Market Perspective: Recent Volatility

Equity markets are off to a rough start in 2022, giving back some of 2021 substantial gains. We had anticipated an increase in market volatility this year and have positioned portfolios accordingly.

We believe the market is currently digesting the pace of monetary tightening, predicting a much faster pace than the likely scenario for interest rate hikes. In short, the market has overreacted, but there are plenty of uncertainties clouding the outlook – monetary policy, geopolitical, legislative and US mid-term elections in November.

We continue to believe 2022 will end with a positive return, though there will be plenty of peaks and valleys. The US economic outlook remains robust, underpinned by a solid consumer and strong corporate earnings growth.

While we proceed cautiously, we will be looking for opportunities to deploy cash selectively. In terms of the portfolio positioning, we are focused on:

- High-quality dividend-paying stocks that tend to hold up better during times of weakness.

- Diversified across sectors with overweights in defensive sectors like consumer staples, health care and utilities.

- Cash levels remain elevated, ranging from 10-15%.

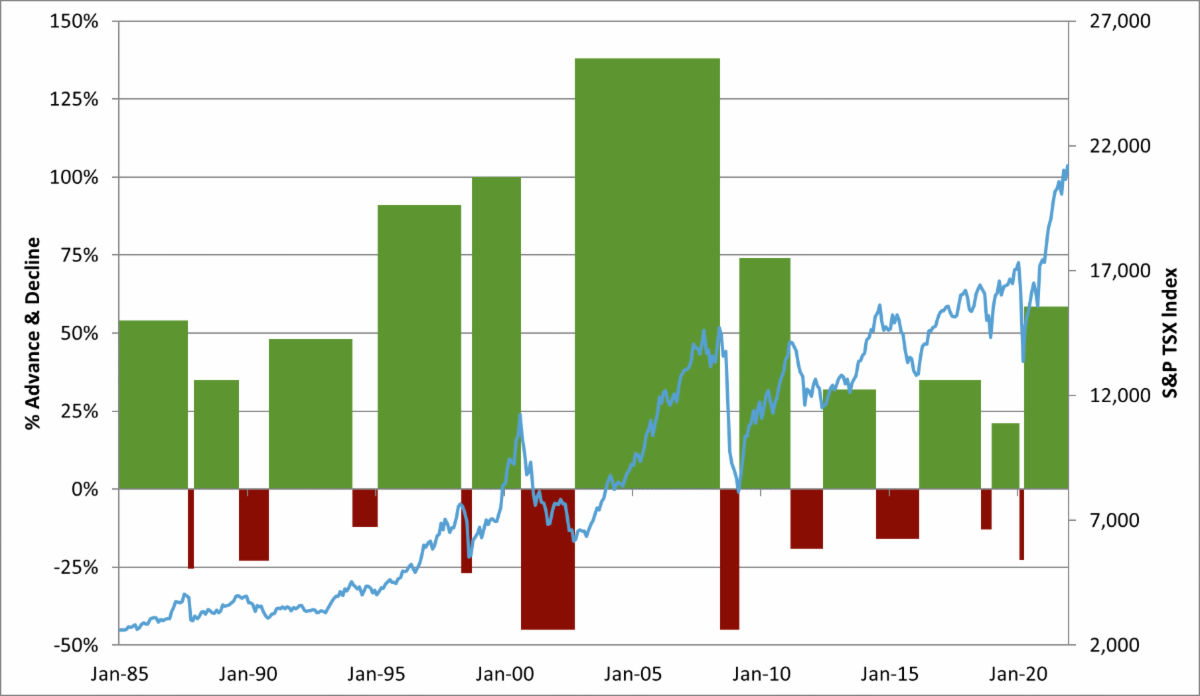

As a reminder, periods of market weakness are a normal part of equity markets cycles.

As illustrated in the chart below, market pullbacks occur occasionally, but they tend to be abrupt and short-lived. Periods of market strength tend to be elongated and more than offset the weakness underscoring the importance of maintaining equity exposure over the long run.

S&P/TSX – Historical Market Advances & Declines

Source: FactSet, Cadence Financial Group

Seth and Jason will be hosting our market update webinar on Tuesday, February 1st, 1:30pm PST, where we will be discussing the current market condition in more detail.

Click here to register for our webinar. RSVP is required. Please submit any questions that you would like addressed to laura.furtado@raymondjames.ca before the meeting.