The More Things Change, The More Things Stay The Same

We laid out our base case for the market to post a mid-single-digit annual return earlier this year. Our assumption was inflation would peak and begin to moderate, allowing interest rates to rise at a modest and manageable pace. This view hasn't changed, but the Russia/Ukraine conflict and China's nonsensical zero-Covid policy have delayed realizing the anticipated benefits from a less aggressive rate hiking cycle.

Market volatility has resulted from inflation and rate uncertainty over the past eight weeks. But there is light at the end of the tunnel as there is evidence inflation has peaked, and the Federal Reserve has, ever so slightly, opened the door to pausing its aggressive hiking cycle later this year.

If you missed it, our Mid-Month-Stretch: Feeling Disconnected is worth reading as we outline the disconnect between the market's performance and underlying fundamentals.

Dimon Hands

After several weeks of downward price pressure, markets bounced before the US Memorial Day long weekend. With all the uncertainty, the market was looking for any glimmers of hope to turn the tide. In the near term, JP Morgan's CEO Jamie Dimon's comments were enough to provide that glimmer,

"We have a strong US economy fueled by monetary and fiscal stimulation that you've never seen before. So it's different than a strong economy and the consumer is in very good shape even today, which means if we go into recession, it may be different than prior recessions... Credit looks really good. We've never seen it this good."

A week and a half later, Dimon did the complete opposite, implying an economic hurricane is on the horizon, "Right now, it's kind of sunny, things are doing fine. Everyone thinks the Fed can handle this. That hurricane is right out there down the road coming our way. We just don't know if it's a minor one or Superstorm Sandy,"

Superman versus Bizarro; from market saviour to market foe in a matter of days. Talk about mixed messages, but this is the market we are dealing with today. There is simply a lot of uncertainty.

The US averages 5.9 hurricanes per year. With preparation and planning, millions of Americans manage. We also have managed through a few financial storms - Long-term Capital Management, the Dot.com bubble, the 9/11 US recession, the Great Financial Crisis and a pandemic, to name a few.

Jamie Dimon's unscripted hyperbole will be correct at some point. Will it be tomorrow, next year or ten years from now? No one knows for sure, but if there are signs of a tropical depression, we have a plan in place to protect capital and manage through the storm. We've done it before; we'll do it again if needed.

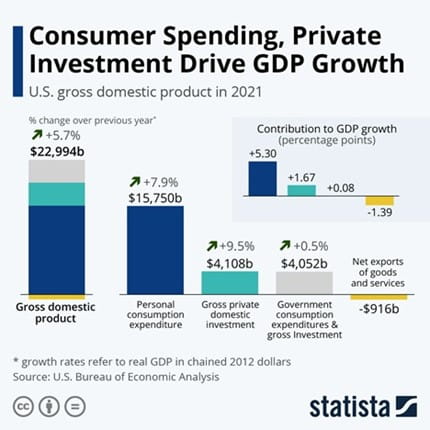

US Consumer Trumps All

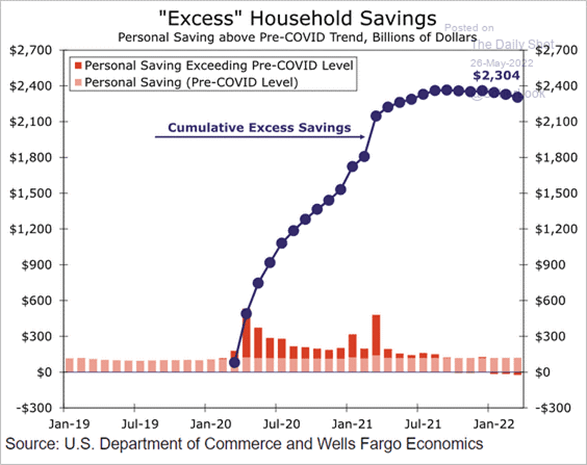

The US consumer represents ~70% of the economy, and with a high savings rate, it's difficult to see a material slowdown occurring in coming quarters. Additionally, the consumer should be in relatively good shape post the current inflationary impulse.

Nonetheless, as indicated by the downward-sloping blue line, the consumer has dipped into savings to offset higher prices. We're watching inflation closely, as it has broad implications for our investment strategy.

Persistently high inflation will eventually exert a financial toll on consumers, but that is not our base case.

Still Plenty of Fuel in the Tank

Bottom line: Inflation and rate uncertainty have been the primary drives of the current market volatility. Signs of peak inflation and hints of a less aggressive rate hiking cycle, coupled with a supportive economic outlook, have provided markets with a glimmer of hope.

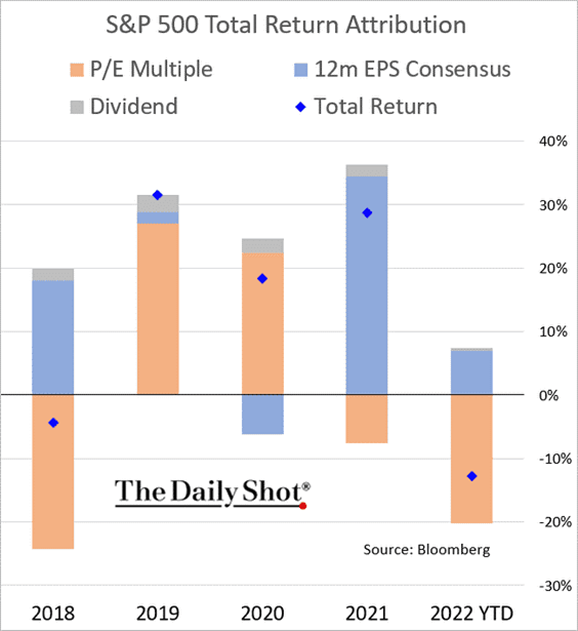

Value is What You Get

Stock returns are composed of earnings growth, multiple expansion/contraction and dividends. As of May 31, 2022, S&P 500 2022 earnings growth has improved through the quarterly earnings season and stands at 10.1%.

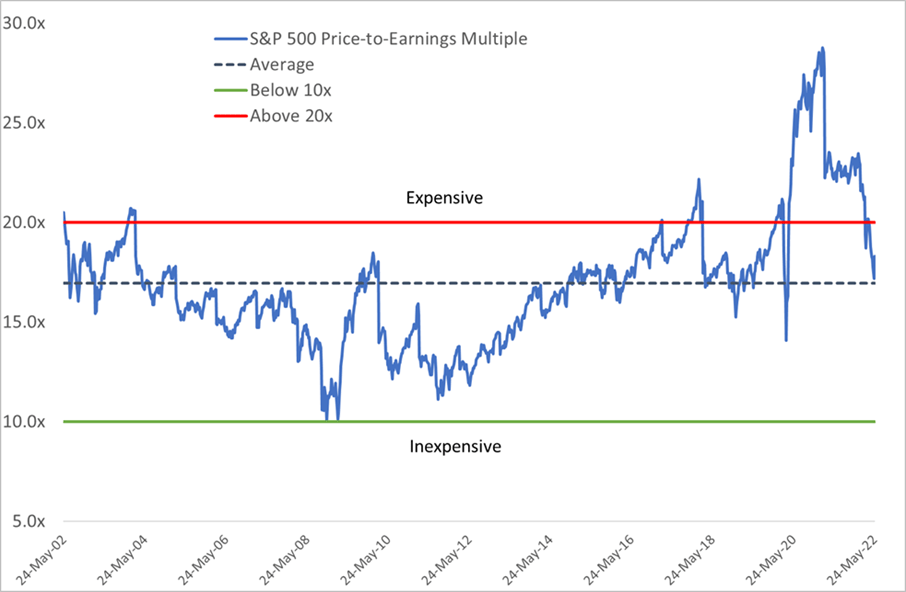

What has changed is what investors are willing to pay for future earnings. The price-to-earnings multiple has contracted significantly due to the uncertain inflation and interest rate outlook. The market is now trading at 18.3x next year's earnings, in line with its 10-year historical average and well below 28x achieved earlier this year.

A Little of This, A Little of That - Composition of Market Returns

From a practical standpoint, what does this mean? Valuation is a good (not perfect) indicator of future return. How do we know this? We looked back at S&P 500 historical valuations and corresponding 5-year return over the last 70 years. We assumed an investment was made when the market traded at a price-to-earnings ratio of 10x or below and 20x or above.

As one may have suspected, investing during periods when market valuations are at a discount produces strong returns – the average 5-year return is 11.3%, and the frequency of positive returns is 100%.

If buying the market at a lower valuation results in a superior outcome, then surely the opposite is true? The short answer is yes, but the numbers provide some surprises. An investment when the market is trading at or above 20x experiences has resulted in an average 5-year return of 5.6%, but the chance of a positive return falls to 66%, and the investor will also experience greater volatility in returns.

While the market is not trading at a steep discount, it is undoubtedly more attractive today than six months ago, meaning long-term patient investors will be rewarded in time.

Bottom line: Today's market valuation is considerably cheaper than 6-months ago. Putting cash to work when valuations are inexpensive increases your long-term odds of generating a positive return.

S&P 500 Historical Valuation

Source: Factset

Source: Factset

Hot Dogs, Get Your Hot Dogs Here!

Active management is a key to this market. Throughout the Q2 earnings season, there have been some rather sizable retail misses, like Target (TGT-US) and Wal-Mart (WMT-US), yet the market is also punishing those that beat expectations and maintain guidance.

Costco (COST-US) is a case in point, which has been dragged down with the rest of the retail space. The wholesale retailer posted better-than-expected revenue and earnings driven by solid membership retention. We believe COST is better positioned than most retailers to execute in this challenging retailing environment. Plus, how can't you love a retailer willing to sell you a hot dog/soda combo for $1.50! First introduced in the mid-80s, the price has never changed.

Portfolio Update

We've been allocating capital in a barbell approach, adding to defensives and cyclicals where we believe the company's long-term growth prospects remain intake.

We outline these trades below, but broadly the switches and new allocations occurred in health care, financials, consumer discretionary, real estate and information technology.

- Financials. We switched from S&P Global (SPGI-US) and added to JP Morgan (JPM-US) and Chubb (CB-US). We took profit on shares of JPM in March, but they are now trading at a discount to the market and its historical average, which we believe offer a good risk/reward assuming the US economy doesn't slip into recession. Balancing the risk-allocation, we increased CB, which is less sensitive to the economic cycle.

- Health care. We switched from Abbott Labs (ABT-US) to AbbVie (ABBV-US) and CVS Health (CVS-US). Due to ABT's double-digit forecasted growth rate, shares trade at a premium valuation, making it vulnerable to any missteps. We continue to like ABT but move to the sideline for now. With the proceeds, we add to ABBV and CVS both of which trade at discounted price-to-earnings multiples, giving them some margin of safety in this challenging environment.

- Information technology. We switched from Micron Technology (MU-US) and initiated a position in NVIDIA (NVDA-US), and added to Microchip Technology (MCHP-US). We are long-term semiconductor bulls but recognize the sector is currently out of favour. We see more risk in owning MU as its end-markets are narrower than NVDA and MCHP, which have a more diversified customer base.

- Consumer Discretionary. We switched from Estee Lauder (EL-US) and initiated a position in Home Depot (HD-US). We see more risk in EL given its exposure to Europe, while HD is North American focused. Additionally, shares of HD are trading at a steep discount to their historical average amid concerns over the impact of higher mortgage rates on the housing market. However, years of housing underinvestment have led to a lack of inventory which bodes well for home prices once mortgage rates peak later this year.

- Real Estate. We took profit on Tricon Residential (TCN-CA) shares in February, and we added back at a lower price. We continue to believe the single-family and multi-family rental home operator prospects are solid given the high population growth in US sunshine states and stable demand for US rental units.

Chart of Interest

We devote the entirety of Charts of Interest to McLovin.

We have to wonder if reality and fantasy have intersected. Is it simply a coincidence that Tesla's CEO Elon Musk said he has a “super bad feeling” about the economy on the same day as McLovin’s birthday? Birthday wishes or another Jamie Dimon hurricane prediction? Time will tell.

Regardless, happy birthday, big guy!