Heat of the Moment

Mid-Month Stretch: Inflation

Heat of the Moment

In 1982 Asia’s Heat of the Moment was the best-selling vinyl, but if Asia is not your cup of tea, perhaps Physical (Olivia Newton-John) or Eye of the Tiger (Survivor) tickle your fancy.

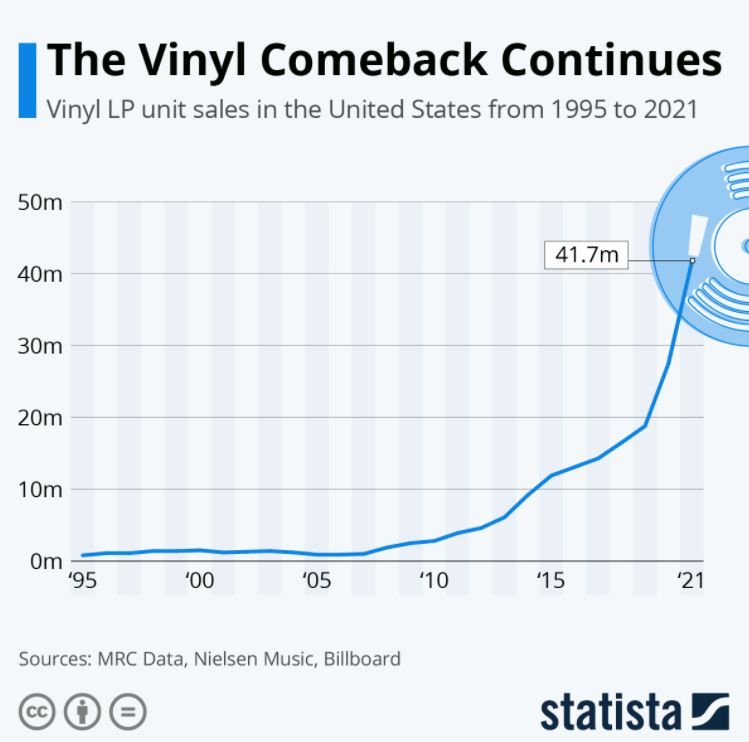

Like the 1980s, today, vinyl records are a hot commodity. Since 2007, unit sales have grown at an exponential pace. Your typical buyers, DJs, audiophile nerds and collectors cannot alone explain the sharp increase in demand. Something changed.

Record labels looking for ways to combat the internet’s commoditization of the music industry pushed consumers back toward an old technology. Vinyl was the answer, plus it had the added tangible benefits that downloaded files did not have.

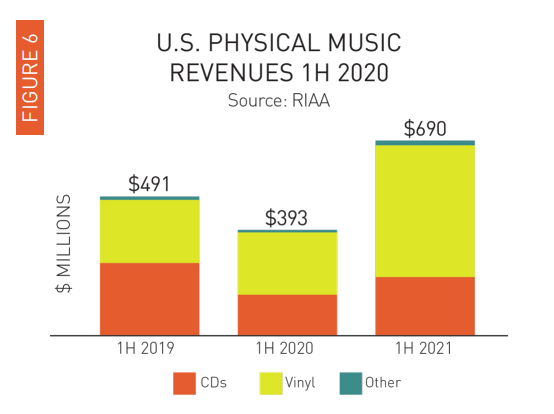

Vinyl record growth has continued at a remarkable pace. In the first half of 2021, revenues from vinyl grew 94% to $467 million and now account for more than 66% of physical format revenue.

Vinyl is back, baby!

Vinyl - Top Selling Physical Format

Source: MID-YEAR 2021 RIAA REVENUE STATISTICS

Like many other products, vinyl records have shot up in price due to labour shortages, supply chain issues, and higher prices of raw materials. Vinyl records sell for ~$30 compared to ~$10 when Heat of the Moment was released (interestingly, if we use an average inflation rate of 2.7% since 1980, we arrive at a present value of ~$30).

Coincidently, December’s US CPI print of +7% was the highest year-over-year advance since 1982.

In the 1980s, inflation was falling from a peak achieved early in the decade. Today, inflation is accelerating after nearly a decade of the Federal Reserve (Fed) trying to create inflation.

Well, mission accomplished, we suppose, but there are some big differences.

The inflation we’re experiencing today is mainly supply-chain related and not the kind of inflation the Fed was counting on.

Our assumption is that supply-side issues should eventually subside this year so that inflation will level off. To what level is the million-dollar question which we will try to answer in the coming quarters.

Early evidence from Q4 earnings season has highlighted labour costs and shortages as factors that have negatively impacted earnings and revenues or are expected to be a headwind moving forward.

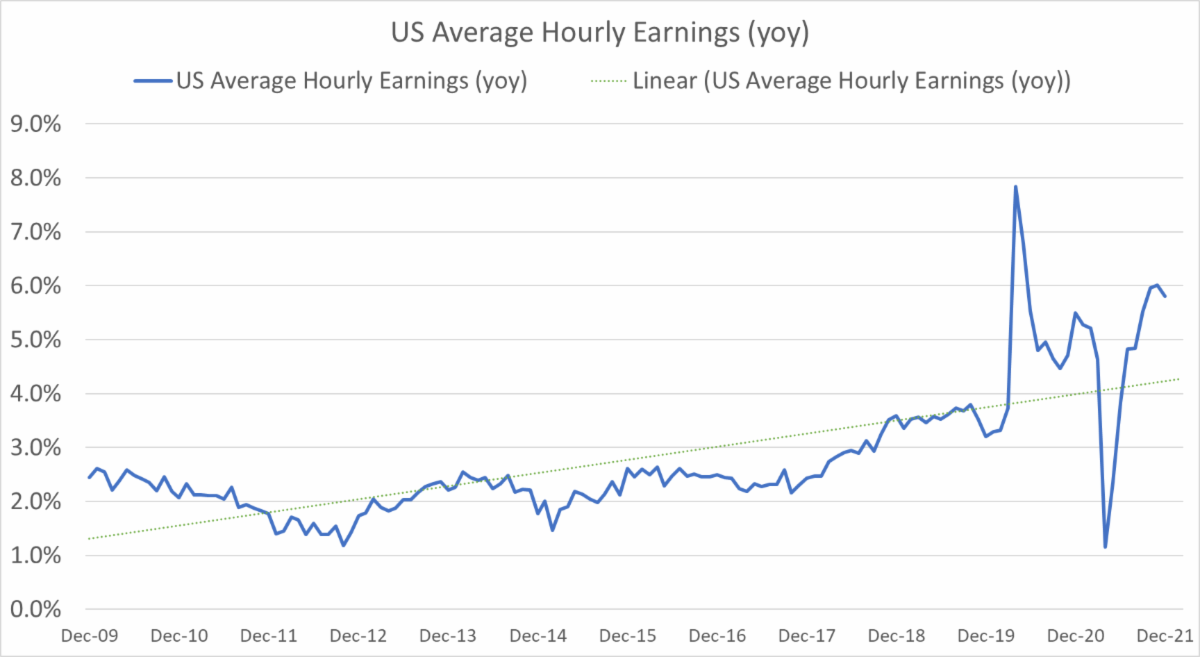

However, wage data has been extremely volatile due to the pandemic, and we will have a clearer picture of whether the sticky kind of inflation (wages) persists as we move through 2022.

Pandemic Distorts US Wage Data

Source: Federal Reserve Bank of St. Louis

Figuring out the inflation question has broad implications. If inflation:

- Moderates = Fed raises rates at a steady but moderate pace = good for equity markets

- Doesn’t moderate = Fed raises rates at a faster pace = not good for equity markets

The market is currently digesting the first scenario. However, if scenario two becomes more apparent, we anticipate more volatility for equity markets. We are actively monitoring this risk to ensure we protect capital in the unlikely scenario.

Random Facts

Five Facts about Vinyl