Let's not bank on Fed predictions

Probably the single biggest determinant of where stock prices go from current record levels will be second quarter earnings season, which began this week.

There was nothing new out of the Fed, who’s chairman repeated his view that inflation “will likely remain elevated in coming months before moderating” as “bottlenecks unwind” and base effects (comparing today’s prices to abnormally low pandemic prices of a year ago) pass. As reasonable as that may sound, we know that Fed chairpersons are capable of being wrong in their predictions.

Higher rates would be a good thing for banks, which so far have reported mixed results. Bank of America’s Q2 profit more than doubled to $9.22 billion. Revenues fell 6% over last year from net interest income suffering due to lower interest rates which peaked in the last quarter. Trading was also down relative to last year’s Q2 panic buying.

The good news is that their lending business has really taken flight and should continue to do well going forward. And let’s also not forget that BoA’s EPS these past two quarters were their strongest in years, all the while holding more safety reserves than ever.

The challenge with government decrees

As witnessed by the return of traffic jams, the back-to-work trend following pandemic lockdowns continues to move toward normal.

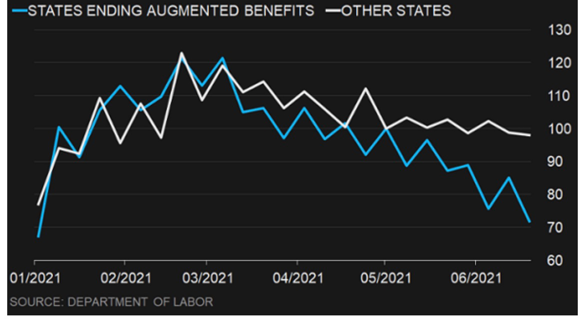

Economists are finally getting some insights into the policy of extending pandemic-offsetting payments to citizens. While help was much needed, the following chart illustrates what many economists have worried about: payments are a disincentive to return to work.

And then there is the even slower trend of workers returning to office towers. According to The Economist, in May only 1 in 20 American office towers had occupancy levels above 10%. Leases tend to be long and the work-from-home phenomena’s effect on commercial property is still unknown.

What’s obvious is that investment values are down and will remain subdued for some time.

If you can’t make money make hype

We came across this interesting meme of famous companies that have yet to turn a profit. It’s true that growth companies tend to re-invest cash to grow their business. They ramp up R&D, hire more and more people, spend more on advertising, etc. It’s also true that some of these companies will never turn a profit, despite their best efforts.

Valuing such companies requires a lot of arbitrary assumptions, as many traditional valuation metrics can’t be applied. It’s why their share prices tend to be erratic and volatile, as sentiment plays such a prominent role when fundamentals are lacking.

We remember the lessons of the dot.com craze and apply them. Many investors today did not experience that era and will have to learn these lessons the hard way.

Musings Beyond the Markets

Ransomware hijackings are one of the more disturbing creations resulting from the creation of the internet. From the relative safety and anonymity of some overseas destination, thieves can roll you without leaving their home or brandishing a gun like the old days.

Earlier this week, one of the most notorious criminal gangs mysteriously went off-line from the dark web. This came days after Joe Biden called Vladimir Putin to once again warn him to do something or else.

It’s not clear what caused REvil (short for “Ransomware evil”) to go off-line, including their publicly viewable list of victims, what they call their “happy blog”.

There is no question that this modern thuggery is a scourge that can threaten absolutely anybody. One moment you are working on your computer or surfing the net, the next moment your computer is frozen with a warning that you must pay or lose all of what is on your computer.

One especially insidious and sad side-effect of taking such groups off are the many victims who have yet to pay to resolve their issue. Taking REvil off-line leaves nobody to negotiate with nor to remove the ransomware, though there is a cogent argument to be made that making no payment is your best option (see Norton’s first tip below). Like America’s policy of not negotiating with terrorists and kidnappers, some are advocating that America make it illegal for companies or individuals to pay ransomware players to salvage data.

But there are examples of where refusing to pay is by far the costlier option, as happened to the city of Baltimore, which refused to pay $80,000 dollars in cryptocurrency to remove the shackles, only to spend $18 million rebuilding it all.

For a list of 7 tips to prevent ransomware, click here.