It's All About the Benjamins

April showers bring forth May flowers, but it also lets us talk about something besides Russia, rates, supply chain issues and inflation – corporate earnings.

By the time you read this newsletter, we will be about halfway through US Q1 earnings season. Besides a couple of one-off misses, the quarter is shaping up relatively well, particularly for our Cadence portfolio names. This “May” (pun intended) provide the markets with a needed positive catalyst as we approach the lazy days of summer.

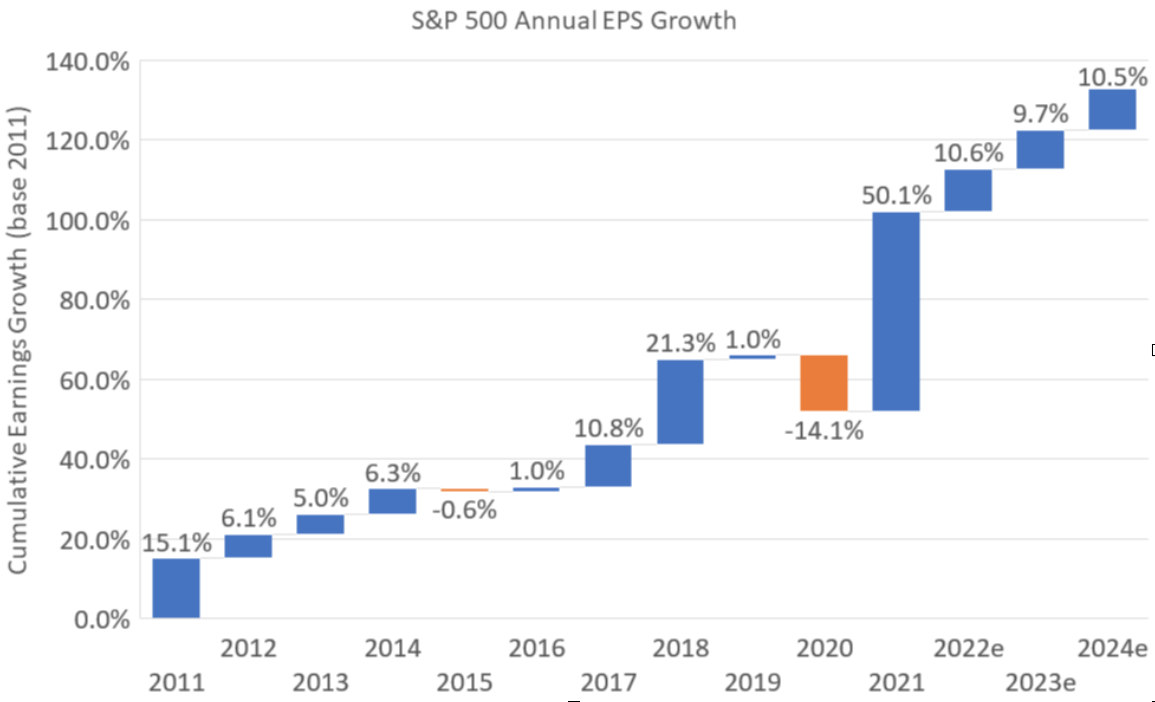

Earnings are the primary driver of stock market returns, and over the past decade, US corporate earnings have grown at a relatively steady-staircase pace, more than doubling since 2011. However, as one can see below, the pandemic paused the advance, followed by one of the most robust earnings recoveries in recent memory.

S&P 500 - Past Annual Earnings Growth

According to FactSet, as of April 28, ~47% of S&P 500 companies have reported quarterly results. The earnings-per-share growth of 6% year-over-year compares favourably to analysts' expectations despite the heightened uncertainty weighing on markets. The most significant contributor to the quarterly growth rate has been energy, information technology, health care and industrials.

For the full year 2022, analysts forecast earnings growth of 10.6%, followed by similar growth rates in 2023 and 2024. We don't put much stock in the 2024 estimate, given that it is impossible to predict what the world will look like two years from now, but we do have more confidence in the 2023 estimate. And we will continue to monitor how rates, inflation and geopolitical events may influence earnings in the coming year.

Despite information technology being the second largest contributor to Q1 earnings growth, the sector is off 18% year-to-date and is simply out of favour. Investors have been selling "growth" stocks to fund the rotation into "value" stocks.

However, rotations are circular, so what goes around comes around. It's only a matter of time before investors rediscover the highly-profitable, faster-growing technology sector and decide to rotate back.

Broadly speaking, management teams during quarterly conference calls have been citing headwinds such as labour costs and shortages, COVID costs, and supply chain disruptions. However, we are not seeing a corresponding denigration to the earnings or revenues outlook. In fact, the full-year earnings estimate for the S&P 500 index has improved from 7.5%, as of December 31, 2021, to the current estimate of 10.6%.

Clearly, the "wall of worry" weighing on investor sentiment is overriding the fundamental backdrop. To wit, companies held in our portfolios thus far have been posting some solid results.

Volatility Got You Down?

Relax and grab a Coca-Cola (KO-US) — both the beverage and the company shares. The beverage giant's shares have gained 10% year to date, outperforming the S&P 500 by a wide margin.

KO posted impressive quarterly results, with revenues in every region exceeding expectations. Overall unit volume growth of 8% drove Q1 revenue to $10.5 bln, up 16.6% from a year earlier.

We think KO has some fizz left in the tank, particularly as consumers return to venues like restaurants, stadiums, and theatres where we are still below pre-pandemic levels.

Beat of the Drum

If only a company existed that supplied mission-critical software to an industry in a secular uptrend. Microsoft, you say. Nope, try again. Cadence Design Systems (CDNS-US), the provider of software used to design and develop semiconductors, reported quarterly earnings growth of 40% and raised full-year guidance.

Thanks to its high recurring revenue stream, the company hasn't skipped a beat, consistently growing revenue and earnings regardless of the industry cycle.

Similarly, Microsoft (MSFT-US) topped expectations driven by robust growth from its cloud services Azure (revenues growth +49%). The software giant guided to "healthy" double-digit growth highlighting the impressive resilience of the model in a volatile environment.

Can You Give Me an Insurance?

Property and casualty insurer Chubb (CB-US) easily topped analysts' expectations, driven by net premiums written and good expense controls. Shares have outperformed the S&P financial index year-to-date; we believe further outperformance is ahead given reasonable valuation and supportive underlying trends.

Overall, the start of the earnings season has been encouraging and “May” refocus investors on the primary driver of market returns – corporate earnings.

Fixing Fixed Income - Portfolio Changes

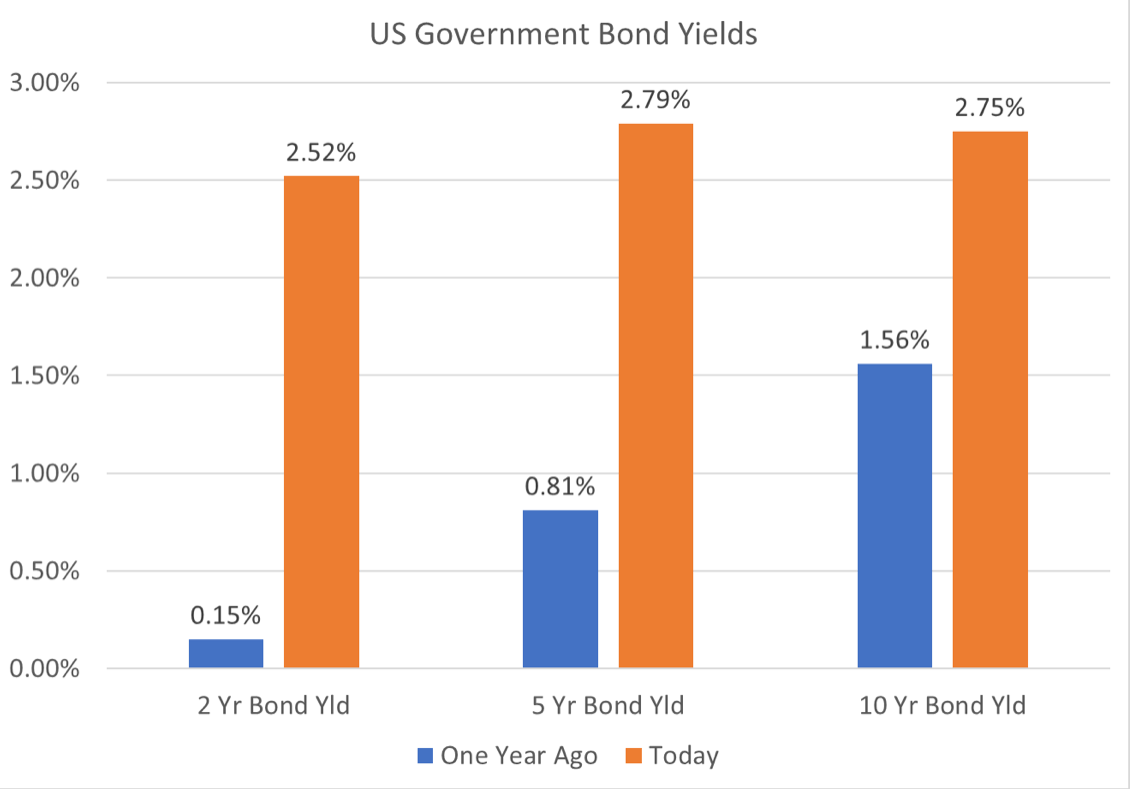

It's been another challenging year for fixed-income investors. Generally, bond prices have slipped amid the robust economic recovery, inflationary pressures and the prospects of higher interest rates. The price drop has pushed bond yields into territory that we view attractive.

While yields could continue to rise from here, the rate of change is unlikely to match what occurred over the last 12 months, and the current yields offer some margin of safety. Referring to the chart below that compares bond yields today from a year earlier, one can see how significant the change has been.

In fact, some of our fixed-income manager's yield-to-maturity are approaching ~5% - PIMCO Active Bond ETF at 5.0%, Canso Corporate Value at 4.5% and Manulife Strategic Income Fund at 3.6% - a threshold that we last saw in the mid-2000s for medium- to low-risk bonds. Twenty years later, we may be returning to those days of low- to medium-risk risk bonds returning 5-7%.

Said another way, bonds look more attractive today than a year earlier. As such, we took advantage of the opportunity and put some cash to work in the fixed income market with managers we believe are well suited to manage the current environment.

Fixed Income Yield – Now and Then

Charts of Interest

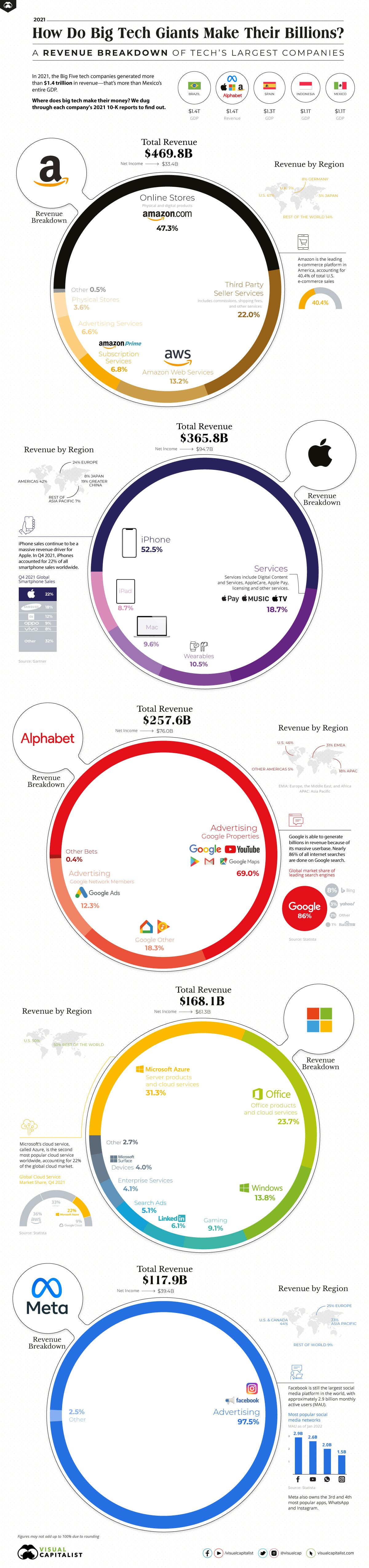

So, you're selling these companies to buy oil stocks…really? Be careful with commodity stocks; they are meant to be rented, not owned.

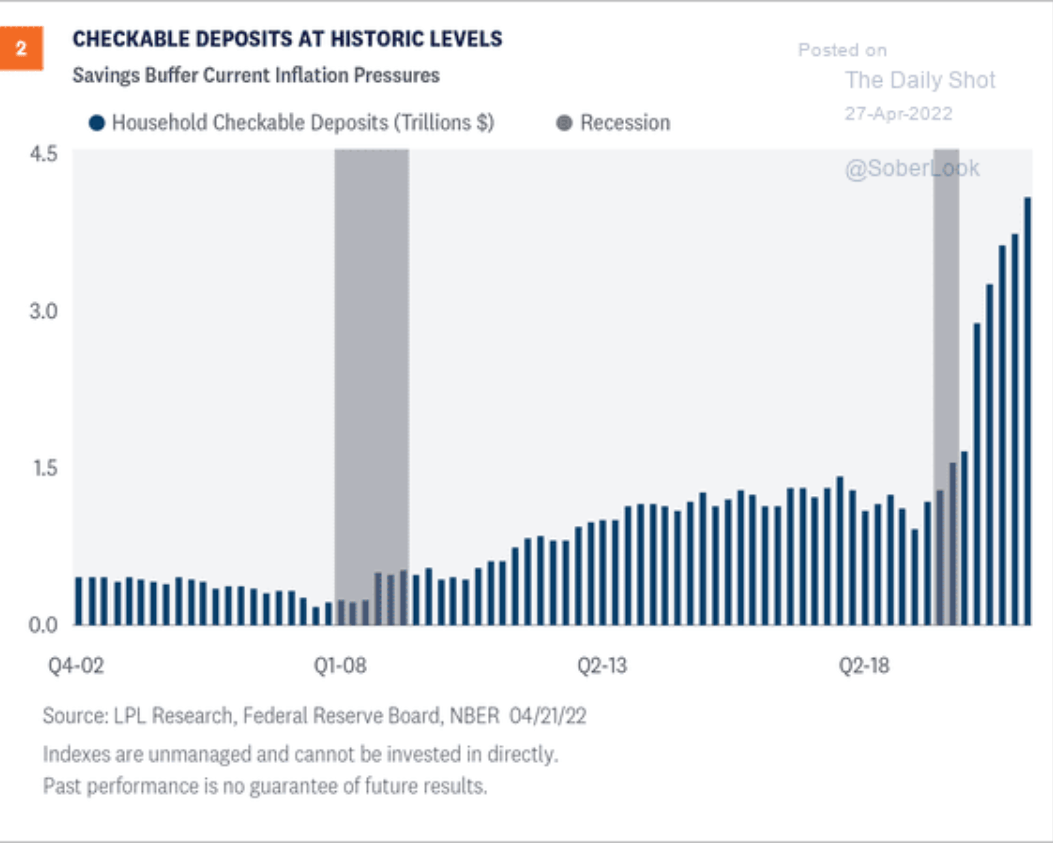

It is difficult to imagine a recession with so much excess savings on consumers' balance sheets, which may allow the consumer to continue spending despite higher prices.

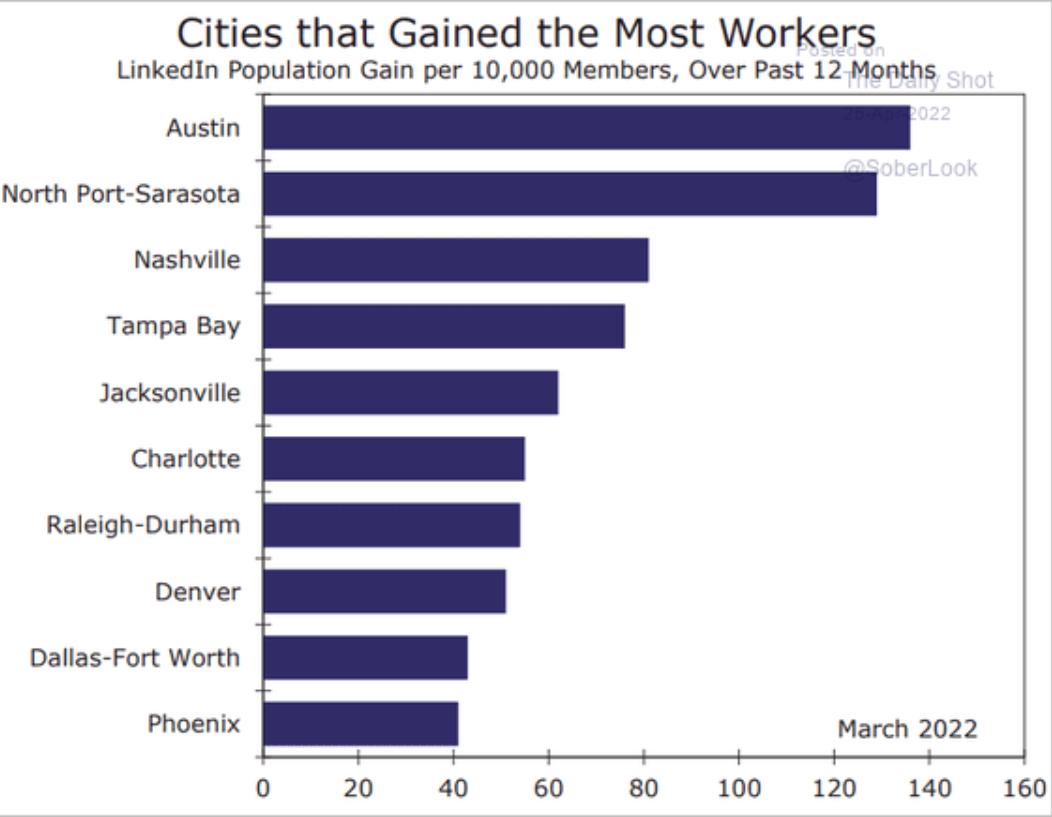

A late Spring even has us considering a move to one of the Sunshine states. US cities that gained the most workers over the past 12 months:

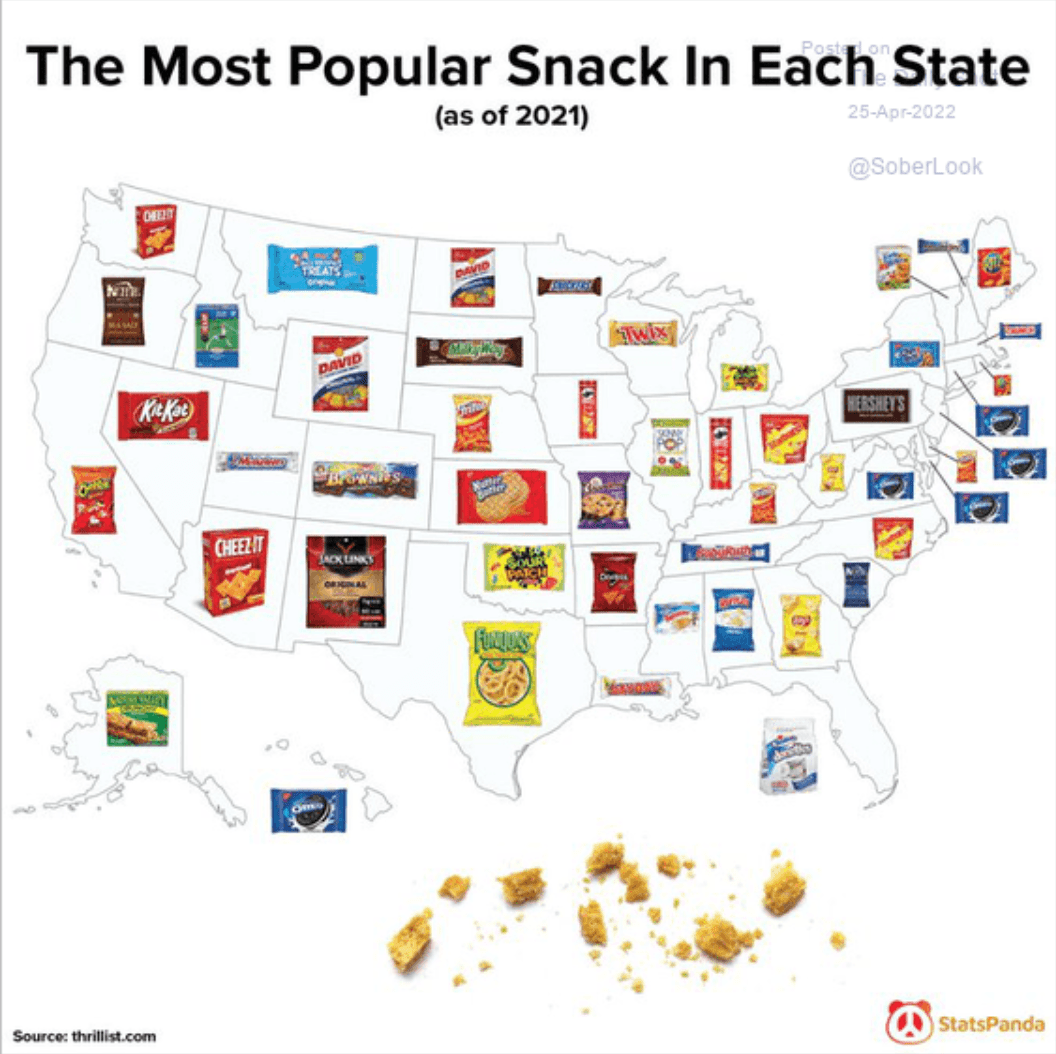

What ya like to snack on? Are you a cheesy west coaster or a wafer-crème-filled east coaster? The most popular snack in each state.

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.