expertise is crucial to Jason. He holds a Chartered Financial Analyst (CFA®) and Canadian Investment Manager (CIM®) designation and has completed numerous securities courses focused on wealth management, investment strategies, and derivatives. Jason holds a Bachelor of Arts from the University of Western Ontario.

Outside of work, Jason is passionate about golf, picking up the game at the young age of 10, playing in numerous events both in Canadian and the U.S. and at the collegiate level. Jason is passionate about giving back to the game and is actively involved at his Toronto home course on the golf committee to support and encourage junior golf development. Jason is a devoted family man; he and his wife are kept busy with their two sons’ demanding hockey schedules and academic activities.

You can reach Jason directly at jason.castelli@raymondjames.ca

Team Member Feature: Herman Wong

We would like to introduce a new member to the Cadence Financial Group, Herman Wong. With his extensive background in the financial services sector, Herman is highly proficient in managing all administrative needs and ensuring clients are provided with the very best service. Herman has over 20 years of experience in the financial services industry and works as our wealth manager assistant. Earlier in his career, he was a financial services representative in retail banking. He is a graduate of the financial management/financial planning program at the British Columbia Institute of Technology.

Herman is licensed as a registered representative, is options and U.S. licensed, and is working towards attaining the Chartered Investment Manager (CIM®) designation.

In his free time, Herman enjoys spending time cycling, travelling, and camping with Mary and his young daughter, Holland. He can be reached directly at herman.wong@raymondjames.ca.

Cadence Gives Back

Over the holiday season, the Cadence Financial Group has helped those in need in our communities. Charities that we have donated to include:

Today the GVFB provides assistance to approximately 8,500 people weekly across Vancouver, Burnaby, New Westminster, and the North Shore. Of all their clients, 24% are children and youth, 58% are adults, and 18% are seniors. They have specialized nutrition programs for children from birth to 12 years old.

Serving the community since 1973, Dixon Transition Society helps to reduce the impact of domestic violence by providing a safe haven for women and children. Transitional housing programs, counselling and outreach services form a continuum of care to help women and children live a life free from violence.

We plan on continuing our charitable endeavours that support and empower various organizations and causes in 2021.

NEW Office Location

Please note that our head office has recently changed. Our new mailing address is (our phone #s and emails remain the same):

Cadence Financial Group

410-1040 West Georgia Street

Vancouver, BC

V6E 4H1

We look forward to having you visit us!

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to.