Trivia: how wide and tall is a “2-by-4?”

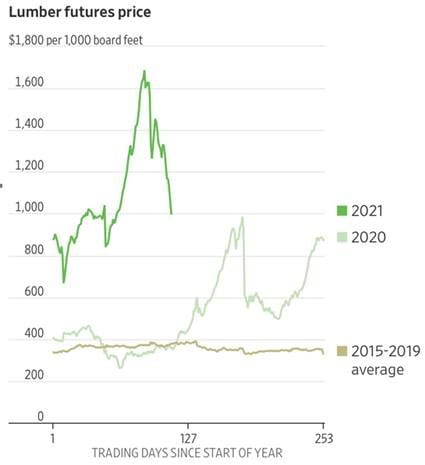

“Trees don’t grow to the sky,” is an old Wall Street saying, a metaphor reminder that most stocks don’t go up forever. Lumber prices seemed to defy this old axiom, having doubled in just a few months (see chart below). But the perfect storm of red-hot housing demand, restaurants all building outdoor patios and sawmills struggling to keep up with demand seems to be abating.

We’ve also seen copper prices come off the boil. That’s probably healthy but doesn’t mean it has seen its price peak. Not if the electrification megatrend remains intact (which it almost certainly will).

Manulife pointed out that the Bank of Canada is likely to hike rates before the Fed, suggesting that the Loonie can strengthen some more over the next year. They are now targeting 84-85 cents against the USD, up from the current exchange rate of almost 82 cents.

The Fed itself met this week. The dot plot of individual Fed members’ outlooks (there are 12 of them) suggests two rate hikes by the end of 2023. Some, like St. Louis Fed President James Bullard, thinks they will move as soon as 2022. “You love to have an economy growing as fast as this one, you love to have a labor market improving the way this one has improved,” he said of today’s conditions.

Those rate hike expectations are a little more hawkish (central bank speak for “less accommodating”) than previously signaled but it’s not like we don’t all know rates are going higher.

One of the more dramatic reactions was silver and gold selling off almost 5% and 7%, respectively. Rate hikes target inflation, which is bad for inflation hedges (all else being equal) such as precious metals.

The prospect of higher rates has probably helped cool the Canadian real estate sales boom, along with more onerous lending rules a few weeks back. “Maybe we all finally have something else to think about other than housing and being stuck at home all the time,” said a senior economist at the CMHC.

As for the trivia question, a two-by-four actually measures 1.5” x 3” but it doesn’t exactly roll off the tongue, does it?

Is it true or is it really just a catchy, believable story?

The late journalism professor Walter Fischer espoused the value of narrative, believing that “stories are more persuasive than logical arguments.” Narratives in markets abound. Bloomberg’s Barry Ritholz points out a few of today’s more prominent narratives:

Bitcoin – Fiat currencies are being debased by central banks, so hedge the risk of fiat currencies becoming worthless paper by buying Bitcoin. And heck, you too might make enough from it to afford a Lamborghini!

Worker shortage – Generous unemployment benefits are keeping lazy, ungrateful scoundrels from going back to work! Or the counter-narrative: Closed schools means childcare is harder to find, making it more difficult for many parents to re-join the workforce.

Passive indexing – It is hard to pick winning stocks! Not only that, it’s expensive to hire the people who might be able to pick winning stocks so instead, just buy a cheap index of the biggest stocks or the entire market.

Inflation – Combining ultra-low rates with record stimulus and pent-up demand from lockdowns will stoke inflation.

Valuation – Buying stocks below their intrinsic value is a good way to make money over the long term. Counternarrative: traditional measures of value must be more robust than just price-to-sales and price-to-earnings ratios; it must include growth rate and intangibles such as patents, algorithms and business processes.

Meme stocks – The collective power of the internet can stick it to the man! Wall Street Bets can identify heavily shorted stocks, and as a group buy out of the money call options, forcing a massive short-squeeze. Power to the people!

To be clear, some of these narratives will prove to be correct but others will not. But how widely held a narrative becomes may have more to do with timing, celebrity endorsement, and rebellious spirit than actual truth. Investment narratives that turn out to be false in the long run can result in investors buying and owning assets at valuations that eventually fall apart along with the narrative.

Examples of failed narratives include Blackberry’s greatness (which was true until the iPhone came along), Fed hikes and other government stimulus during the Credit Crisis stoking hyper-inflation (it never materialized), or the sophisticated investors who piled $400 million in to Theranos which reached a $9 billion valuation only to find out that the company’s blood analyzing box never did work as advertised.

“In the short run, the market is a narrative machine, but in the long run, it is a narrative debunking machine,” writes Ritholz, paraphrasing and updating Benjamin Graham’s famous quote: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Noteworthy links:

- Report by the Pan-Canadian Health Data Strategy Expert Advisory Group concludes Canada’s data gaps hampered pandemic response

- Supreme court votes 7-2 to uphold Affordable Care Act

- Mark Cuba calls for stablecoin regulation after trading token that crashed to zero

- Can a $110 million helmet unlock the secrets of the mind?

- Kim Jong Un admits North Korea is facing ‘tense food situation’

- How to grill just about any vegetable

- 20 photos of the week, by The Guardian

Word of the Week

edifying (adj.) – providing moral or intellectual instruction. “The man who doesn’t relax and hoot a few hoots voluntarily, now and then, is in great danger of hooting hoots and standing on his head for the edification of the pathologist and trained nurse, a little later on.”