Weekly Market Comment: Saturday, April 9th

Filling potholes with corporate taxes

“The U.S. economy will likely boom,” wrote JPMorgan’s CEO and Chairman, Jamie Dimon, this week in his annual letter to shareholders, citing a cocktail of over $1 trillion in extra savings by American households in the past year, vaccinations, government deficit spending and “euphoria around the end of the pandemic”.

To help pay for the eyewatering levels of government stimulus spending of $2.25 trillion, Treasury Secretary Janet Yellen is trying to promote a global minimum corporate tax rate to help pay for it. She estimates that her proposed increase of the marginal federal corporate tax rate from 21% to 28% - as well as clamping down on “off-shoring” by American companies looking to reduce or avoid U.S. federal taxes – would yield an extra $2 trillion in taxes over the next decade.

Gone are the days of Biden supporting Reagan’s push for smaller taxation in the 1980s and support of a more moderate, centrist agenda.

While “infrastructure” is universally popular, many non-infrastructure pet spending projects have crept into this gargantuan spending bill.

It’s not just government that is piling on the leverage. Investor margin debt has been booming. Bank of America says $576 billion has flowed into equity funds over the past five months, more than the past 12 years’ worth of inflows combined. Combined!

The good news is that, as Goldman Sachs predicts, the U.S. economy is poised to grow over 6% this year while interest rates remain below 2%. The last time the U.S. economy grew over 6% was in 1984 when interest rates were 13%. Based on the Fed Model, which measures the value of stocks as a function of the earnings yield of stocks minus the risk free rate, stocks are at their 40th percentile valuation currently. Goldman argues this model is the single most reliable stock market indicator in modern times.

Warren Buffett warned derivatives can be weapons of mass destruction

Late last week, an insanely leveraged hedge fund run by a family office, Archegos Capital Management, was forced to liquidate over $20 billion in swaps contracts (also called “contracts-for-difference”). Holdings like ViacomCBS, Discovery, Baidu and Tencent Music dropped anywhere from 27% to over 48% spanning a week.

These leveraged swaps were a way to gain both leverage as well as anonymity; as stakes exceeding 5% did not have to be disclosed as Archegos’ ownership wasn’t direct (as opposed to the way normal people like Buffett, our team, and you invest).

The top lenders to the fund are Credit Suisse and Nomura, which were forced to liquidate their clients’ assets after a default on margin calls. Nomura shares dropped 16.3% in one day while Credit Suisse dropped 14%.

To be clear, these strange derivatives will affect a limited number of big players and is not a cause for concern for investors engaged in normal, leverage-free investing, which is what we do.

Will China continue to be a leading indicator?

China got hit early by Covid, but they were also early to show signs of recovery. Data from China’s largest travel-booking site, Trip.com, showed that travel for the national “tomb-sweeping” holiday was 94.5% of what it was in 2019 (some 9 months before Covid started causing problems).

For context, only about 10% of the Chinese population has been vaccinated thus far. One traveler, who took four days off to travel to the desert, reported being surprised at how many fellow travelers she witnessed.

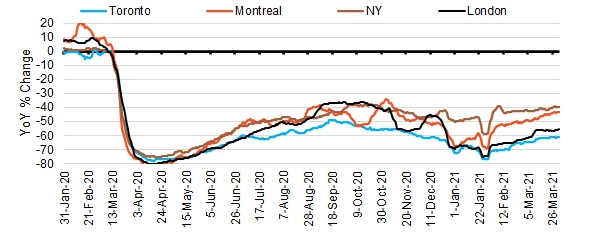

By the way, here is a post-Covid view of subway ridership in the West:

In a game of ‘rock-paper-scissors’, dividend stocks trump all three

Most investors regard higher interest rates as being bad for dividend stocks but the historic data is more nuanced. BMO Capital Markets annualized 30 years of data and found that companies that regularly increase dividends outpace the market even in a rising rate environment. “Rising rates are not a dividend-growth-stock killer,” concluded the strategist.

We have long been attracted to dividend growers, with investments like banks, telecom providers, and pipelines regularly raising their dividends.

So when we see signs of market froth, concerns about excessive leverage, or see bubbles in sectors like technology or marijuana stocks, we generally exclude dividend growers from our concerns. They are an investable theme to be held through thick-and-thin, even though we do prune individual names from time to time as we see fit.

Why? When markets crash, dividend growers always survive until the next cycle, paying us all along the way.

Noteworthy links:

- More money poured into stocks in past five months than over last 12 years: BofA

- After a decade of failure, LG officially quits the smartphone market

- Google wins legal duel with Oracle over Android’s use of Java code

- ‘Calm yourself’, from the Dr. Phil Stieg podcast “This Is Your Brain”

- Ski fans won’t want to miss this classic 1987 video of the Whistler Blackcomb Saudan Couloir Ski Race Extreme

Musings Beyond The Markets

In 1997, the California Coastal Records Project began to update and maintain records of the entire California coastline. To do so, a husband-and-wife team flew a helicopter along the beaches, snapping photographs. The point was to collect records of the shoreline, but the photos inevitably captured photos of homes.

An owner of one of those homes was singer Barbra Streisand. In 2002, her home ended up anonymously in the background of one pictures on the project website, and in 2003 she sued the project to have it removed from their website.

The lawsuit was dismissed, and “Babs” was ordered to pay $155,567.04 in legal fees.

Up until the lawsuit, the photo had been downloaded a total of six times – twice by her lawyers.

However, the publicity from the lawsuit sent almost a half million internet users to the website in the first month following. It has probably been seen millions of times since. Oops!

The effort to hide something from the world, only to draw vastly more unwanted attention to that thing, is today known as “the Streisand Effect”.

Word of the Week

sweater (n.) – a thing your nagging mother makes you wear when she’s cold. “A sweater is like life; you get nothing out of it that you don’t put into it!” – Marilyn Monroe