Mid-Year Outlook: Navigating the Post-Pandemic Path

Summer has arrived, and she is not holding back. You may have noticed it is hot, really hot, so hot that dozens of locations across western Canada broke temperature records in the last few weeks. The intense heat is undoubtedly more bearable sitting by a lake than melting in the city. As many of you plan your escape for a made in Canada summer vacation, if you're driving along Highway 99, you know the weather can often change on the turn of a dime. The change in conditions usually means one needs to adapt to the situation and adjust one’s speed. The stepdown in speed means you'll arrive at your destination, but a little later than you had first anticipated.

Similarly, economic growth has been chugging along and accelerating at a healthy clip, but after Q2, growth will slow. This deceleration doesn't imply a contraction; rather, the economy will experience positive growth at a slower pace. U.S. Q2 real GDP is anticipated to be 10% quarter-over-quarter, Q3 and Q4 are both expected to print below 7%. These are still healthy growth numbers but clearly slower than Q2's growth profile. Despite the slowdown, the U.S. economic expansion is anticipated to outpace that of China’s growth for the first time this century. From our perspective, this deceleration has broad implications for the second half of the year:

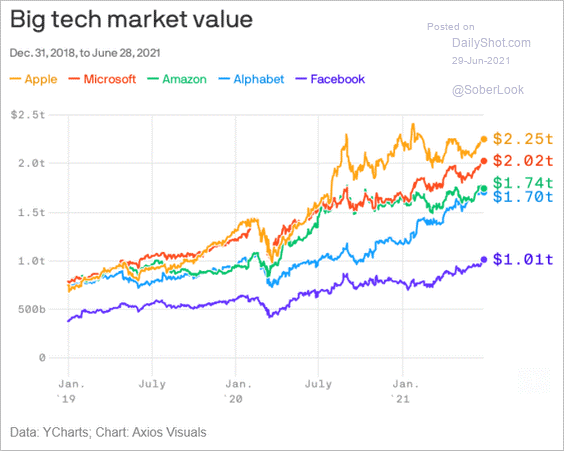

- A step down in growth may impact investment style and sector rotation. We believe investors may gravitate towards large-cap quality-growth stocks by taking profits on cyclical value areas. In June, we have seen some evidence of this rotation taking hold as investors moved from cyclical value sectors (financials, industrials and materials) into "growthier" sectors (technology and consumer discretionary). We are monitoring this shift to determine whether it becomes the dominant trend. We are balanced in our approach, holding both value and growth stocks, but can tilt the portfolios to take advantage of these shifts.

- We anticipate greater volatility, particularly if some critical economic data disappoints within the context of the slower growth profile. This could be complicated because central banks may increase their rhetoric that short-term interest rates may need to move higher to cool inflationary pressures, which would be problematic if growth is indeed slowing. However, if inflationary pressures prove to be transitory, there will be little need to hike interest rates or taper asset purchases in the near term. As such, we see the U.S. Federal Reserve Jackson Hole Annual August Policy Retreat as a critical date for the markets.

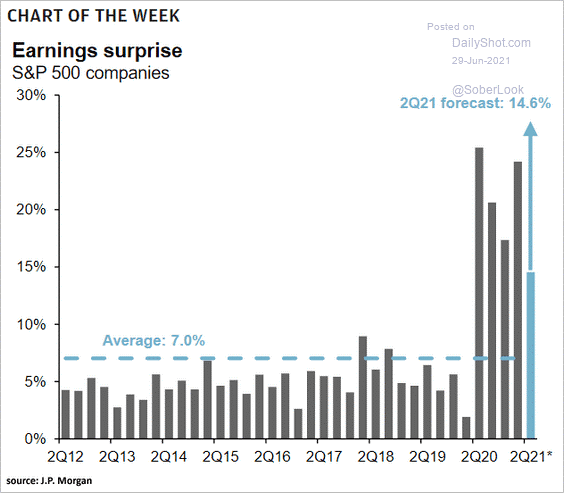

We close out a solid first half of the year in Cadence portfolios; the usual suspects have been the primary driver, including central bank liquidity tailwind, fiscal stimulus, vaccine traction, reopening momentum and outsized earnings surprises. There are many moving parts that we are monitoring and continue to tilt the portfolios to take advantage of our outlook. However, a universal truth is that equities remain an attractive asset class, and we believe we are still in the early innings of a multi-year bull market.

That said, we are constantly monitoring the risks to the outlook and making adjustments, as needed. Our key areas of concern revolve around stretched valuations, central bank policy (particularly the looming Fed tapering), the potential for an inflation overshoot, margin headwinds from higher input costs, and slower economic growth in China.

Portfolio Positioning & June Trades

Given our second-half outlook, we believe the portfolios are well positioned, though we continue to look for opportunities to increase our allocation to quality-technology stocks. We have carried an underweight in information technology given stretched valuations and our expectations that there would be a better entry point into some of the better secular growth stories as we progress through 2021. We have not changed that view and have been actively looking for opportunities in this area.

We added Canadian Apartment REIT (CAR.UN-CA) and U.S. investment bank, Goldman Sachs (GS-US) in June . Canadian Apartment Properties Real Estate Investment Trust (CAPREIT) owns and operates a portfolio of multi-unit residential rental properties - 67,600 suites across Canada (Ontario 44%, Quebec 17% & BC 9%) and Europe (Netherlands ~10%).

We took profit on two winning trades, TFI International (TFII-CA) and Alimentation Couche-Tard (ATD.B-CA), and reduced exposure to Abbott Labs (ABT-US) after the medical and diagnostic maker lowered its full-year guidance. We continue to believe ABT will be a long-term winner, but near-term headwinds suggest the stock may spend some time consolidating. With the ABT proceeds and to maintain our exposure to health care, we added to our position in Bristol Myers Squibb (BMY-US).

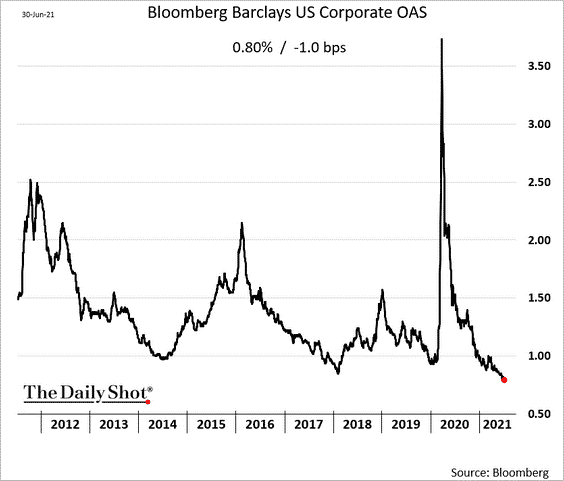

Within our fixed income sleeve, we trimmed Canso Corporate Value Bond Fund and with the proceeds added to Mackenzie Unconstrained Bond ETF and Sun Life Opportunistic Fixed Income. Canso has been a very strong performer since the market bottom in March 2020, however with credit spreads at record lows we believe there is limited upside for this credit bond manager. By moving to Mackenzie and Sun Life we increase exposure to emerging markets debt.

Charts of Interest

Not much more room for improvement; U.S. credit spreads keep hitting new lows. As mentioned, Canso Corporate Value has been a primary benefactor from the narrowing of credit spreads.

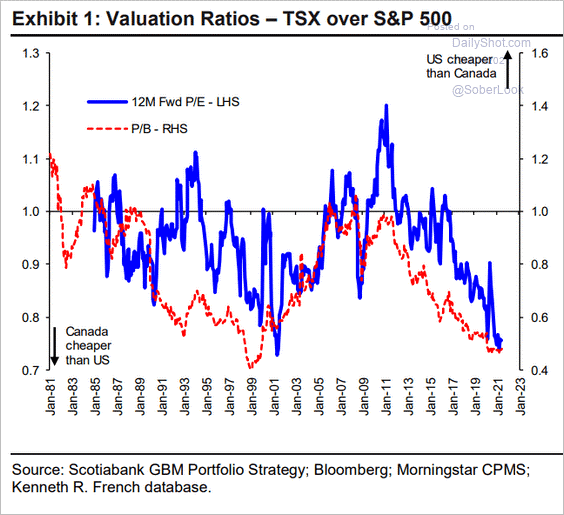

O Canada; Canadian stocks are trading at a deep discount to the U.S. Can the commodities boom narrow the discount? Only time will tell.

And the hits just keep on comin'; positive earnings surprises are expected to continue for the U.S. Q2 reporting season.

While Cadence portfolios are underweight information technology, we do own many of the trillion-dollar club: Apple, Qualcomm, Microsoft and Facebook.

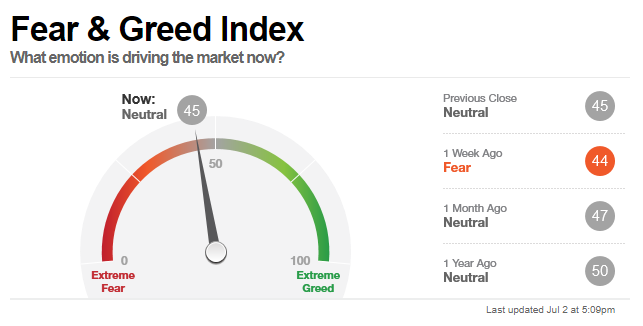

Goldilocks market sentiment – not too hot, not too cold.